Silent cyber coverage addresses cyber risks that are not explicitly mentioned in traditional insurance policies, providing protection against unforeseen digital threats inherent in standard coverage. Endorsement coverage, on the other hand, specifically adds cyber risk protections as an amendment to existing policies, clearly defining coverage scope and limits. Explore detailed comparisons to understand which option best suits your organization's cyber risk management strategy.

Why it is important

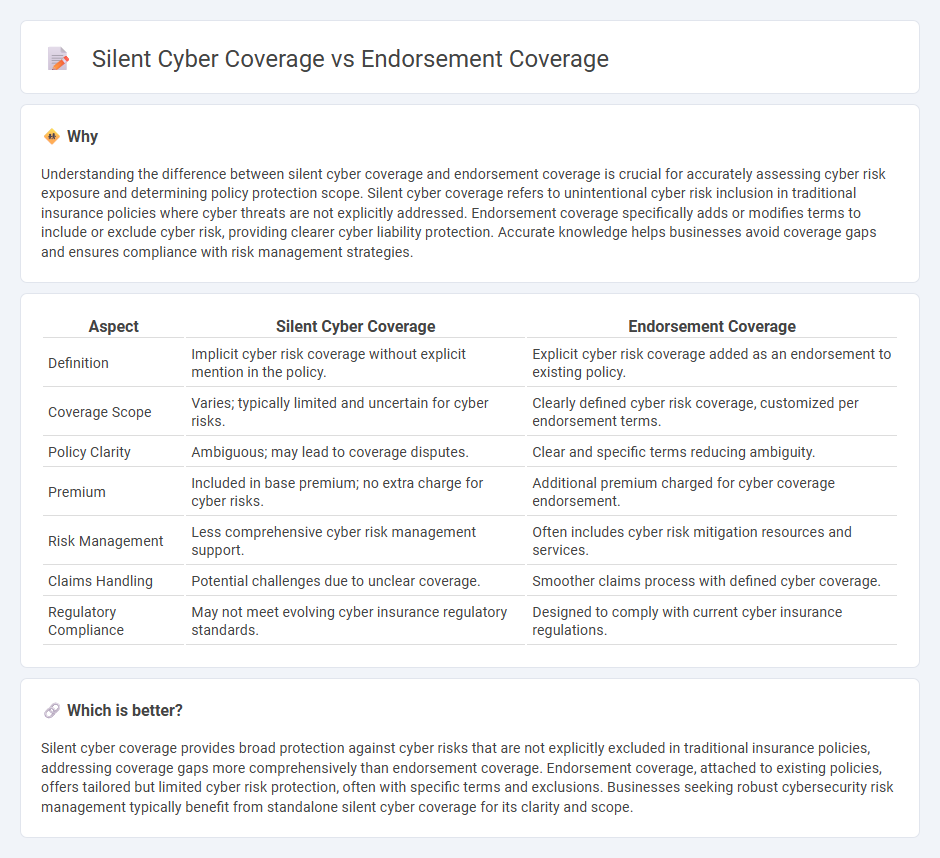

Understanding the difference between silent cyber coverage and endorsement coverage is crucial for accurately assessing cyber risk exposure and determining policy protection scope. Silent cyber coverage refers to unintentional cyber risk inclusion in traditional insurance policies where cyber threats are not explicitly addressed. Endorsement coverage specifically adds or modifies terms to include or exclude cyber risk, providing clearer cyber liability protection. Accurate knowledge helps businesses avoid coverage gaps and ensures compliance with risk management strategies.

Comparison Table

| Aspect | Silent Cyber Coverage | Endorsement Coverage |

|---|---|---|

| Definition | Implicit cyber risk coverage without explicit mention in the policy. | Explicit cyber risk coverage added as an endorsement to existing policy. |

| Coverage Scope | Varies; typically limited and uncertain for cyber risks. | Clearly defined cyber risk coverage, customized per endorsement terms. |

| Policy Clarity | Ambiguous; may lead to coverage disputes. | Clear and specific terms reducing ambiguity. |

| Premium | Included in base premium; no extra charge for cyber risks. | Additional premium charged for cyber coverage endorsement. |

| Risk Management | Less comprehensive cyber risk management support. | Often includes cyber risk mitigation resources and services. |

| Claims Handling | Potential challenges due to unclear coverage. | Smoother claims process with defined cyber coverage. |

| Regulatory Compliance | May not meet evolving cyber insurance regulatory standards. | Designed to comply with current cyber insurance regulations. |

Which is better?

Silent cyber coverage provides broad protection against cyber risks that are not explicitly excluded in traditional insurance policies, addressing coverage gaps more comprehensively than endorsement coverage. Endorsement coverage, attached to existing policies, offers tailored but limited cyber risk protection, often with specific terms and exclusions. Businesses seeking robust cybersecurity risk management typically benefit from standalone silent cyber coverage for its clarity and scope.

Connection

Silent cyber coverage addresses cyber risks not explicitly included or excluded in traditional insurance policies, filling coverage gaps for cyber incidents. Endorsement coverage involves specific policy amendments or additions that explicitly include or exclude cyber risks, clarifying insurer and insured responsibilities. These two are connected as silent cyber coverage evolves to reduce ambiguity, while endorsement coverage formalizes the scope of cyber risk protection within insurance contracts.

Key Terms

Policy Modification

Endorsement coverage modifies an existing insurance policy by explicitly adding or excluding specific risks, providing clarity on cyber-related exposures. Silent cyber coverage refers to unintentional, ambiguous cyber risk exposures not clearly addressed in traditional policies, often leading to disputes during claims. Discover how precise policy modifications can prevent silent cyber gaps and enhance your risk management strategy.

Explicit Cyber Risk

Endorsement coverage explicitly includes cyber risk by adding specific cyber-related clauses to traditional insurance policies, ensuring clear protection against cyber threats. Silent cyber coverage refers to the unintended exposure to cyber risk within non-cyber policies, which can lead to coverage disputes due to its ambiguity. Explore how explicit cyber risk coverage reduces uncertainty and enhances policyholder security.

Coverage Grant

Endorsement coverage explicitly includes cyber risks by modifying existing insurance policies to cover specified cyber incidents, offering clear and tailored protection. Silent cyber coverage arises when traditional policies unintentionally cover cyber-related losses due to ambiguous policy language, leading to potential gaps or disputes over the Coverage Grant. Explore comprehensive insights to ensure your policy's coverage grant aligns with your cyber risk management strategy.

Source and External Links

Insurance Endorsements Explained - A policy endorsement is a formal amendment that can add, remove, limit, modify, or clarify coverage within your existing insurance contract, altering both the scope and terms of your protection.

What Is An Insurance Endorsement? - Endorsements, sometimes called riders, allow policyholders to address gaps, enhance specific protections, or adjust limits not fully covered by their base policy, and may incur additional costs depending on the changes requested.

What is an insurance endorsement? - You can obtain an endorsement by contacting your agent at any point during your policy term, but the duration and applicability of the coverage depend on the specific endorsement and your insurer's terms.

dowidth.com

dowidth.com