Insurance sandboxes enable companies to test innovative products and services in a controlled regulatory environment, fostering innovation while managing risk. Accelerator programs offer startups mentorship, funding, and access to industry networks to accelerate growth and market entry. Explore the differences between insurance sandboxes and accelerators to find the best path for your insurance innovation.

Why it is important

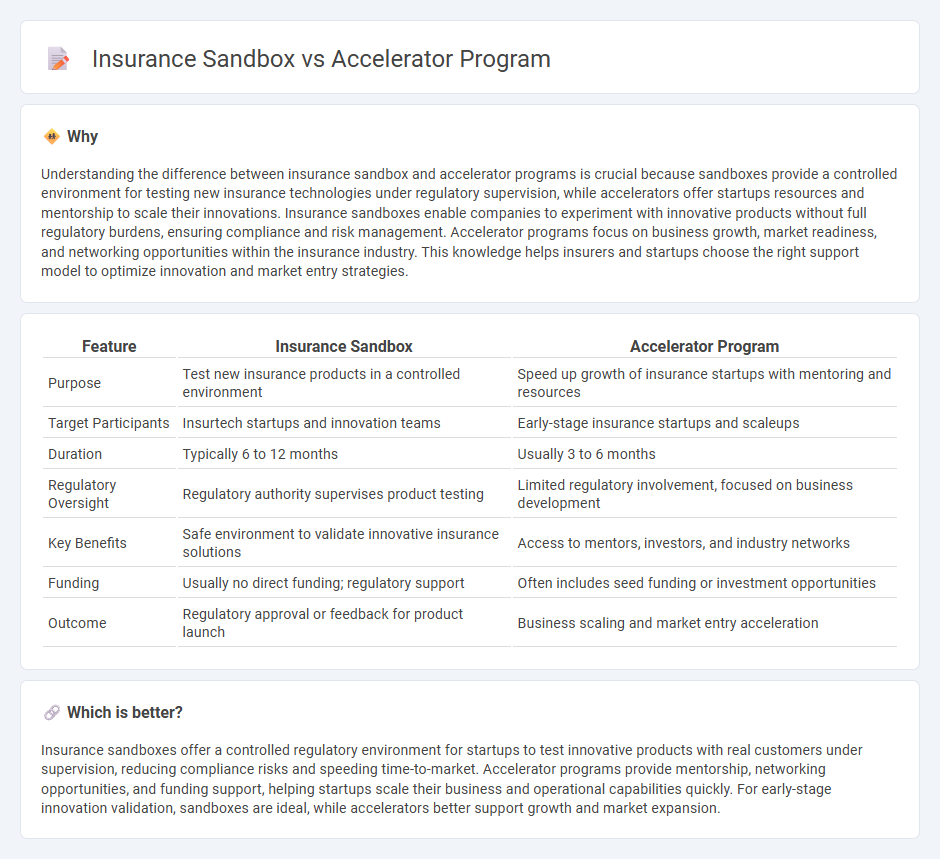

Understanding the difference between insurance sandbox and accelerator programs is crucial because sandboxes provide a controlled environment for testing new insurance technologies under regulatory supervision, while accelerators offer startups resources and mentorship to scale their innovations. Insurance sandboxes enable companies to experiment with innovative products without full regulatory burdens, ensuring compliance and risk management. Accelerator programs focus on business growth, market readiness, and networking opportunities within the insurance industry. This knowledge helps insurers and startups choose the right support model to optimize innovation and market entry strategies.

Comparison Table

| Feature | Insurance Sandbox | Accelerator Program |

|---|---|---|

| Purpose | Test new insurance products in a controlled environment | Speed up growth of insurance startups with mentoring and resources |

| Target Participants | Insurtech startups and innovation teams | Early-stage insurance startups and scaleups |

| Duration | Typically 6 to 12 months | Usually 3 to 6 months |

| Regulatory Oversight | Regulatory authority supervises product testing | Limited regulatory involvement, focused on business development |

| Key Benefits | Safe environment to validate innovative insurance solutions | Access to mentors, investors, and industry networks |

| Funding | Usually no direct funding; regulatory support | Often includes seed funding or investment opportunities |

| Outcome | Regulatory approval or feedback for product launch | Business scaling and market entry acceleration |

Which is better?

Insurance sandboxes offer a controlled regulatory environment for startups to test innovative products with real customers under supervision, reducing compliance risks and speeding time-to-market. Accelerator programs provide mentorship, networking opportunities, and funding support, helping startups scale their business and operational capabilities quickly. For early-stage innovation validation, sandboxes are ideal, while accelerators better support growth and market expansion.

Connection

Insurance sandbox and accelerator programs are connected through their shared goal of fostering innovation within the insurance industry by providing a controlled environment for testing new technologies and business models. The insurance sandbox allows startups to trial products under regulatory oversight, while accelerator programs support these innovators by offering mentorship, funding, and networking opportunities. Together, they accelerate the development and adoption of cutting-edge insurance solutions, enhancing market competitiveness and customer experience.

Key Terms

Regulatory Innovation

Accelerator programs and insurance sandboxes both foster regulatory innovation by enabling startups to test new insurance products and technologies under controlled environments. Accelerator programs emphasize mentorship, funding, and market entry strategies, while insurance sandboxes prioritize regulatory oversight and compliance testing to ensure consumer protection and risk management. Explore how these approaches drive transformation in insurance regulation and innovation.

Experimentation Environment

Accelerator programs provide startups with mentorship, resources, and networking to rapidly develop innovative insurance solutions, while insurance sandboxes offer a controlled regulatory environment to test new products and business models without full compliance burdens. The experimentation environment in accelerator programs emphasizes market readiness and scalability, whereas sandboxes prioritize regulatory compliance and risk management. Explore how these distinct frameworks can accelerate innovation in the insurance sector.

Consumer Protection

Accelerator programs foster innovation by supporting startups with mentorship and resources, while insurance sandboxes provide a controlled regulatory environment to test new products without full compliance burdens. Consumer protection in accelerator programs is ensured through guidance and risk assessment, whereas insurance sandboxes emphasize real-time monitoring and regulatory oversight to safeguard consumer interests. Explore how these approaches balance innovation with consumer safety in the insurance sector.

Source and External Links

How do startup accelerators work? - Silicon Valley Bank - Startup accelerators are mentor-based, fixed-term programs that provide guidance, support, and limited funding in exchange for equity, culminating in a demo day pitch to investors.

Startup accelerator - Wikipedia - Startup accelerators, also known as seed accelerators, are cohort-based programs offering mentorship, education, and sometimes funding, with a competitive application process and a focus on rapid growth.

Accelerator Program | College of Business | Illinois State - The Means Center Accelerator provides year-round funding and support exclusively to Illinois State University student entrepreneurs to help scale their existing businesses.

dowidth.com

dowidth.com