Insurance as a service offers comprehensive, subscription-based coverage with continuous risk management, providing clients with personalized policies tailored to their long-term needs. In contrast, on-demand insurance delivers flexible, short-term protection activated only when required, ideal for specific events or situations like travel or gadget use. Explore how these innovative insurance models can be optimized for your unique coverage requirements.

Why it is important

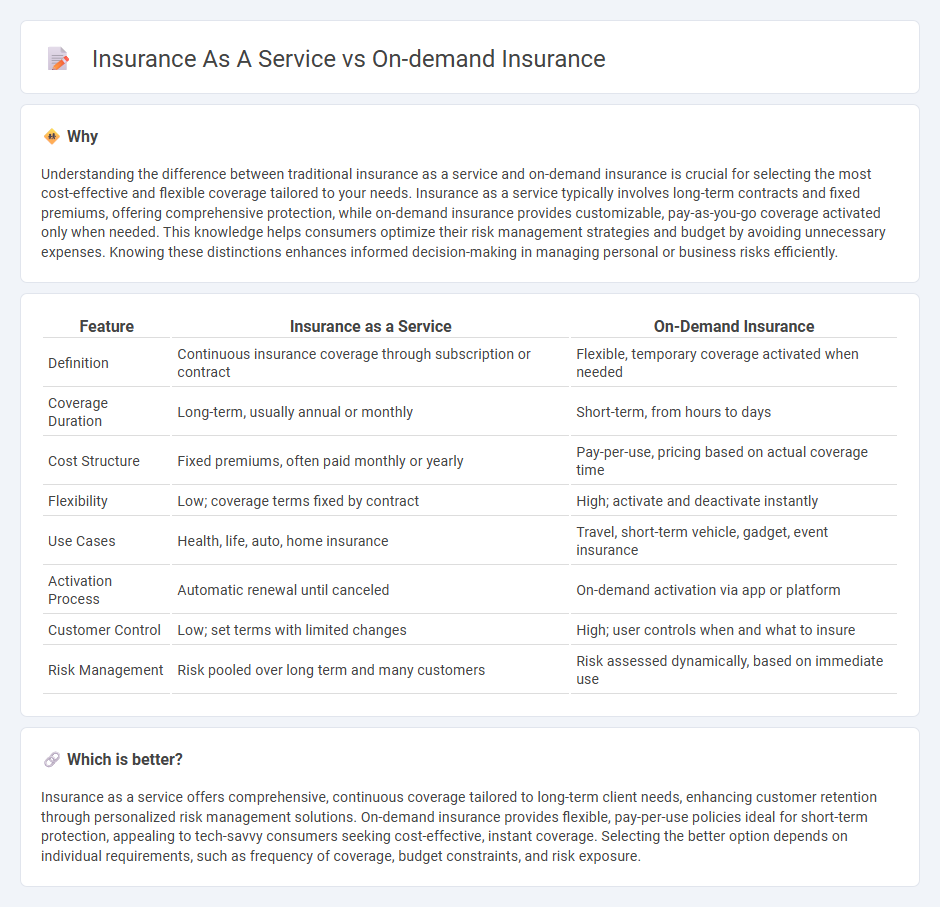

Understanding the difference between traditional insurance as a service and on-demand insurance is crucial for selecting the most cost-effective and flexible coverage tailored to your needs. Insurance as a service typically involves long-term contracts and fixed premiums, offering comprehensive protection, while on-demand insurance provides customizable, pay-as-you-go coverage activated only when needed. This knowledge helps consumers optimize their risk management strategies and budget by avoiding unnecessary expenses. Knowing these distinctions enhances informed decision-making in managing personal or business risks efficiently.

Comparison Table

| Feature | Insurance as a Service | On-Demand Insurance |

|---|---|---|

| Definition | Continuous insurance coverage through subscription or contract | Flexible, temporary coverage activated when needed |

| Coverage Duration | Long-term, usually annual or monthly | Short-term, from hours to days |

| Cost Structure | Fixed premiums, often paid monthly or yearly | Pay-per-use, pricing based on actual coverage time |

| Flexibility | Low; coverage terms fixed by contract | High; activate and deactivate instantly |

| Use Cases | Health, life, auto, home insurance | Travel, short-term vehicle, gadget, event insurance |

| Activation Process | Automatic renewal until canceled | On-demand activation via app or platform |

| Customer Control | Low; set terms with limited changes | High; user controls when and what to insure |

| Risk Management | Risk pooled over long term and many customers | Risk assessed dynamically, based on immediate use |

Which is better?

Insurance as a service offers comprehensive, continuous coverage tailored to long-term client needs, enhancing customer retention through personalized risk management solutions. On-demand insurance provides flexible, pay-per-use policies ideal for short-term protection, appealing to tech-savvy consumers seeking cost-effective, instant coverage. Selecting the better option depends on individual requirements, such as frequency of coverage, budget constraints, and risk exposure.

Connection

Insurance as a service leverages cloud computing and digital platforms to offer flexible, scalable coverage solutions tailored to customer needs, enabling seamless integration of on-demand insurance. On-demand insurance provides instant, short-term policies activated via mobile apps or online portals, exemplifying the real-time accessibility and customization enabled by insurance as a service models. Both concepts prioritize user-centric experiences, cost efficiency, and adaptive risk management through advanced technology and data analytics.

Key Terms

Flexibility

On-demand insurance offers unparalleled flexibility by allowing users to activate coverage precisely when needed, minimizing costs and avoiding unnecessary premiums. Insurance as a service integrates flexibility through continuous digital engagement, enabling real-time policy adjustments and personalized risk management. Explore the distinctive advantages of each model to determine the best fit for your insurance needs.

Customization

On-demand insurance provides users with the ability to activate coverage instantly for specific events or periods, allowing highly flexible risk management tailored to immediate needs. Insurance as a service (IaaS) offers a fully integrated, continuous insurance solution embedded within digital platforms, enabling personalized policy adjustments based on real-time data and customer behavior. Explore how these innovative approaches to customization redefine modern insurance experiences.

Digital Platform

On-demand insurance leverages digital platforms to provide flexible, usage-based coverage activated instantly through mobile apps, enhancing customer convenience and real-time risk management. Insurance as a Service (IaaS) integrates cloud-based APIs and scalable microservices allowing businesses to embed insurance products seamlessly within their digital ecosystems, promoting personalized and automated underwriting processes. Explore the advantages and technical implementations of digital platforms to understand how these innovations revolutionize the insurance industry.

Source and External Links

The ins and outs of on-demand insurance: a growing trend in coverage flexibility - On-demand insurance allows consumers to purchase flexible, short-term coverage as needed through digital platforms, offering personalized protection for assets not constantly in use, such as travel or rental car insurance.

What Is On-Demand Insurance? - Insuranceopedia - On-demand insurance refers to policies that can be bought instantly online or via apps without broker interaction, providing faster application and approval processes tailored to the modern digital economy.

On-demand Insurance Market Size & Share Report, 2030 - Valued at $955.3 million in 2022 and growing rapidly, on-demand insurance often uses AI-driven digital platforms to offer transparent, convenient, and personalized coverage options, with North America leading the market.

dowidth.com

dowidth.com