Invisible insurance integrates seamlessly into everyday purchases and services, offering coverage without requiring separate policies or actions from the insured. Peer-to-peer insurance leverages community risk-sharing, where members pool premiums for enhanced transparency and potential cost savings. Explore the distinct benefits and mechanisms of these emerging insurance models to better understand their impact on the industry's future.

Why it is important

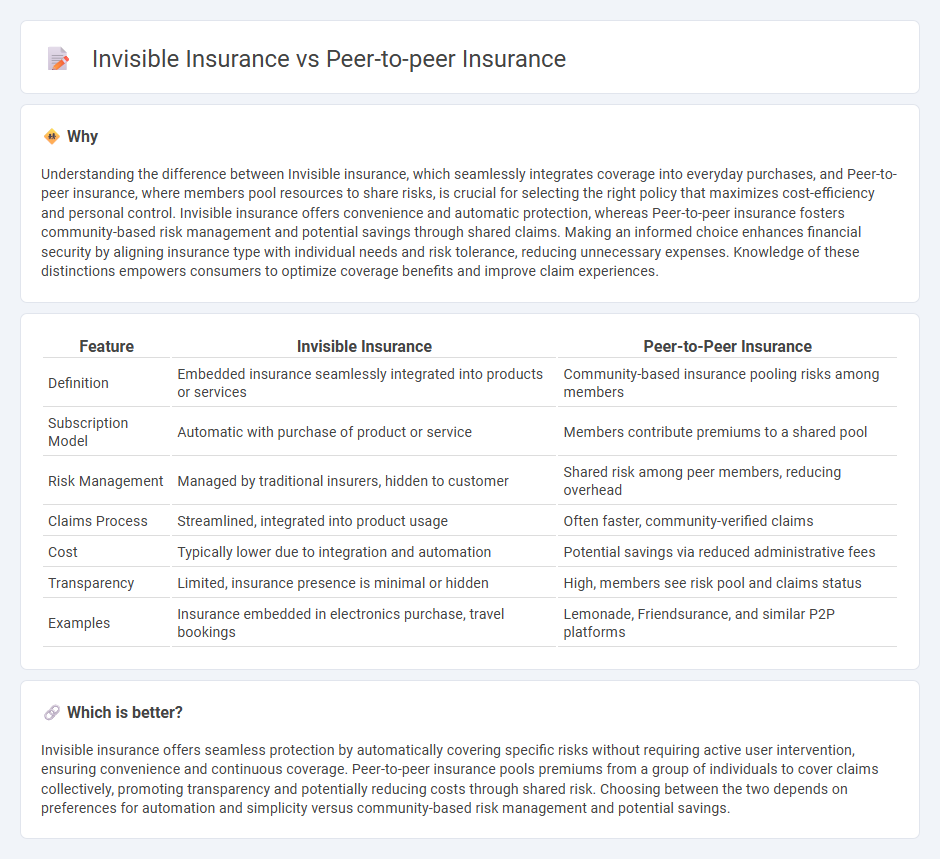

Understanding the difference between Invisible insurance, which seamlessly integrates coverage into everyday purchases, and Peer-to-peer insurance, where members pool resources to share risks, is crucial for selecting the right policy that maximizes cost-efficiency and personal control. Invisible insurance offers convenience and automatic protection, whereas Peer-to-peer insurance fosters community-based risk management and potential savings through shared claims. Making an informed choice enhances financial security by aligning insurance type with individual needs and risk tolerance, reducing unnecessary expenses. Knowledge of these distinctions empowers consumers to optimize coverage benefits and improve claim experiences.

Comparison Table

| Feature | Invisible Insurance | Peer-to-Peer Insurance |

|---|---|---|

| Definition | Embedded insurance seamlessly integrated into products or services | Community-based insurance pooling risks among members |

| Subscription Model | Automatic with purchase of product or service | Members contribute premiums to a shared pool |

| Risk Management | Managed by traditional insurers, hidden to customer | Shared risk among peer members, reducing overhead |

| Claims Process | Streamlined, integrated into product usage | Often faster, community-verified claims |

| Cost | Typically lower due to integration and automation | Potential savings via reduced administrative fees |

| Transparency | Limited, insurance presence is minimal or hidden | High, members see risk pool and claims status |

| Examples | Insurance embedded in electronics purchase, travel bookings | Lemonade, Friendsurance, and similar P2P platforms |

Which is better?

Invisible insurance offers seamless protection by automatically covering specific risks without requiring active user intervention, ensuring convenience and continuous coverage. Peer-to-peer insurance pools premiums from a group of individuals to cover claims collectively, promoting transparency and potentially reducing costs through shared risk. Choosing between the two depends on preferences for automation and simplicity versus community-based risk management and potential savings.

Connection

Invisible insurance and peer-to-peer insurance are connected through their shared emphasis on making coverage seamless and community-driven. Invisible insurance integrates protection into everyday transactions without explicit user interaction, enhancing convenience and reducing barriers to claims. Peer-to-peer insurance leverages collective risk-sharing among groups, fostering transparency and trust, while both models prioritize affordable and accessible coverage through innovative technology platforms.

Key Terms

**Peer-to-peer insurance:**

Peer-to-peer insurance leverages community pooling of resources where policyholders share risks and benefits directly, reducing reliance on traditional insurers and often resulting in lower premiums. This model enhances transparency and fosters trust among members while utilizing technology platforms for claims processing and risk assessment. Explore how peer-to-peer insurance can transform your coverage experience and offer cost-effective protection.

Risk Pooling

Peer-to-peer insurance leverages risk pooling by grouping individuals with similar risks to share premiums and claims directly, eliminating traditional insurer overhead. Invisible insurance integrates risk pooling seamlessly within everyday transactions or services, often relying on embedded technology to distribute risk discreetly across a broader network. Explore how risk pooling transforms coverage models by comparing peer-to-peer and invisible insurance innovations.

Policyholder Networks

Peer-to-peer insurance leverages policyholder networks to pool risks collectively, reducing costs through shared premiums and mutual accountability. Invisible insurance integrates seamlessly into everyday transactions, embedding coverage within digital platforms without policyholders' direct intervention. Explore how these innovative models transform risk management and enhance customer experience.

Source and External Links

Insurance Topics | Peer-to-Peer Insurance - Peer-to-peer insurance is a model where a group of individuals with common interests pool their premiums to insure against risks, promoting transparency and cost reduction.

How Peer-to-Peer Insurance Works - This model combines technology and sharing economy principles to offer personalized insurance coverage by creating risk-sharing networks.

SS 46.2-1409. Peer-to-peer insurance coverage - In peer-to-peer vehicle sharing, platforms must ensure primary liability insurance coverage for shared vehicles during the sharing period.

dowidth.com

dowidth.com