Pet health insurance covers veterinary expenses, including routine care, emergency treatments, and surgeries, ensuring your pet's well-being without significant out-of-pocket costs. Umbrella insurance provides extra liability coverage beyond existing policies, protecting assets from substantial claims or lawsuits. Explore the benefits and differences to determine which insurance best suits your protection needs.

Why it is important

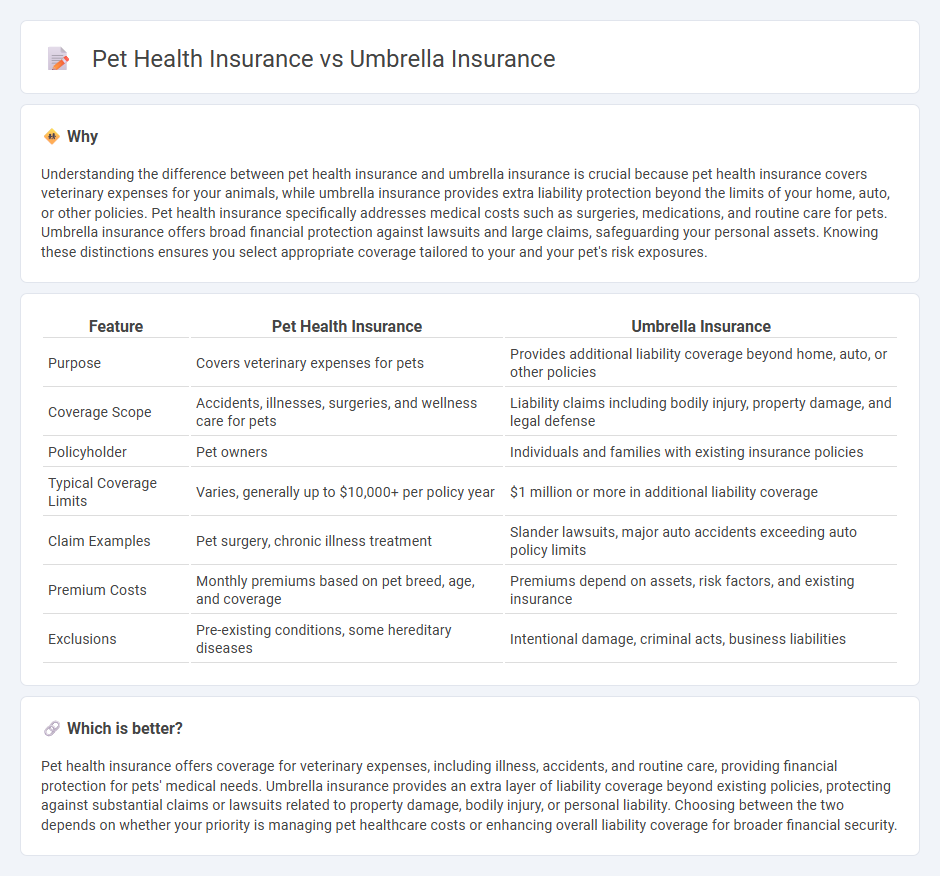

Understanding the difference between pet health insurance and umbrella insurance is crucial because pet health insurance covers veterinary expenses for your animals, while umbrella insurance provides extra liability protection beyond the limits of your home, auto, or other policies. Pet health insurance specifically addresses medical costs such as surgeries, medications, and routine care for pets. Umbrella insurance offers broad financial protection against lawsuits and large claims, safeguarding your personal assets. Knowing these distinctions ensures you select appropriate coverage tailored to your and your pet's risk exposures.

Comparison Table

| Feature | Pet Health Insurance | Umbrella Insurance |

|---|---|---|

| Purpose | Covers veterinary expenses for pets | Provides additional liability coverage beyond home, auto, or other policies |

| Coverage Scope | Accidents, illnesses, surgeries, and wellness care for pets | Liability claims including bodily injury, property damage, and legal defense |

| Policyholder | Pet owners | Individuals and families with existing insurance policies |

| Typical Coverage Limits | Varies, generally up to $10,000+ per policy year | $1 million or more in additional liability coverage |

| Claim Examples | Pet surgery, chronic illness treatment | Slander lawsuits, major auto accidents exceeding auto policy limits |

| Premium Costs | Monthly premiums based on pet breed, age, and coverage | Premiums depend on assets, risk factors, and existing insurance |

| Exclusions | Pre-existing conditions, some hereditary diseases | Intentional damage, criminal acts, business liabilities |

Which is better?

Pet health insurance offers coverage for veterinary expenses, including illness, accidents, and routine care, providing financial protection for pets' medical needs. Umbrella insurance provides an extra layer of liability coverage beyond existing policies, protecting against substantial claims or lawsuits related to property damage, bodily injury, or personal liability. Choosing between the two depends on whether your priority is managing pet healthcare costs or enhancing overall liability coverage for broader financial security.

Connection

Pet health insurance and umbrella insurance both provide financial protection by covering unexpected expenses beyond standard policies. Pet health insurance covers veterinary costs for illnesses and injuries, while umbrella insurance offers additional liability coverage for incidents that exceed homeowners or auto insurance limits. Together, they ensure broader risk management by safeguarding against high-cost medical bills and liability claims.

Key Terms

Liability Coverage

Umbrella insurance provides extensive liability coverage beyond standard policy limits, protecting against major claims or lawsuits involving bodily injury, property damage, and personal liability. Pet health insurance typically covers medical expenses related to illnesses, injuries, and routine care but does not offer liability protection for pet-related incidents. Explore the key differences in liability coverage to choose the best insurance solution for your needs.

Veterinary Expenses

Umbrella insurance primarily provides liability coverage beyond standard policy limits, offering protection for significant claims but typically excluding veterinary expenses. Pet health insurance specifically covers veterinary costs such as routine check-ups, surgeries, and emergency treatments, ensuring direct financial support for pet healthcare. Explore detailed comparisons to determine the best insurance option for managing veterinary expenses effectively.

Policy Limits

Umbrella insurance provides extra liability coverage beyond the limits of your standard policies, often offering millions in protection for personal injury, property damage, and legal defense. Pet health insurance typically has lower policy limits, focusing on covering veterinary bills for illnesses, accidents, and routine care with annual or lifetime benefit caps. Explore detailed comparisons of policy limits to determine which coverage best suits your risk management needs.

dowidth.com

dowidth.com