Drone insurance provides coverage for damages, liability, and theft related to unmanned aerial vehicles, addressing risks unique to drone operation such as property damage and personal injury. Pet insurance offers financial protection against veterinary expenses, covering accidents, illnesses, and sometimes routine care for cats, dogs, and other animals. Explore the key differences and benefits of drone insurance versus pet insurance to determine the best coverage for your needs.

Why it is important

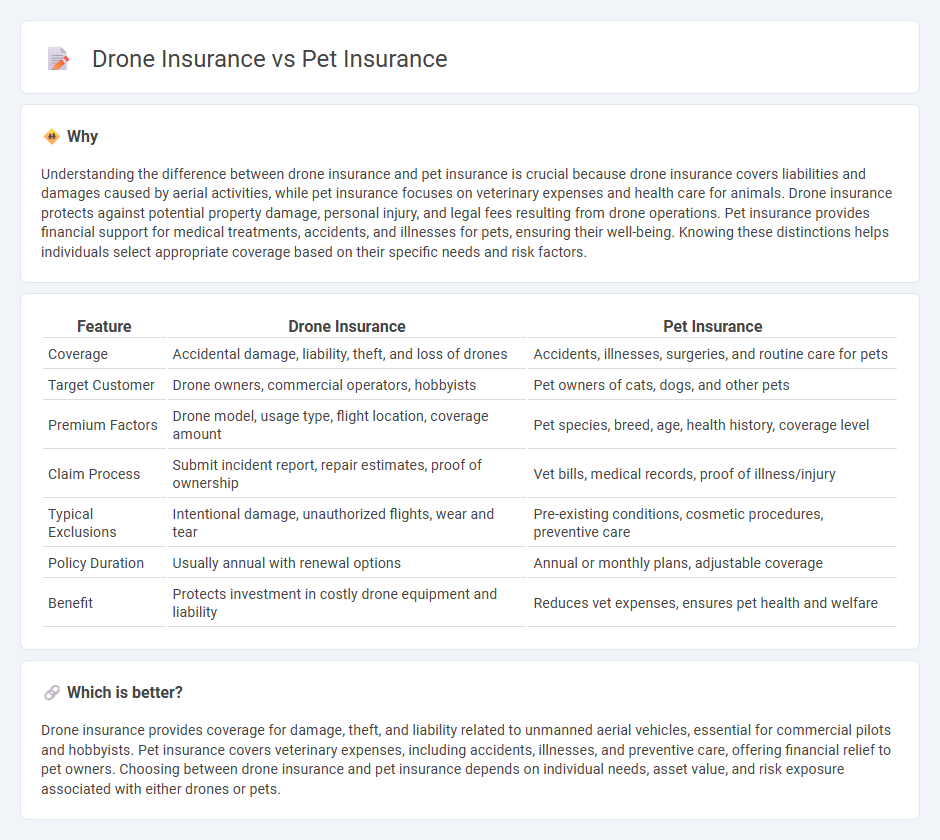

Understanding the difference between drone insurance and pet insurance is crucial because drone insurance covers liabilities and damages caused by aerial activities, while pet insurance focuses on veterinary expenses and health care for animals. Drone insurance protects against potential property damage, personal injury, and legal fees resulting from drone operations. Pet insurance provides financial support for medical treatments, accidents, and illnesses for pets, ensuring their well-being. Knowing these distinctions helps individuals select appropriate coverage based on their specific needs and risk factors.

Comparison Table

| Feature | Drone Insurance | Pet Insurance |

|---|---|---|

| Coverage | Accidental damage, liability, theft, and loss of drones | Accidents, illnesses, surgeries, and routine care for pets |

| Target Customer | Drone owners, commercial operators, hobbyists | Pet owners of cats, dogs, and other pets |

| Premium Factors | Drone model, usage type, flight location, coverage amount | Pet species, breed, age, health history, coverage level |

| Claim Process | Submit incident report, repair estimates, proof of ownership | Vet bills, medical records, proof of illness/injury |

| Typical Exclusions | Intentional damage, unauthorized flights, wear and tear | Pre-existing conditions, cosmetic procedures, preventive care |

| Policy Duration | Usually annual with renewal options | Annual or monthly plans, adjustable coverage |

| Benefit | Protects investment in costly drone equipment and liability | Reduces vet expenses, ensures pet health and welfare |

Which is better?

Drone insurance provides coverage for damage, theft, and liability related to unmanned aerial vehicles, essential for commercial pilots and hobbyists. Pet insurance covers veterinary expenses, including accidents, illnesses, and preventive care, offering financial relief to pet owners. Choosing between drone insurance and pet insurance depends on individual needs, asset value, and risk exposure associated with either drones or pets.

Connection

Drone insurance and pet insurance both fall under specialized insurance categories designed to mitigate unique risks associated with modern liabilities and personal property. Each policy addresses specific coverage needs: drone insurance protects against damage, theft, and liability from drone operations, while pet insurance covers veterinary expenses and liability related to pets. Insurers use advanced data analytics and risk assessment models for both to tailor premiums and coverage limits based on individual risk profiles and usage patterns.

Key Terms

**Pet Insurance:**

Pet insurance provides financial protection for veterinary expenses, covering accidents, illnesses, and wellness care for cats, dogs, and other pets. Policies typically include coverage for surgeries, medications, diagnostic tests, and sometimes preventative treatments, with premiums varying based on pet breed, age, and coverage limits. Explore detailed comparisons to understand how pet insurance safeguards your beloved pet's health and your budget.

Veterinary Coverage

Veterinary coverage in pet insurance typically includes expenses for accidents, illnesses, and routine care like vaccinations and dental cleanings, providing financial relief for pet owners. Drone insurance, on the other hand, does not cover veterinary care but focuses on liability and damage related to drone operation, such as property damage and personal injury. Explore detailed comparisons to understand how each insurance type benefits different needs.

Pre-existing Conditions

Pet insurance policies often exclude coverage for pre-existing conditions, meaning illnesses or injuries present before the start of the policy are not reimbursed. Drone insurance typically does not involve pre-existing conditions but focuses on risks such as accidental damage, theft, or liability during drone operation. Explore detailed comparisons to understand how pre-existing conditions impact insurance claims and coverage options.

Source and External Links

Pumpkin Pet Insurance for Dogs & Cats - Pumpkin offers pet insurance plans that cover a wide range of accidents and illnesses including dental, behavioral, and hereditary conditions, with no breed or age restrictions, and also provides optional wellness packages for vaccines and preventive care.

Costco Members Could Save Through Figo Pet Insurance - Figo Pet Insurance reimburses medical expenses up to 100% for accidents and illnesses, with options for routine wellness plans and 24/7 live vet access through their app.

Pet Insurance - Commonwealth of Pennsylvania - Pet insurance helps offset veterinary costs and varies by plan in coverage and cost; it often excludes pre-existing conditions and may have breed-specific restrictions, with options including accident-only, comprehensive, and wellness add-ons.

dowidth.com

dowidth.com