Crop yield insurance protects farmers against losses caused by natural disasters, pests, or adverse weather conditions, ensuring financial stability when harvests are reduced. Farm liability insurance covers legal costs and damages resulting from accidents or injuries occurring on the farm, safeguarding farmers from lawsuits and third-party claims. Explore more to understand which insurance best suits your agricultural needs.

Why it is important

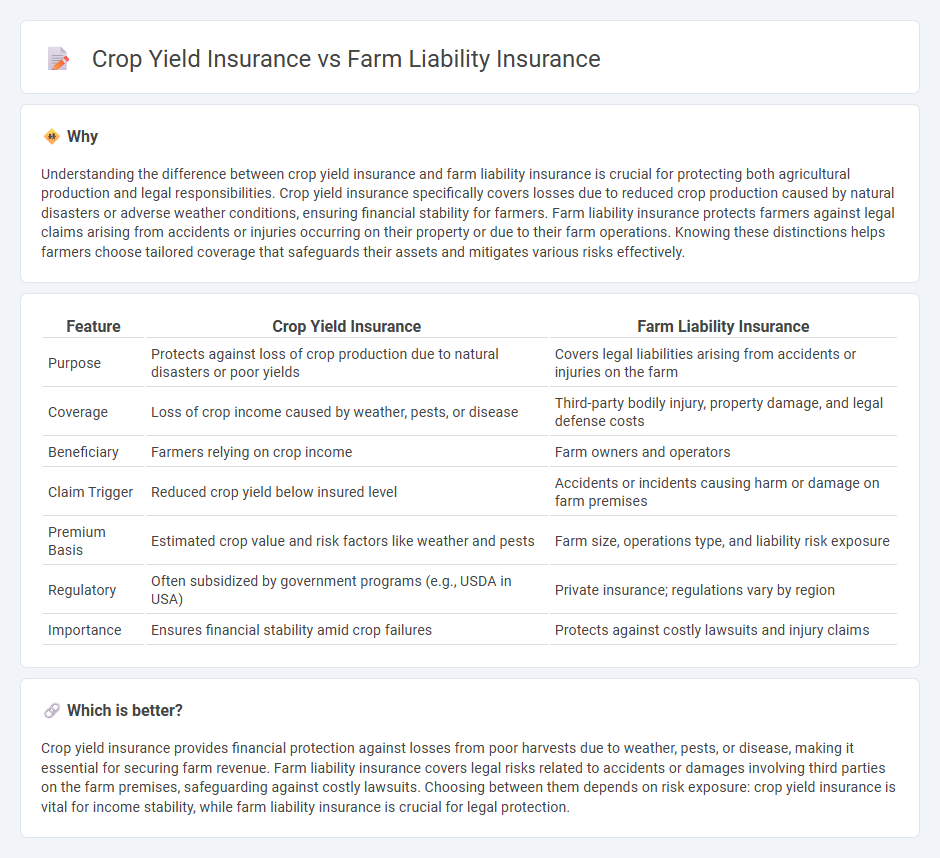

Understanding the difference between crop yield insurance and farm liability insurance is crucial for protecting both agricultural production and legal responsibilities. Crop yield insurance specifically covers losses due to reduced crop production caused by natural disasters or adverse weather conditions, ensuring financial stability for farmers. Farm liability insurance protects farmers against legal claims arising from accidents or injuries occurring on their property or due to their farm operations. Knowing these distinctions helps farmers choose tailored coverage that safeguards their assets and mitigates various risks effectively.

Comparison Table

| Feature | Crop Yield Insurance | Farm Liability Insurance |

|---|---|---|

| Purpose | Protects against loss of crop production due to natural disasters or poor yields | Covers legal liabilities arising from accidents or injuries on the farm |

| Coverage | Loss of crop income caused by weather, pests, or disease | Third-party bodily injury, property damage, and legal defense costs |

| Beneficiary | Farmers relying on crop income | Farm owners and operators |

| Claim Trigger | Reduced crop yield below insured level | Accidents or incidents causing harm or damage on farm premises |

| Premium Basis | Estimated crop value and risk factors like weather and pests | Farm size, operations type, and liability risk exposure |

| Regulatory | Often subsidized by government programs (e.g., USDA in USA) | Private insurance; regulations vary by region |

| Importance | Ensures financial stability amid crop failures | Protects against costly lawsuits and injury claims |

Which is better?

Crop yield insurance provides financial protection against losses from poor harvests due to weather, pests, or disease, making it essential for securing farm revenue. Farm liability insurance covers legal risks related to accidents or damages involving third parties on the farm premises, safeguarding against costly lawsuits. Choosing between them depends on risk exposure: crop yield insurance is vital for income stability, while farm liability insurance is crucial for legal protection.

Connection

Crop yield insurance protects farmers against financial losses due to reduced agricultural output caused by natural disasters, pests, or diseases, ensuring income stability. Farm liability insurance covers legal and medical expenses resulting from accidents or injuries occurring on the farm, safeguarding the farm's operational continuity. Both insurances collectively mitigate risks associated with farming, providing comprehensive financial protection to agricultural producers against unpredictable events affecting yield and liability.

Key Terms

Liability Coverage

Farm liability insurance protects farmers against legal claims arising from bodily injury, property damage, or personal injury linked to farm operations, ensuring coverage for accidents, injuries, or damages occurring on the property. Crop yield insurance specifically safeguards farmers against losses due to reduced harvests caused by natural disasters or adverse weather conditions, focusing on income protection rather than liability risks. Explore the detailed differences to determine which coverage best fits your agricultural business needs.

Yield Protection

Yield Protection insurance primarily covers losses in crop production due to natural causes such as drought, floods, or pests, ensuring financial stability for farmers when actual yields fall below the guaranteed amount. In contrast, farm liability insurance safeguards against legal claims stemming from property damage or bodily injury related to farm operations. To explore how Yield Protection can specifically secure your agricultural income, learn more about its coverage options and benefits.

Third-Party Claims

Farm liability insurance protects farmers against third-party claims for bodily injury or property damage occurring on their property or due to farm operations, ensuring coverage for legal defense and settlements. Crop yield insurance, however, does not cover third-party claims but focuses on compensating farmers for losses in crop production due to adverse weather, pests, or diseases. To understand which insurance best safeguards your farming operations from third-party risks, learn more about the differences and benefits.

Source and External Links

Get Farm Liability Insurance Coverage - Nationwide - Farm liability insurance protects farmers and ranchers from lawsuits and losses caused by bodily injury or property damage related to farm operations, including coverage for premises, operations liability such as incidents involving farm machinery on public roadways, and some farm product liability for unprocessed goods.

Farm or Ranch Liability Insurance (Coverage & Options) - FBFS - Farm or ranch liability insurance covers bodily injury claims from visitors and accidental property damage, with customizable options based on your farm's size, public access, employee considerations, and operational risks, helping protect your assets from costly liability claims.

Farm and Ranch Insurance | Markel - Markel offers tailored farm and ranch liability policies with coverage limits up to $1 million per occurrence and $3 million aggregate, including enhancements for commercial general liability, medical payments, employee benefits, and coverage for disruptions to farming operations.

dowidth.com

dowidth.com