Pay-as-you-drive insurance charges premiums based on the actual miles a driver covers, providing cost efficiency for low-mileage users by linking rates directly to driving behavior and distance. Named driver insurance specifies coverage exclusively for individuals listed on the policy, often benefiting households with multiple drivers by tailoring risk assessment to each person's driving history. Explore the distinct advantages and suitability of each insurance type to determine the best fit for your driving habits and coverage needs.

Why it is important

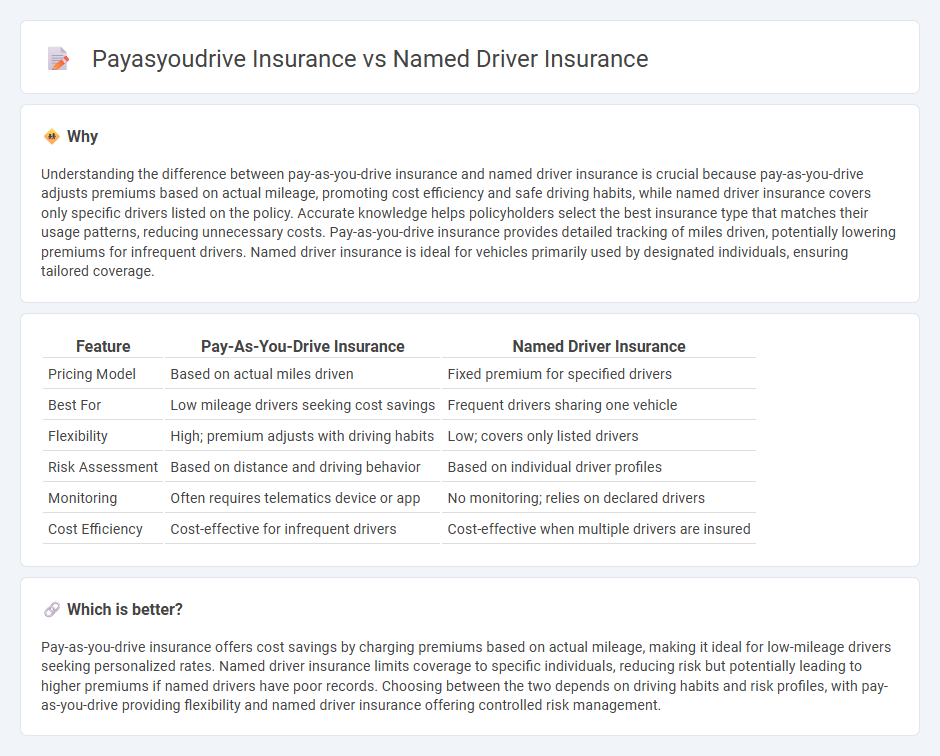

Understanding the difference between pay-as-you-drive insurance and named driver insurance is crucial because pay-as-you-drive adjusts premiums based on actual mileage, promoting cost efficiency and safe driving habits, while named driver insurance covers only specific drivers listed on the policy. Accurate knowledge helps policyholders select the best insurance type that matches their usage patterns, reducing unnecessary costs. Pay-as-you-drive insurance provides detailed tracking of miles driven, potentially lowering premiums for infrequent drivers. Named driver insurance is ideal for vehicles primarily used by designated individuals, ensuring tailored coverage.

Comparison Table

| Feature | Pay-As-You-Drive Insurance | Named Driver Insurance |

|---|---|---|

| Pricing Model | Based on actual miles driven | Fixed premium for specified drivers |

| Best For | Low mileage drivers seeking cost savings | Frequent drivers sharing one vehicle |

| Flexibility | High; premium adjusts with driving habits | Low; covers only listed drivers |

| Risk Assessment | Based on distance and driving behavior | Based on individual driver profiles |

| Monitoring | Often requires telematics device or app | No monitoring; relies on declared drivers |

| Cost Efficiency | Cost-effective for infrequent drivers | Cost-effective when multiple drivers are insured |

Which is better?

Pay-as-you-drive insurance offers cost savings by charging premiums based on actual mileage, making it ideal for low-mileage drivers seeking personalized rates. Named driver insurance limits coverage to specific individuals, reducing risk but potentially leading to higher premiums if named drivers have poor records. Choosing between the two depends on driving habits and risk profiles, with pay-as-you-drive providing flexibility and named driver insurance offering controlled risk management.

Connection

Pay-as-you-drive insurance and named driver insurance both tailor coverage based on driver-specific factors to optimize premiums and risk assessment. Pay-as-you-drive insurance calculates costs using actual driving behavior and mileage, encouraging safer and reduced driving habits. Named driver insurance assigns coverage to specific individuals, allowing tailored pricing based on each driver's history and risk profile.

Key Terms

Policyholder

Named driver insurance limits coverage to individuals explicitly listed on the policy, ensuring tailored risk assessment and premium calculation based on those specific drivers' profiles. Pay-as-you-drive insurance charges policyholders according to actual mileage and driving behavior, offering personalized rates that reward safe driving habits while providing flexible coverage for varying usage. Explore more about how these policies impact your insurance costs and coverage options.

Premium

Named driver insurance typically offers lower premiums by limiting coverage to specific individuals, reducing risk for insurers. Pay-as-you-drive insurance calculates premiums based on actual mileage and driving behavior, potentially lowering costs for infrequent or careful drivers. Explore detailed comparisons to find the best premium plan for your driving habits.

Telematics

Named driver insurance assigns coverage specifically to individuals listed on the policy, limiting claims to those drivers only, whereas pay-as-you-drive insurance utilizes telematics technology to monitor actual driving behavior and distance, providing personalized premiums based on usage and risk. Telematics devices collect data such as speed, braking patterns, and mileage, enabling insurers to reward safer drivers with lower rates and promote responsible driving habits. Explore detailed insights on how telematics transforms auto insurance models and benefits policyholders.

Source and External Links

Named Driver Policies - A named driver insurance policy covers only those drivers specifically named on the policy, excluding coverage for others in the insured's household and requiring clear disclosures to the insured about these limitations.

What is a Named Driver Policy? - Named driver insurance covers only listed drivers, unlike standard policies that may cover infrequent drivers through permissive use, meaning unlisted drivers--even those allowed permission--are not covered in an accident.

What are named drivers, and do they impact my policy - Named drivers are additional drivers listed on an insurance policy whose presence can affect premiums positively or negatively; when a named driver causes an accident, the main driver's insurance is impacted.

dowidth.com

dowidth.com