Cyber insurance protects businesses and individuals from financial losses caused by data breaches, cyberattacks, and other digital threats, while life insurance provides financial security to beneficiaries upon the policyholder's death. Both types of insurance address different risk domains--cyber insurance focuses on intangible digital assets and liability, whereas life insurance centers on personal and family financial protection. Explore the key differences and benefits of cyber insurance versus life insurance to determine which coverage suits your needs best.

Why it is important

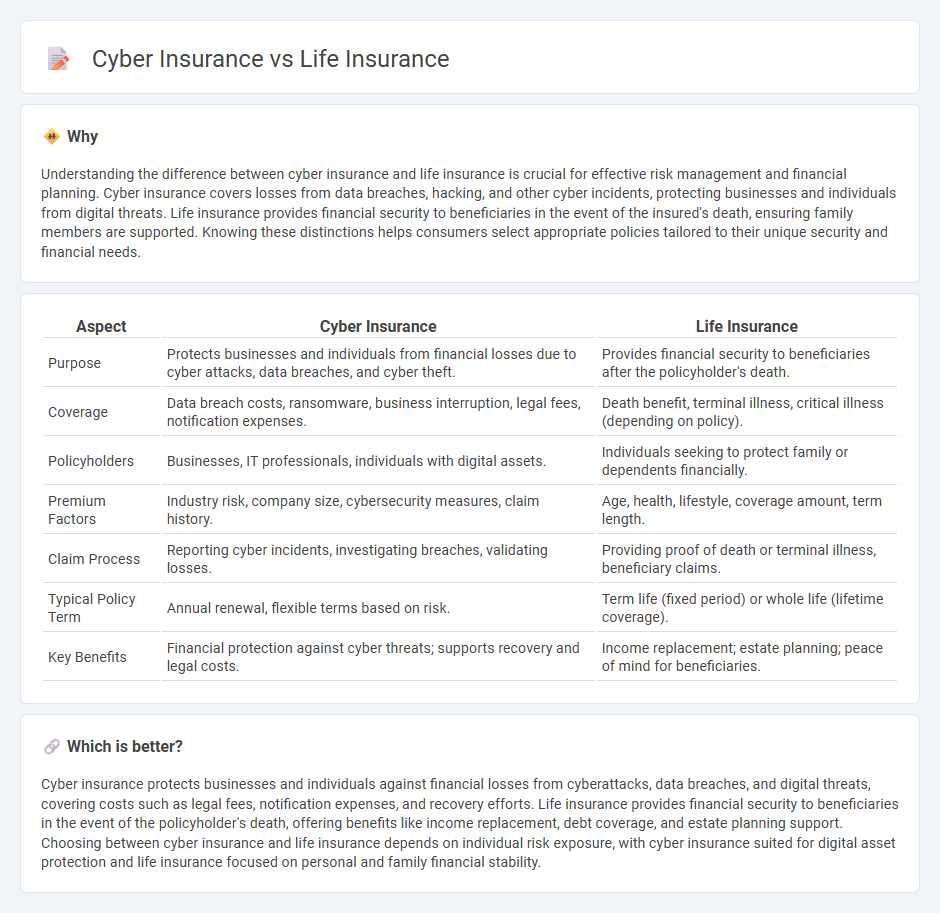

Understanding the difference between cyber insurance and life insurance is crucial for effective risk management and financial planning. Cyber insurance covers losses from data breaches, hacking, and other cyber incidents, protecting businesses and individuals from digital threats. Life insurance provides financial security to beneficiaries in the event of the insured's death, ensuring family members are supported. Knowing these distinctions helps consumers select appropriate policies tailored to their unique security and financial needs.

Comparison Table

| Aspect | Cyber Insurance | Life Insurance |

|---|---|---|

| Purpose | Protects businesses and individuals from financial losses due to cyber attacks, data breaches, and cyber theft. | Provides financial security to beneficiaries after the policyholder's death. |

| Coverage | Data breach costs, ransomware, business interruption, legal fees, notification expenses. | Death benefit, terminal illness, critical illness (depending on policy). |

| Policyholders | Businesses, IT professionals, individuals with digital assets. | Individuals seeking to protect family or dependents financially. |

| Premium Factors | Industry risk, company size, cybersecurity measures, claim history. | Age, health, lifestyle, coverage amount, term length. |

| Claim Process | Reporting cyber incidents, investigating breaches, validating losses. | Providing proof of death or terminal illness, beneficiary claims. |

| Typical Policy Term | Annual renewal, flexible terms based on risk. | Term life (fixed period) or whole life (lifetime coverage). |

| Key Benefits | Financial protection against cyber threats; supports recovery and legal costs. | Income replacement; estate planning; peace of mind for beneficiaries. |

Which is better?

Cyber insurance protects businesses and individuals against financial losses from cyberattacks, data breaches, and digital threats, covering costs such as legal fees, notification expenses, and recovery efforts. Life insurance provides financial security to beneficiaries in the event of the policyholder's death, offering benefits like income replacement, debt coverage, and estate planning support. Choosing between cyber insurance and life insurance depends on individual risk exposure, with cyber insurance suited for digital asset protection and life insurance focused on personal and family financial stability.

Connection

Cyber insurance and life insurance are connected through the increasing need to protect individuals and families from risks arising from digital threats and data breaches impacting personal information. Life insurance providers are integrating cyber risk assessments to evaluate potential vulnerabilities affecting policyholders' financial security and identity protection. The evolving cyber threat landscape drives insurers to develop comprehensive strategies combining cyber liability coverage with life insurance benefits to ensure holistic risk management.

Key Terms

Life Insurance:

Life insurance provides financial security to beneficiaries by covering risks related to the policyholder's death, offering benefits such as term life, whole life, and universal life policies tailored for income replacement, debt coverage, or estate planning. Key data shows that over 80% of life insurance policies in the U.S. focus on term life, providing cost-effective protection for a specific period, whereas whole life policies accumulate cash value. Explore in-depth comparisons and detailed benefits of life insurance to make informed decisions about your financial protection.

Beneficiary

Life insurance designates a beneficiary who receives a death benefit payout to provide financial security after the insured's passing. Cyber insurance, however, protects businesses from financial losses due to cyberattacks, with no designated beneficiary but rather coverage for incident costs and liabilities. Explore further to understand how each policy's beneficiary structure impacts your risk management strategy.

Premium

Life insurance premiums are calculated based on factors such as age, health, lifestyle, and coverage amount, typically involving long-term fixed payments that protect beneficiaries financially after death. Cyber insurance premiums depend on organizational risk profiles, including data sensitivity, cybersecurity measures, and industry type, often varying annually to cover potential cyberattack-related losses. Explore the key differences in premium structures to make informed decisions on securing life or cyber insurance.

Source and External Links

Life Insurance | Get Your Quote Today - Allstate - Provides personalized life insurance quotes and various coverage options to fit individual needs.

Life Insurance Policy - Get a Free Quote | Aflac - Offers term, whole, and final expense life insurance policies for financial security with options like guaranteed-issue policies.

Life Insurance - Get a Free Quote Now - GEICO - Offers affordable life insurance policies with options for term, whole, and universal life insurance to meet different needs.

dowidth.com

dowidth.com