Pet health insurance covers veterinary expenses, including accidents, illnesses, and routine care, providing financial relief for unexpected medical costs. Motorcycle insurance offers protection against theft, accidents, liability, and damage specific to motorbikes, ensuring legal compliance and peace of mind on the road. Discover detailed comparisons and benefits to choose the best insurance for your needs.

Why it is important

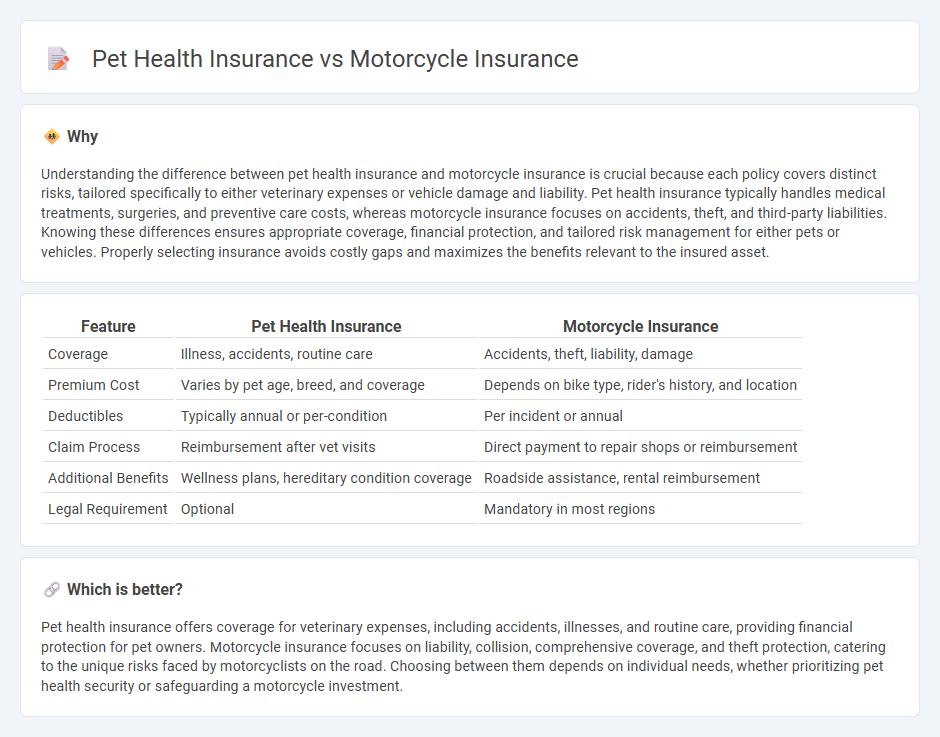

Understanding the difference between pet health insurance and motorcycle insurance is crucial because each policy covers distinct risks, tailored specifically to either veterinary expenses or vehicle damage and liability. Pet health insurance typically handles medical treatments, surgeries, and preventive care costs, whereas motorcycle insurance focuses on accidents, theft, and third-party liabilities. Knowing these differences ensures appropriate coverage, financial protection, and tailored risk management for either pets or vehicles. Properly selecting insurance avoids costly gaps and maximizes the benefits relevant to the insured asset.

Comparison Table

| Feature | Pet Health Insurance | Motorcycle Insurance |

|---|---|---|

| Coverage | Illness, accidents, routine care | Accidents, theft, liability, damage |

| Premium Cost | Varies by pet age, breed, and coverage | Depends on bike type, rider's history, and location |

| Deductibles | Typically annual or per-condition | Per incident or annual |

| Claim Process | Reimbursement after vet visits | Direct payment to repair shops or reimbursement |

| Additional Benefits | Wellness plans, hereditary condition coverage | Roadside assistance, rental reimbursement |

| Legal Requirement | Optional | Mandatory in most regions |

Which is better?

Pet health insurance offers coverage for veterinary expenses, including accidents, illnesses, and routine care, providing financial protection for pet owners. Motorcycle insurance focuses on liability, collision, comprehensive coverage, and theft protection, catering to the unique risks faced by motorcyclists on the road. Choosing between them depends on individual needs, whether prioritizing pet health security or safeguarding a motorcycle investment.

Connection

Pet health insurance and motorcycle insurance are connected through their shared focus on risk management and financial protection against unexpected expenses. Both types of insurance policies employ similar underwriting principles to assess risk factors and set premiums tailored to the insured's profile. By mitigating potential high costs from accidents or health emergencies, these insurance products provide peace of mind and promote responsible ownership of pets and motorcycles alike.

Key Terms

**Motorcycle Insurance:**

Motorcycle insurance provides financial protection against accidents, theft, and liability, covering damages to both the rider and third parties. Policies often include comprehensive, collision, and liability coverage tailored to various motorcycle models and rider needs. Discover how motorcycle insurance safeguards your investment and ensures peace of mind on the road.

Liability Coverage

Motorcycle insurance liability coverage protects against damages or injuries caused to others in an accident, often including bodily injury and property damage up to policy limits. Pet health insurance does not typically cover liability for damages caused by pets, as it focuses primarily on veterinary expenses for illness or injury. Explore how liability coverage differs across these policies to better safeguard your assets.

Collision Coverage

Collision coverage in motorcycle insurance specifically protects the rider from financial losses due to accidents involving other vehicles or objects, addressing repair or replacement costs. Pet health insurance, on the other hand, generally does not include collision coverage but focuses on veterinary treatments and medical expenses for pets. Explore detailed comparisons to understand how coverage types align with your specific insurance needs.

Source and External Links

GEICO Motorcycle Insurance - Offers affordable motorcycle insurance with options for liability, collision, comprehensive, and specialty coverages like accessory and helmet protection, plus emergency roadside service.

Liberty Mutual Motorcycle Insurance - Provides customizable coverage, with discounts and average rates around $33/month, while meeting most state requirements for liability and collision protection.

Dairyland Motorcycle Insurance - Known for competitive rates starting as low as $7/month, Dairyland insures motorcycles, ATVs, and dirt bikes, with coverage tailored to rider history and location.

dowidth.com

dowidth.com