Reciprocal insurance involves a group of individuals or entities who agree to insure each other by sharing risks and premiums through an attorney-in-fact managing the operation. Pooling arrangements combine resources from multiple insurers or policyholders to share losses collectively, often used for large or catastrophic risks. Explore further to understand how each method impacts risk management and financial stability.

Why it is important

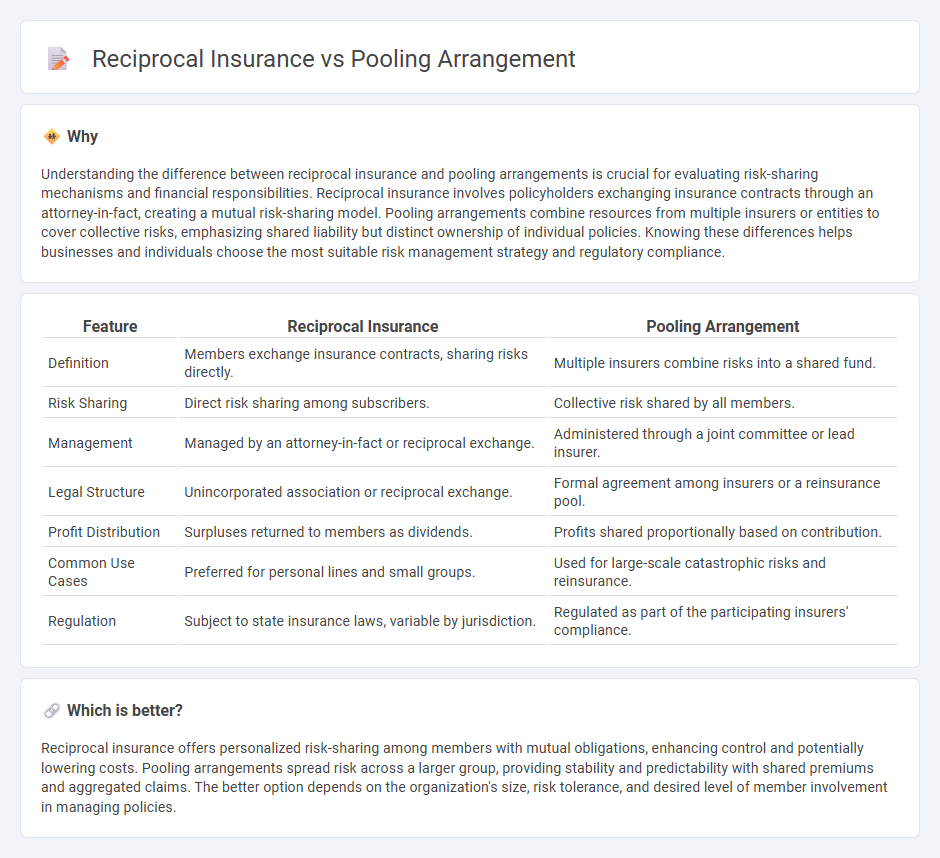

Understanding the difference between reciprocal insurance and pooling arrangements is crucial for evaluating risk-sharing mechanisms and financial responsibilities. Reciprocal insurance involves policyholders exchanging insurance contracts through an attorney-in-fact, creating a mutual risk-sharing model. Pooling arrangements combine resources from multiple insurers or entities to cover collective risks, emphasizing shared liability but distinct ownership of individual policies. Knowing these differences helps businesses and individuals choose the most suitable risk management strategy and regulatory compliance.

Comparison Table

| Feature | Reciprocal Insurance | Pooling Arrangement |

|---|---|---|

| Definition | Members exchange insurance contracts, sharing risks directly. | Multiple insurers combine risks into a shared fund. |

| Risk Sharing | Direct risk sharing among subscribers. | Collective risk shared by all members. |

| Management | Managed by an attorney-in-fact or reciprocal exchange. | Administered through a joint committee or lead insurer. |

| Legal Structure | Unincorporated association or reciprocal exchange. | Formal agreement among insurers or a reinsurance pool. |

| Profit Distribution | Surpluses returned to members as dividends. | Profits shared proportionally based on contribution. |

| Common Use Cases | Preferred for personal lines and small groups. | Used for large-scale catastrophic risks and reinsurance. |

| Regulation | Subject to state insurance laws, variable by jurisdiction. | Regulated as part of the participating insurers' compliance. |

Which is better?

Reciprocal insurance offers personalized risk-sharing among members with mutual obligations, enhancing control and potentially lowering costs. Pooling arrangements spread risk across a larger group, providing stability and predictability with shared premiums and aggregated claims. The better option depends on the organization's size, risk tolerance, and desired level of member involvement in managing policies.

Connection

Reciprocal insurance and pooling arrangements are connected through their mutual risk-sharing mechanisms among members. In reciprocal insurance, members exchange insurance contracts to cover each other's risks, while pooling arrangements aggregate individual risks into a collective fund to spread potential losses. Both methods optimize risk distribution and enhance financial stability within the insured group.

Key Terms

Risk Sharing

Pooling arrangements involve multiple parties contributing to a common fund to collectively absorb and manage risk, distributing losses proportionally based on each member's contribution. Reciprocal insurance is a contractual risk-sharing mechanism where subscribers, known as members, exchange insurance contracts to mutually indemnify one another against specified risks. Explore the nuanced differences between these risk-sharing methods to optimize financial protection strategies.

Underwriting Agreement

Pooling arrangements involve multiple insurers sharing risks and premiums under a collective underwriting agreement, promoting risk diversification and stabilizing loss experience. Reciprocal insurance exchanges operate through subscriber agreements where members agree to indemnify each other, managed by an attorney-in-fact overseeing underwriting and claims. Explore detailed differences and benefits of these underwriting agreements to optimize risk management strategies.

Legal Structure

Pooling arrangements operate under joint agreements where multiple entities share predetermined risks and losses, creating a collective fund without forming a separate legal entity. Reciprocal insurance, in contrast, is structured as an unincorporated association where members, known as subscribers, mutually insure each other through an attorney-in-fact who manages operations legally on their behalf. Explore the detailed legal distinctions and implications to understand which structure aligns best with your risk management needs.

Source and External Links

pooling arrangement Definition | Law Insider - A pooling arrangement is a formal agreement where multiple insurance or reinsurance companies share identified risks in defined proportions, but the insured parties are not themselves members of the pool.

Pooling arrangements in health financing systems - PubMed Central - Pooling arrangements in health financing refer to systems where health funds from multiple sources are combined to spread financial risk across a population, often categorized into types like single pool, territorially distinct pools, or multiple competing pools with risk adjustment.

Pooling 101: RPA - Risk Program Administrators - In risk management, a pool is a member-created, member-owned group that shares risks to stabilize costs, provide tailored coverage, and invest in loss prevention, offering financial stability and specialized services for members.

dowidth.com

dowidth.com