Pay-per-mile insurance charges drivers based on the exact number of miles they drive, offering a cost-effective solution for low-mileage users by leveraging telematics to track usage. Pay-as-you-drive insurance similarly adjusts premiums according to driving behavior and mileage but may incorporate factors like time of day, speed, and road conditions for a more comprehensive risk assessment. Explore the differences between these innovative insurance models to find the best fit for your driving habits and savings.

Why it is important

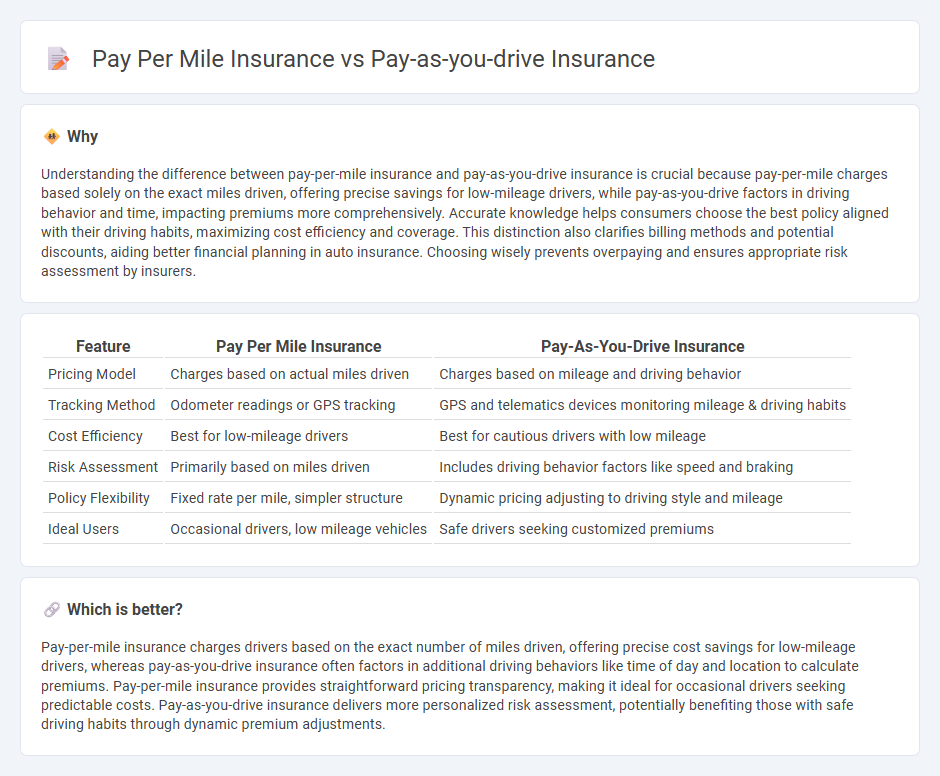

Understanding the difference between pay-per-mile insurance and pay-as-you-drive insurance is crucial because pay-per-mile charges based solely on the exact miles driven, offering precise savings for low-mileage drivers, while pay-as-you-drive factors in driving behavior and time, impacting premiums more comprehensively. Accurate knowledge helps consumers choose the best policy aligned with their driving habits, maximizing cost efficiency and coverage. This distinction also clarifies billing methods and potential discounts, aiding better financial planning in auto insurance. Choosing wisely prevents overpaying and ensures appropriate risk assessment by insurers.

Comparison Table

| Feature | Pay Per Mile Insurance | Pay-As-You-Drive Insurance |

|---|---|---|

| Pricing Model | Charges based on actual miles driven | Charges based on mileage and driving behavior |

| Tracking Method | Odometer readings or GPS tracking | GPS and telematics devices monitoring mileage & driving habits |

| Cost Efficiency | Best for low-mileage drivers | Best for cautious drivers with low mileage |

| Risk Assessment | Primarily based on miles driven | Includes driving behavior factors like speed and braking |

| Policy Flexibility | Fixed rate per mile, simpler structure | Dynamic pricing adjusting to driving style and mileage |

| Ideal Users | Occasional drivers, low mileage vehicles | Safe drivers seeking customized premiums |

Which is better?

Pay-per-mile insurance charges drivers based on the exact number of miles driven, offering precise cost savings for low-mileage drivers, whereas pay-as-you-drive insurance often factors in additional driving behaviors like time of day and location to calculate premiums. Pay-per-mile insurance provides straightforward pricing transparency, making it ideal for occasional drivers seeking predictable costs. Pay-as-you-drive insurance delivers more personalized risk assessment, potentially benefiting those with safe driving habits through dynamic premium adjustments.

Connection

Pay-per-mile insurance and pay-as-you-drive insurance both tie premiums directly to actual driving behavior, calculating costs based on miles driven to provide personalized rates. These usage-based insurance models leverage telematics technology to monitor vehicle usage, encouraging safer driving habits while reducing expenses for low-mileage drivers. By aligning insurance costs with real-world driving patterns, they offer a flexible and cost-effective alternative to traditional fixed-rate auto insurance policies.

Key Terms

Telematics

Pay-as-you-drive insurance uses telematics devices to monitor overall driving time and patterns, offering premiums based on hours spent on the road, while pay-per-mile insurance calculates costs strictly on the exact miles driven, utilizing GPS or odometer data for precision. Both models leverage telematics technology to provide personalized rates that reflect actual driving behavior, promoting fairness and potential savings for low-mileage drivers. Discover how telematics innovations are revolutionizing auto insurance pricing models for enhanced accuracy and customer benefits.

Mileage Tracking

Pay-as-you-drive insurance and pay-per-mile insurance both rely on accurate mileage tracking to determine premiums based on actual vehicle usage. Pay-per-mile insurance offers a more granular approach by charging customers a base rate plus a fixed rate for every mile driven, tracked through GPS devices or smartphone apps. Learn more about how advanced mileage tracking technologies enhance cost savings and policy customization.

Premium Calculation

Pay-as-you-drive insurance calculates premiums based on time frames such as months or years combined with estimated average mileage, often using telematics to track driving behavior, resulting in a fixed base rate plus mileage adjustments. Pay per mile insurance, in contrast, determines premiums solely on the exact number of miles driven, offering precise, usage-based pricing with rates typically ranging from $0.10 to $0.25 per mile. Explore how these different premium calculation methods can impact your insurance costs and coverage options.

Source and External Links

Pay as You Drive (PAYD) Car Insurance by Digit - PAYD insurance allows car owners to pay premiums based on the distance driven (up to 10,000 km/year), offering discounts up to 85%, without needing complicated tracking devices, and is suitable for low-mileage drivers.

Pay-Per-Mile Car Insurance: What You Should Know - Pay-per-mile insurance charges drivers based on actual miles driven, making it ideal for people who drive very little, such as remote workers or retirees, often saving up to 40% compared to traditional policies.

Metromile: Pay Per Mile Car Insurance - Metromile offers pay-per-mile car insurance where customers pay a low base monthly rate plus a few cents per mile, potentially saving hundreds annually and providing flexible coverage with an app for easy management.

dowidth.com

dowidth.com