Pay-as-you-drive insurance charges premiums based on actual mileage, promoting cost-efficiency for low-mileage drivers. Temporary car insurance offers short-term coverage ideal for borrowers or short usage without committing to long-term policies. Explore further to determine which insurance option suits your driving needs best.

Why it is important

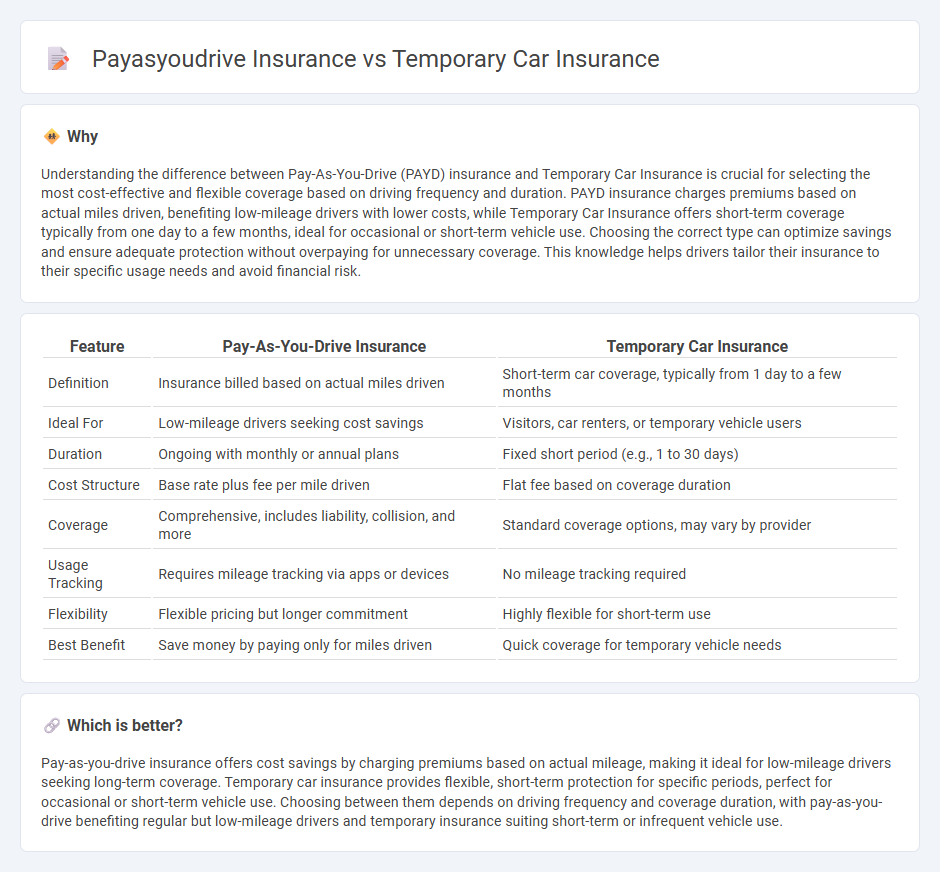

Understanding the difference between Pay-As-You-Drive (PAYD) insurance and Temporary Car Insurance is crucial for selecting the most cost-effective and flexible coverage based on driving frequency and duration. PAYD insurance charges premiums based on actual miles driven, benefiting low-mileage drivers with lower costs, while Temporary Car Insurance offers short-term coverage typically from one day to a few months, ideal for occasional or short-term vehicle use. Choosing the correct type can optimize savings and ensure adequate protection without overpaying for unnecessary coverage. This knowledge helps drivers tailor their insurance to their specific usage needs and avoid financial risk.

Comparison Table

| Feature | Pay-As-You-Drive Insurance | Temporary Car Insurance |

|---|---|---|

| Definition | Insurance billed based on actual miles driven | Short-term car coverage, typically from 1 day to a few months |

| Ideal For | Low-mileage drivers seeking cost savings | Visitors, car renters, or temporary vehicle users |

| Duration | Ongoing with monthly or annual plans | Fixed short period (e.g., 1 to 30 days) |

| Cost Structure | Base rate plus fee per mile driven | Flat fee based on coverage duration |

| Coverage | Comprehensive, includes liability, collision, and more | Standard coverage options, may vary by provider |

| Usage Tracking | Requires mileage tracking via apps or devices | No mileage tracking required |

| Flexibility | Flexible pricing but longer commitment | Highly flexible for short-term use |

| Best Benefit | Save money by paying only for miles driven | Quick coverage for temporary vehicle needs |

Which is better?

Pay-as-you-drive insurance offers cost savings by charging premiums based on actual mileage, making it ideal for low-mileage drivers seeking long-term coverage. Temporary car insurance provides flexible, short-term protection for specific periods, perfect for occasional or short-term vehicle use. Choosing between them depends on driving frequency and coverage duration, with pay-as-you-drive benefiting regular but low-mileage drivers and temporary insurance suiting short-term or infrequent vehicle use.

Connection

Pay-as-you-drive insurance and temporary car insurance both offer flexible coverage tailored to specific driving needs and durations. Pay-as-you-drive insurance calculates premiums based on actual miles driven, promoting cost efficiency for infrequent drivers. Temporary car insurance provides short-term protection, ideal for renters or occasional drivers, ensuring coverage without long-term commitments.

Key Terms

Coverage duration

Temporary car insurance typically offers coverage for a fixed, short-term period ranging from one hour up to 30 days, making it ideal for short trips or occasional vehicle use. Pay-as-you-drive insurance provides ongoing coverage where premiums are calculated based on actual mileage driven, promoting cost efficiency for infrequent drivers over an extended time. Explore detailed comparisons to determine which insurance solution best fits your driving habits and coverage needs.

Usage-based premiums

Temporary car insurance offers fixed premiums for short-term coverage periods, ideal for occasional or emergency use, while pay-as-you-drive insurance calculates premiums based on actual miles driven, rewarding low-mileage drivers with cost savings. Usage-based premiums in pay-as-you-drive policies leverage telematics to monitor driving behavior, providing personalized rates that reflect real-time risk assessment. Explore more to understand which insurance best fits your driving habits and budget.

Flexibility

Temporary car insurance offers immediate coverage for short periods, ideal for occasional drivers or short-term needs, providing high flexibility without long-term commitments. Pay-as-you-drive insurance calculates premiums based on actual miles driven, allowing users to pay only for their road usage, enhancing cost efficiency and adaptability for variable driving patterns. Explore how these flexible insurance options can fit your driving habits and financial preferences.

Source and External Links

Temporary Car Insurance in California: Best Month-to- ... - California offers various short-term auto insurance options for temporary owners, occasional drivers, or borrowers, with policies lasting from 1 day to 6 months and covering full protection or just liability depending on the need.

How to Get Temporary Car Insurance - Temporary car insurance usually lasts about 30 days, typically provides liability coverage only without collision or comprehensive, has no cancellation fees, and may carry higher risks for insurers, so alternatives like non-owner or pay-per-mile insurance are often better.

Temporary Car Insurance - Insurance Navy offers flexible short-term car insurance policies starting from one month, providing comprehensive protection suitable for brief coverage needs, with competitive rates tailored individually.

dowidth.com

dowidth.com