Pay-as-you-drive insurance calculates premiums based on the distance driven, offering cost savings for low-mileage drivers, while behavior-based insurance assesses driving habits such as speed, braking, and acceleration to determine personalized rates. Both models utilize telematics technology but focus on different data points, providing flexible options tailored to individual driving patterns. Explore how these innovative insurance solutions can optimize your coverage and reduce costs.

Why it is important

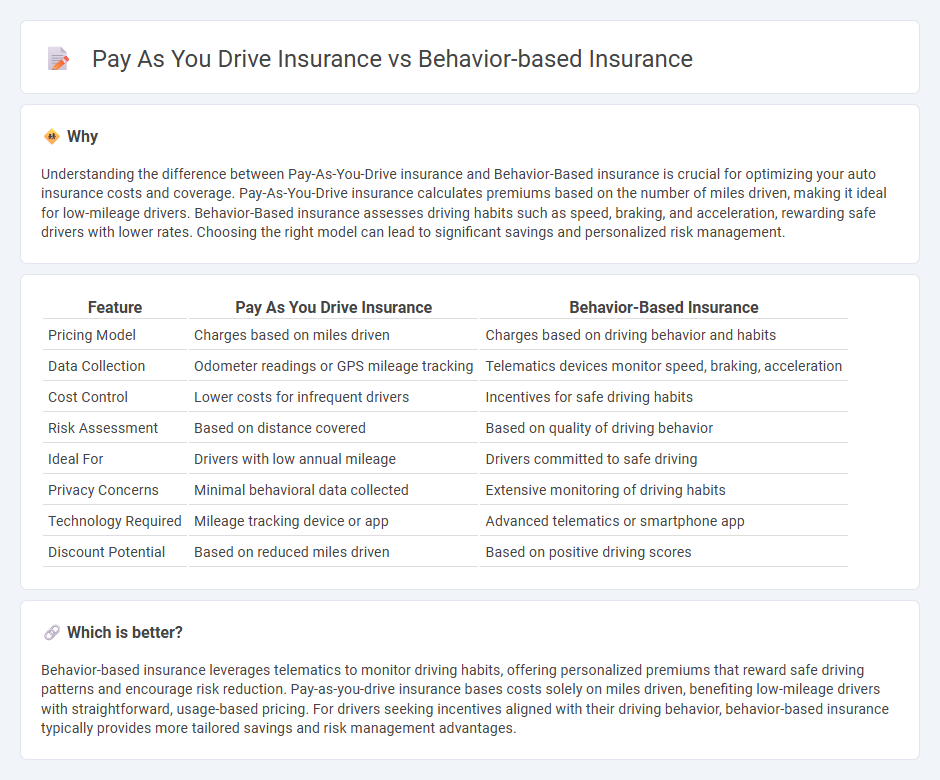

Understanding the difference between Pay-As-You-Drive insurance and Behavior-Based insurance is crucial for optimizing your auto insurance costs and coverage. Pay-As-You-Drive insurance calculates premiums based on the number of miles driven, making it ideal for low-mileage drivers. Behavior-Based insurance assesses driving habits such as speed, braking, and acceleration, rewarding safe drivers with lower rates. Choosing the right model can lead to significant savings and personalized risk management.

Comparison Table

| Feature | Pay As You Drive Insurance | Behavior-Based Insurance |

|---|---|---|

| Pricing Model | Charges based on miles driven | Charges based on driving behavior and habits |

| Data Collection | Odometer readings or GPS mileage tracking | Telematics devices monitor speed, braking, acceleration |

| Cost Control | Lower costs for infrequent drivers | Incentives for safe driving habits |

| Risk Assessment | Based on distance covered | Based on quality of driving behavior |

| Ideal For | Drivers with low annual mileage | Drivers committed to safe driving |

| Privacy Concerns | Minimal behavioral data collected | Extensive monitoring of driving habits |

| Technology Required | Mileage tracking device or app | Advanced telematics or smartphone app |

| Discount Potential | Based on reduced miles driven | Based on positive driving scores |

Which is better?

Behavior-based insurance leverages telematics to monitor driving habits, offering personalized premiums that reward safe driving patterns and encourage risk reduction. Pay-as-you-drive insurance bases costs solely on miles driven, benefiting low-mileage drivers with straightforward, usage-based pricing. For drivers seeking incentives aligned with their driving behavior, behavior-based insurance typically provides more tailored savings and risk management advantages.

Connection

Pay-as-you-drive insurance and behavior-based insurance both utilize telematics technology to monitor driving habits and mileage, allowing insurers to assess risk more accurately and personalize premiums. These usage-based models incentivize safer driving by linking insurance costs directly to real-time driving behavior and distance covered. By integrating data such as speed, acceleration, and braking patterns, they provide a comprehensive risk profile that benefits both drivers and insurance providers.

Key Terms

Telematics

Behavior-based insurance relies on telematics devices to monitor driving habits such as speed, braking, and acceleration, enabling insurers to offer personalized premiums based on actual behavior. Pay-as-you-drive insurance calculates premiums primarily on the distance driven, using telematics to track mileage rather than detailed driving patterns. Explore how telematics technology transforms auto insurance by linking driving behavior and usage to personalized rates.

Usage-Based Premiums

Usage-based premiums are central to both behavior-based insurance and pay-as-you-drive insurance models, leveraging telematics data to assess risk and personalize rates. Behavior-based insurance analyzes driving habits like speed, braking, and acceleration, while pay-as-you-drive insurance charges based on mileage. Explore the nuances of these innovative insurance approaches to optimize your coverage and savings.

Driving Behavior Analysis

Behavior-based insurance relies on telematics technology to monitor various driving behaviors such as speed, acceleration, braking, and cornering to assess risk and tailor premiums accordingly. Pay as you drive insurance primarily calculates costs based on miles driven, offering a straightforward pricing model linked to vehicle usage. Explore the nuances of driving behavior analysis to understand how these insurance models impact your coverage and savings.

Source and External Links

Behavior-Based Insurance: Role In Transforming Health Plans - This article discusses how behavior-based insurance adjusts premiums based on observed behaviors, offering a more personalized approach to risk assessment.

Behavioral Insurance Reshapes Risk Models - Behavioral insurance incorporates continuous risk data tracking and interventions, affecting premiums in sectors like auto, life, and home insurance.

Comparing UBI and BBI Insurance Models - This article compares Usage-Based Insurance (UBI) and Behavior-Based Insurance (BBI), highlighting their different focuses and benefits, such as BBI's comprehensive approach to risk assessment.

dowidth.com

dowidth.com