Catastrophe bonds transfer risk from insurers to capital market investors, providing alternative funding for catastrophic events with payout triggered by predefined disaster parameters. Collateralized reinsurance involves insurers posting collateral to secure coverage, ensuring immediate liquidity for claims from natural disasters. Explore detailed comparisons to understand which financial instrument best suits disaster risk management strategies.

Why it is important

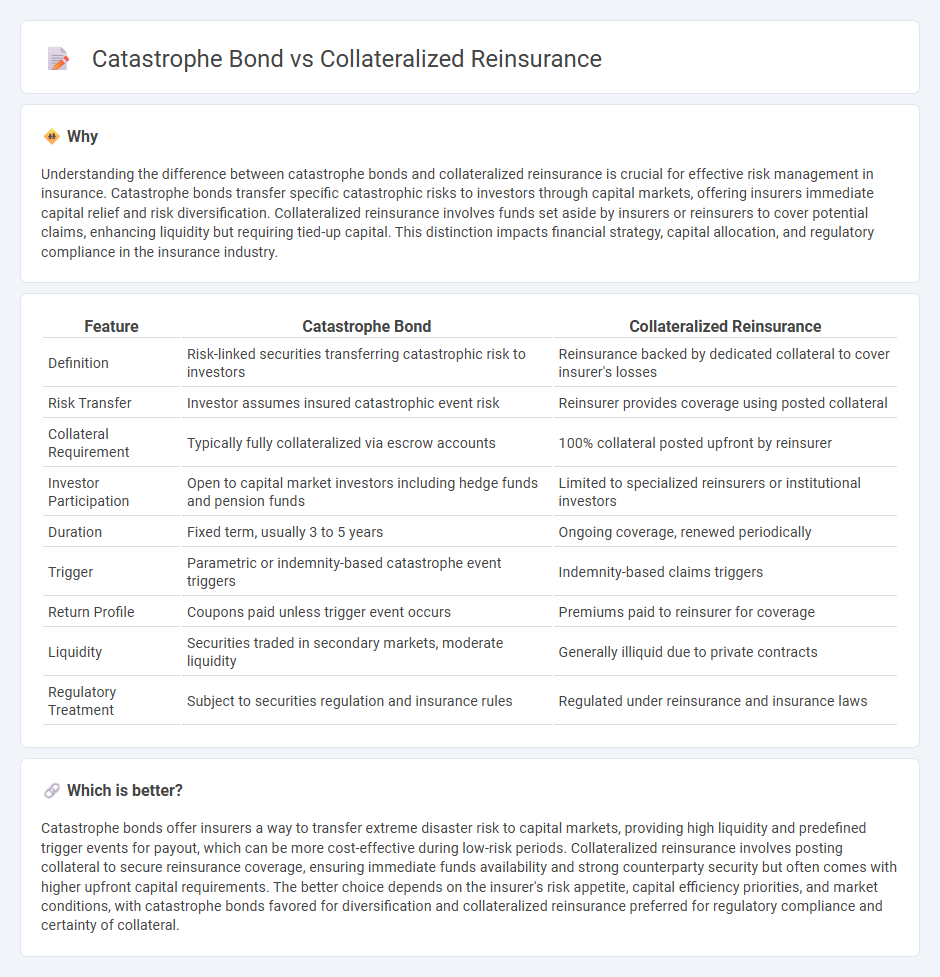

Understanding the difference between catastrophe bonds and collateralized reinsurance is crucial for effective risk management in insurance. Catastrophe bonds transfer specific catastrophic risks to investors through capital markets, offering insurers immediate capital relief and risk diversification. Collateralized reinsurance involves funds set aside by insurers or reinsurers to cover potential claims, enhancing liquidity but requiring tied-up capital. This distinction impacts financial strategy, capital allocation, and regulatory compliance in the insurance industry.

Comparison Table

| Feature | Catastrophe Bond | Collateralized Reinsurance |

|---|---|---|

| Definition | Risk-linked securities transferring catastrophic risk to investors | Reinsurance backed by dedicated collateral to cover insurer's losses |

| Risk Transfer | Investor assumes insured catastrophic event risk | Reinsurer provides coverage using posted collateral |

| Collateral Requirement | Typically fully collateralized via escrow accounts | 100% collateral posted upfront by reinsurer |

| Investor Participation | Open to capital market investors including hedge funds and pension funds | Limited to specialized reinsurers or institutional investors |

| Duration | Fixed term, usually 3 to 5 years | Ongoing coverage, renewed periodically |

| Trigger | Parametric or indemnity-based catastrophe event triggers | Indemnity-based claims triggers |

| Return Profile | Coupons paid unless trigger event occurs | Premiums paid to reinsurer for coverage |

| Liquidity | Securities traded in secondary markets, moderate liquidity | Generally illiquid due to private contracts |

| Regulatory Treatment | Subject to securities regulation and insurance rules | Regulated under reinsurance and insurance laws |

Which is better?

Catastrophe bonds offer insurers a way to transfer extreme disaster risk to capital markets, providing high liquidity and predefined trigger events for payout, which can be more cost-effective during low-risk periods. Collateralized reinsurance involves posting collateral to secure reinsurance coverage, ensuring immediate funds availability and strong counterparty security but often comes with higher upfront capital requirements. The better choice depends on the insurer's risk appetite, capital efficiency priorities, and market conditions, with catastrophe bonds favored for diversification and collateralized reinsurance preferred for regulatory compliance and certainty of collateral.

Connection

Catastrophe bonds (cat bonds) and collateralized reinsurance both provide alternative risk transfer solutions to insurance companies facing large-scale losses from natural disasters. Cat bonds transfer risk to capital markets by issuing securities backed by the insurer's obligations, while collateralized reinsurance involves posting collateral to guarantee claims payments, reducing counterparty risk. Both mechanisms enhance insurer capital efficiency by diversifying risk and accessing broader financial resources beyond traditional reinsurance markets.

Key Terms

Risk Transfer

Collateralized reinsurance transfers risk by using capital reserves to cover potential losses, providing direct financial backing and immediate claims payments. Catastrophe bonds shift risk to investors by issuing securities that pay out only if a predefined disaster occurs, thus transferring the risk away from the insurer to the capital markets. Explore the detailed mechanisms and benefits of these risk transfer tools to enhance your understanding of modern insurance solutions.

Special Purpose Vehicle (SPV)

Collateralized reinsurance uses a Special Purpose Vehicle (SPV) to hold funds from the insurer, ensuring prompt claims payments by segregating collateral assets, whereas catastrophe bonds involve an SPV issuing securities to transfer risk to capital market investors. Both mechanisms leverage SPVs for risk isolation and regulatory compliance, but catastrophe bonds provide greater market liquidity and diversification of risk sources. Explore further how SPVs optimize risk transfer in these financial instruments.

Collateralization

Collateralized reinsurance involves securing reinsurance liabilities with collateral to ensure claims are paid, enhancing financial security for cedents by minimizing counterparty risk. Catastrophe bonds transfer risk to capital market investors but do not typically require full collateralization, leading to differences in liquidity and credit profile. Explore further to understand how collateralization impacts risk management strategies.

Source and External Links

What is collateralized (collateralised) reinsurance? - Collateralized reinsurance is a reinsurance contract fully backed by collateral--typically equal to the contract limit minus premiums--posted by investors, enabling unrated or third-party capital to directly participate in reinsurance programs and providing cedents with a fully secured source of risk capital.

Collateralized Reinsurance - Collateralized reinsurance can protect the 'Ultimate Net Loss' of the reinsured, is issued by regulated entities, and involves investors posting collateral that is returned (with premiums) at contract end, with risk assessment based on a deep understanding of the reinsured's portfolio.

Management of Collateralised Reinsurance - Collateralized reinsurance is widely used in the market to reduce counterparty credit risk, lower capital requirements, and provide access to a broader capital pool, though it can involve complex legal and jurisdictional arrangements beyond traditional reinsurance.

dowidth.com

dowidth.com