Mental health insurance provides coverage for therapy, counseling, and psychiatric treatments, addressing the increasing awareness and need for mental wellness support. Homeowners insurance protects your property against risks like fire, theft, and natural disasters, ensuring financial security for your residence and belongings. Explore the key differences and benefits to determine the best insurance coverage for your needs.

Why it is important

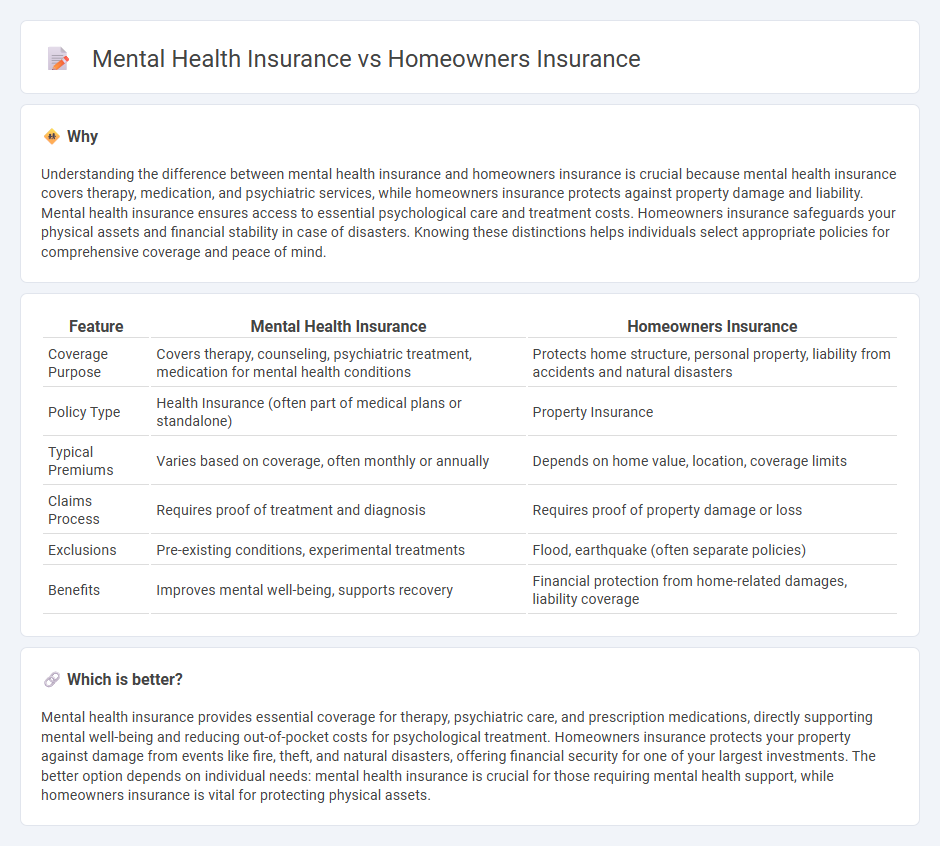

Understanding the difference between mental health insurance and homeowners insurance is crucial because mental health insurance covers therapy, medication, and psychiatric services, while homeowners insurance protects against property damage and liability. Mental health insurance ensures access to essential psychological care and treatment costs. Homeowners insurance safeguards your physical assets and financial stability in case of disasters. Knowing these distinctions helps individuals select appropriate policies for comprehensive coverage and peace of mind.

Comparison Table

| Feature | Mental Health Insurance | Homeowners Insurance |

|---|---|---|

| Coverage Purpose | Covers therapy, counseling, psychiatric treatment, medication for mental health conditions | Protects home structure, personal property, liability from accidents and natural disasters |

| Policy Type | Health Insurance (often part of medical plans or standalone) | Property Insurance |

| Typical Premiums | Varies based on coverage, often monthly or annually | Depends on home value, location, coverage limits |

| Claims Process | Requires proof of treatment and diagnosis | Requires proof of property damage or loss |

| Exclusions | Pre-existing conditions, experimental treatments | Flood, earthquake (often separate policies) |

| Benefits | Improves mental well-being, supports recovery | Financial protection from home-related damages, liability coverage |

Which is better?

Mental health insurance provides essential coverage for therapy, psychiatric care, and prescription medications, directly supporting mental well-being and reducing out-of-pocket costs for psychological treatment. Homeowners insurance protects your property against damage from events like fire, theft, and natural disasters, offering financial security for one of your largest investments. The better option depends on individual needs: mental health insurance is crucial for those requiring mental health support, while homeowners insurance is vital for protecting physical assets.

Connection

Mental health insurance and homeowners insurance intersect in providing comprehensive protection that supports overall well-being and financial security within the home environment. Mental health insurance covers therapy and counseling expenses, which can be crucial for coping with stressors related to homeownership challenges such as property damage or disputes. Homeowners insurance offers protection against physical damages and liabilities, reducing financial strain that might otherwise impact mental health stability.

Key Terms

Coverage (Dwelling vs. Therapy/Medication)

Homeowners insurance primarily covers physical damage to your dwelling and personal property caused by perils like fire, theft, or natural disasters, ensuring the structural integrity and replacement of your home. Mental health insurance focuses on therapy sessions, psychiatric consultations, and prescribed medications, providing financial support for mental health treatment and wellness. Explore detailed comparisons to understand which policy best suits your protection needs.

Peril (Property Damage vs. Mental Health Diagnosis)

Homeowners insurance primarily covers property damage caused by perils such as fire, theft, or natural disasters, protecting the structure and personal belongings within a residence. Mental health insurance focuses on the diagnosis and treatment of mental health conditions, offering coverage for therapy, counseling, and psychiatric care under health plans. Explore detailed comparisons and coverage nuances to understand how each insurance type addresses specific risks and health needs.

Exclusion (Flood/Earthquake vs. Certain Mental Disorders)

Homeowners insurance often excludes coverage for flood and earthquake damages, requiring separate policies or endorsements to protect against these natural disasters. In contrast, mental health insurance frequently excludes certain mental disorders or pre-existing conditions, limiting coverage based on policy terms and medical necessity criteria. Explore detailed comparisons to understand how exclusions impact your overall protection and financial planning.

Source and External Links

Homeowners Insurance - Get a Home Insurance Quote - Homeowners insurance is a contract where you pay premiums and the insurer covers damages to your home from covered losses, with coverage and premiums based on factors like location, home materials, and usage.

Homeowners Insurance - Online Quotes - Homeowners insurance protects your home and belongings from damage, theft, liability claims, and living expenses during repairs, covering dwelling, personal property, and liability.

Homeowners Insurance - Get a Free Home Insurance Quote ... - Homeowners insurance is usually required by mortgage lenders and includes the "80% rule," which mandates insuring your home for at least 80% of its replacement cost to avoid underinsurance.

dowidth.com

dowidth.com