Invisible insurance offers seamless coverage embedded within everyday transactions, reducing the need for separate policy management, while self-insurance involves individuals or businesses setting aside funds to cover potential losses independently, providing greater control but increased financial risk. Understanding the distinctions between these approaches can help optimize risk protection and cost-efficiency tailored to specific needs. Explore the benefits and drawbacks of invisible insurance versus self-insurance to determine the best strategy for your financial security.

Why it is important

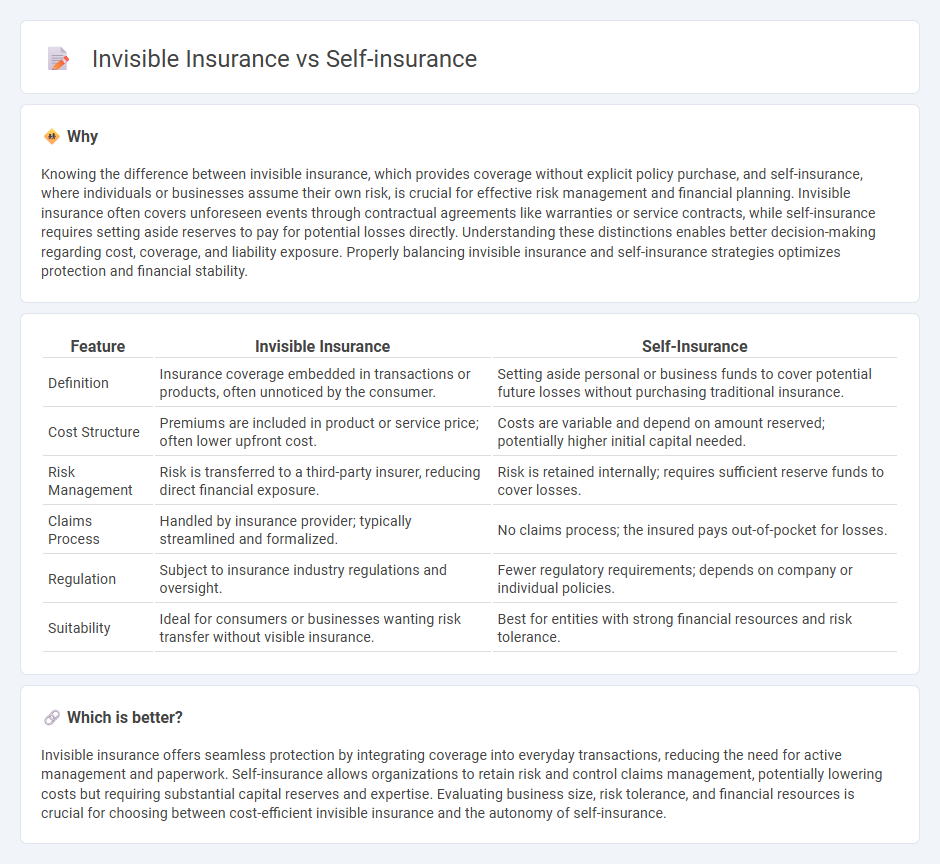

Knowing the difference between invisible insurance, which provides coverage without explicit policy purchase, and self-insurance, where individuals or businesses assume their own risk, is crucial for effective risk management and financial planning. Invisible insurance often covers unforeseen events through contractual agreements like warranties or service contracts, while self-insurance requires setting aside reserves to pay for potential losses directly. Understanding these distinctions enables better decision-making regarding cost, coverage, and liability exposure. Properly balancing invisible insurance and self-insurance strategies optimizes protection and financial stability.

Comparison Table

| Feature | Invisible Insurance | Self-Insurance |

|---|---|---|

| Definition | Insurance coverage embedded in transactions or products, often unnoticed by the consumer. | Setting aside personal or business funds to cover potential future losses without purchasing traditional insurance. |

| Cost Structure | Premiums are included in product or service price; often lower upfront cost. | Costs are variable and depend on amount reserved; potentially higher initial capital needed. |

| Risk Management | Risk is transferred to a third-party insurer, reducing direct financial exposure. | Risk is retained internally; requires sufficient reserve funds to cover losses. |

| Claims Process | Handled by insurance provider; typically streamlined and formalized. | No claims process; the insured pays out-of-pocket for losses. |

| Regulation | Subject to insurance industry regulations and oversight. | Fewer regulatory requirements; depends on company or individual policies. |

| Suitability | Ideal for consumers or businesses wanting risk transfer without visible insurance. | Best for entities with strong financial resources and risk tolerance. |

Which is better?

Invisible insurance offers seamless protection by integrating coverage into everyday transactions, reducing the need for active management and paperwork. Self-insurance allows organizations to retain risk and control claims management, potentially lowering costs but requiring substantial capital reserves and expertise. Evaluating business size, risk tolerance, and financial resources is crucial for choosing between cost-efficient invisible insurance and the autonomy of self-insurance.

Connection

Invisible insurance and self-insurance both focus on risk management without traditional policy purchases, where invisible insurance mitigates loss through embedded protections in products or services, while self-insurance involves setting aside funds to cover potential losses internally. Organizations often integrate invisible insurance mechanisms within self-insurance strategies to reduce claim frequency and severity, optimizing financial resilience. This connection enhances risk control efficiency by leveraging both proactive loss prevention and financial self-coverage.

Key Terms

Risk Retention

Self-insurance involves a company or individual assuming financial responsibility for potential losses instead of purchasing traditional insurance, emphasizing direct risk retention and cost control. Invisible insurance refers to embedded coverage within products or services, offering risk protection indirectly without explicit policy acknowledgment. Explore further to understand how these approaches optimize risk management strategies.

Premium Payments

Self-insurance involves setting aside funds to cover potential losses without paying external premiums, allowing direct control over risk management and cost savings. Invisible insurance, on the other hand, embeds protection costs within everyday transactions or fees, making premium payments less noticeable to consumers. Explore the differences in premium structures and risk strategies to understand which approach best fits your financial planning needs.

Coverage Transparency

Self-insurance offers direct control over risk management by retaining financial responsibility for losses, providing clear visibility into specific coverage limits and claim handling processes. Invisible insurance typically embeds coverage within other services or products, often leading to less transparent terms and potentially unexpected exclusions or limits. Explore deeper insights into how these insurance models impact coverage clarity and decision-making for better risk protection.

Source and External Links

Self-insurance - Self-insurance is a risk management strategy where an organization assumes the financial risk itself rather than purchasing external insurance, often saving costs by eliminating premiums.

A Guide to Self-Insurance - This guide provides a comprehensive approach to managing self-insurance by creating a strong team, analyzing cash flow, and developing a self-insurance policy.

Self-Insured Vs. Fully Insured Health Plans - Self-insurance, also known as self-funding, allows employers to manage health benefit costs directly, offering flexibility and potential cost savings.

dowidth.com

dowidth.com