Micro-mobility insurance focuses on protecting individual users and their personal electric scooters, bikes, or other compact vehicles against theft, accidents, and liability. Scooter sharing insurance covers fleets owned by service providers, addressing risks like third-party liability, property damage, and user injuries during rental periods. Explore the key differences and specific requirements for both insurance types to ensure optimal coverage.

Why it is important

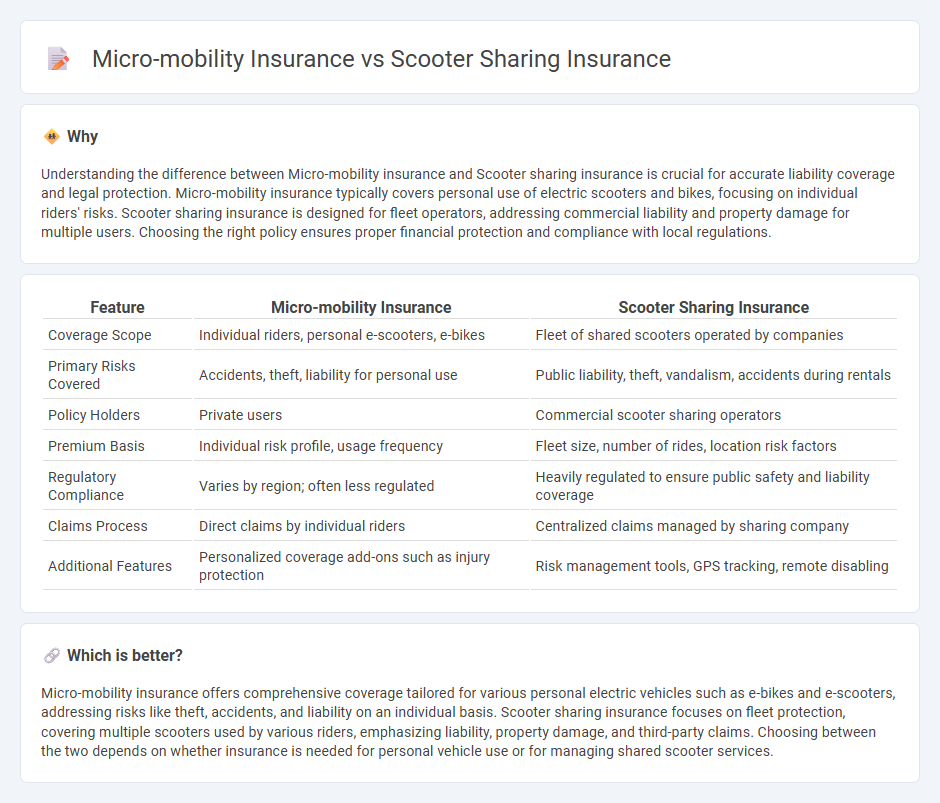

Understanding the difference between Micro-mobility insurance and Scooter sharing insurance is crucial for accurate liability coverage and legal protection. Micro-mobility insurance typically covers personal use of electric scooters and bikes, focusing on individual riders' risks. Scooter sharing insurance is designed for fleet operators, addressing commercial liability and property damage for multiple users. Choosing the right policy ensures proper financial protection and compliance with local regulations.

Comparison Table

| Feature | Micro-mobility Insurance | Scooter Sharing Insurance |

|---|---|---|

| Coverage Scope | Individual riders, personal e-scooters, e-bikes | Fleet of shared scooters operated by companies |

| Primary Risks Covered | Accidents, theft, liability for personal use | Public liability, theft, vandalism, accidents during rentals |

| Policy Holders | Private users | Commercial scooter sharing operators |

| Premium Basis | Individual risk profile, usage frequency | Fleet size, number of rides, location risk factors |

| Regulatory Compliance | Varies by region; often less regulated | Heavily regulated to ensure public safety and liability coverage |

| Claims Process | Direct claims by individual riders | Centralized claims managed by sharing company |

| Additional Features | Personalized coverage add-ons such as injury protection | Risk management tools, GPS tracking, remote disabling |

Which is better?

Micro-mobility insurance offers comprehensive coverage tailored for various personal electric vehicles such as e-bikes and e-scooters, addressing risks like theft, accidents, and liability on an individual basis. Scooter sharing insurance focuses on fleet protection, covering multiple scooters used by various riders, emphasizing liability, property damage, and third-party claims. Choosing between the two depends on whether insurance is needed for personal vehicle use or for managing shared scooter services.

Connection

Micro-mobility insurance and scooter sharing insurance both address the unique risks and liabilities associated with short-distance, shared transportation modes such as electric scooters and bikes. These insurance types provide coverage for damages, theft, and third-party injuries, ensuring protection for riders, companies, and pedestrians involved in micro-mobility ecosystems. Integration of real-time data and usage-based policies enhances the efficiency and accuracy of risk assessment within these interconnected insurance frameworks.

Key Terms

Scooter sharing insurance:

Scooter sharing insurance specifically covers risks associated with electric scooter rental operations, including liability for rider injuries, property damage, and theft, tailored to the unique usage patterns and regulatory requirements of shared scooters. It provides coverage for fleet operators against claims arising from accidents during rental periods, ensuring compliance with local laws and protecting both company assets and user safety. Explore detailed coverage options and benefits to optimize your scooter sharing business's insurance strategy.

Fleet coverage

Scooter sharing insurance specifically covers risks associated with shared electric scooters, including damage, theft, and liability for users, ensuring protected operations within fleet management. Micro-mobility insurance offers broader protection for various small electric vehicles like e-bikes and e-scooters, providing fleet coverage that addresses diverse asset risks and regulatory requirements in urban environments. Discover how tailored insurance solutions optimize fleet safety and business continuity in the evolving micro-mobility sector.

Liability protection

Scooter sharing insurance primarily focuses on liability protection tailored for shared electric scooters, covering third-party bodily injury and property damage during rental periods. Micro-mobility insurance extends this liability coverage to a broader range of vehicles like e-bikes and skateboards, addressing risks associated with diverse micro-transportation modes. Explore our detailed analysis to understand the nuances between these insurance types and optimize your liability protection.

Source and External Links

Do I Need to Insure an Electric Scooter? - This article discusses the importance of checking if your insurance policy covers e-scooter rentals, as some providers may offer coverage for accidents.

Does insurance cover electric scooter rentals? - This resource explains that car insurance policies typically do not cover accidents involving rental scooters.

Scooter Rental Insurance Solutions - Offers specialized insurance solutions for scooter rental businesses, protecting against liability claims and unexpected incidents.

dowidth.com

dowidth.com