Reciprocal insurance involves a group of individuals or entities exchanging insurance coverage through a shared attorney-in-fact, offering customized policies and flexible management. Risk Retention Groups (RRGs) are liability insurance companies owned by their members, providing risk-sharing solutions primarily for businesses with similar risk profiles under federal regulation. Explore the differences and benefits of reciprocal insurance and Risk Retention Groups to determine the best fit for your risk management needs.

Why it is important

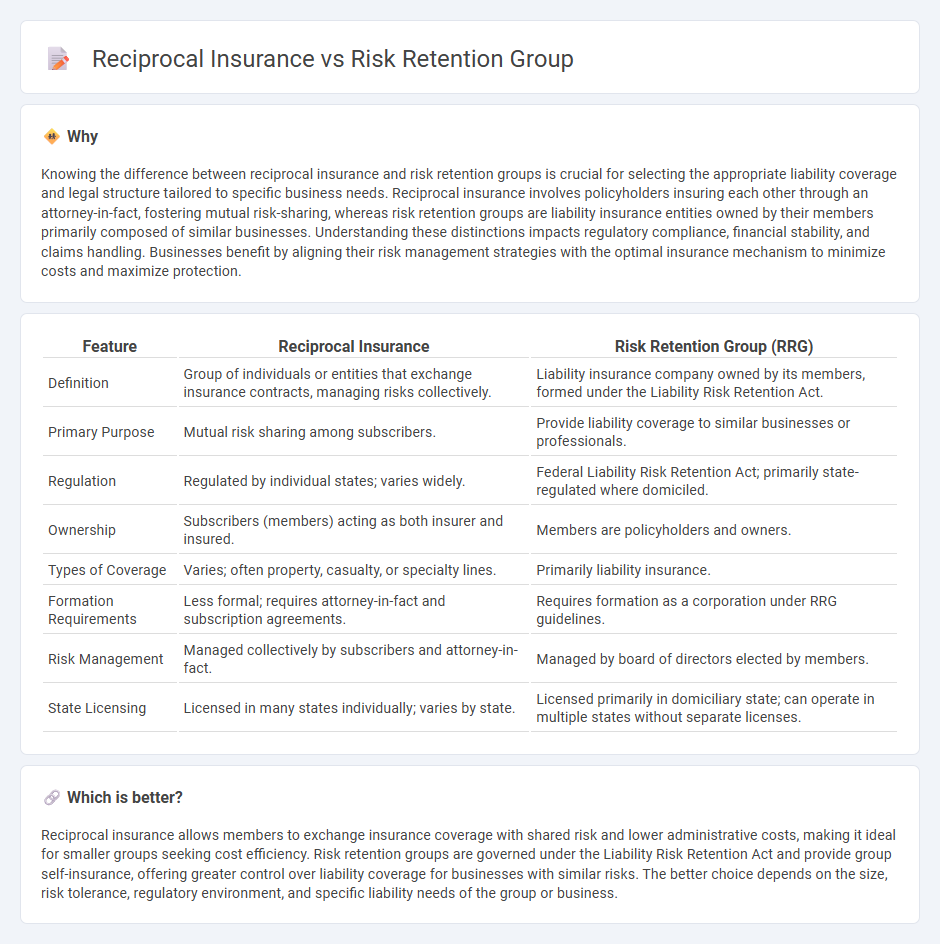

Knowing the difference between reciprocal insurance and risk retention groups is crucial for selecting the appropriate liability coverage and legal structure tailored to specific business needs. Reciprocal insurance involves policyholders insuring each other through an attorney-in-fact, fostering mutual risk-sharing, whereas risk retention groups are liability insurance entities owned by their members primarily composed of similar businesses. Understanding these distinctions impacts regulatory compliance, financial stability, and claims handling. Businesses benefit by aligning their risk management strategies with the optimal insurance mechanism to minimize costs and maximize protection.

Comparison Table

| Feature | Reciprocal Insurance | Risk Retention Group (RRG) |

|---|---|---|

| Definition | Group of individuals or entities that exchange insurance contracts, managing risks collectively. | Liability insurance company owned by its members, formed under the Liability Risk Retention Act. |

| Primary Purpose | Mutual risk sharing among subscribers. | Provide liability coverage to similar businesses or professionals. |

| Regulation | Regulated by individual states; varies widely. | Federal Liability Risk Retention Act; primarily state-regulated where domiciled. |

| Ownership | Subscribers (members) acting as both insurer and insured. | Members are policyholders and owners. |

| Types of Coverage | Varies; often property, casualty, or specialty lines. | Primarily liability insurance. |

| Formation Requirements | Less formal; requires attorney-in-fact and subscription agreements. | Requires formation as a corporation under RRG guidelines. |

| Risk Management | Managed collectively by subscribers and attorney-in-fact. | Managed by board of directors elected by members. |

| State Licensing | Licensed in many states individually; varies by state. | Licensed primarily in domiciliary state; can operate in multiple states without separate licenses. |

Which is better?

Reciprocal insurance allows members to exchange insurance coverage with shared risk and lower administrative costs, making it ideal for smaller groups seeking cost efficiency. Risk retention groups are governed under the Liability Risk Retention Act and provide group self-insurance, offering greater control over liability coverage for businesses with similar risks. The better choice depends on the size, risk tolerance, regulatory environment, and specific liability needs of the group or business.

Connection

Reciprocal insurance exchanges and Risk Retention Groups (RRGs) both provide alternative risk financing mechanisms tailored to groups with shared interests, enabling members to pool and self-insure against specific risks. Reciprocal insurance operates through an attorney-in-fact managing pooled premiums for mutual coverage, while RRGs are liability insurers formed under the Liability Risk Retention Act allowing businesses with similar liability exposures to underwrite and share risks collectively. Both structures offer enhanced control over coverage terms, cost efficiencies, and risk management tailored to unique group requirements.

Key Terms

Ownership structure

Risk retention groups (RRGs) are owned by their members, typically businesses with similar liability risks, allowing policyholders to share in profits and losses. Reciprocal insurance exchanges operate through subscribers who mutually insure each other, managed by an attorney-in-fact, providing a flexible governance model without traditional corporate structure. Explore further to understand the distinct ownership models and implications for risk management.

Liability sharing

Risk retention groups (RRGs) are liability insurance entities owned by their members, primarily focusing on shared risk among businesses with similar liability exposures, such as healthcare providers or manufacturers. Reciprocal insurance exchanges operate by policyholders acting as both insurers and insureds, pooling resources through an attorney-in-fact to manage liabilities collectively across diverse industries. Explore in-depth comparisons of risk retention groups and reciprocal insurance to understand their nuances in liability sharing and risk management.

Regulation

Risk retention groups (RRGs) operate under the Liability Risk Retention Act (LRRA) of 1986, allowing groups of similar businesses to pool liability risks and are primarily regulated by the state of domicile but allowed to operate nationwide with limited state regulation. Reciprocal insurance exchanges function through an attorney-in-fact who manages policyholder contributions and are subject to more stringent multi-state regulatory frameworks, including state insurance departments that oversee solvency, rates, and market conduct. Explore further to understand how these regulatory distinctions impact operational flexibility and compliance requirements.

Source and External Links

Risk retention group - A risk retention group (RRG) is a liability insurance company created under the federal Liability Risk Retention Act, owned by and insuring organizations engaged in similar businesses, allowing them to assume and spread liability exposures among members.

Risk Retention Group vs. Captive - RRGs provide members with greater control over their insurance programs, access to reinsurance markets, and the potential to receive dividends based on favorable loss experience, all while offering stable, predictable pricing and multi-state operations.

What Are Risk Retention Groups & What's Their Role? - RRGs are member-owned insurers that pool liability risks for self-insurance, offering customization, exemption from many state requirements, and the advantage of policyholders retaining profits that would otherwise go to a traditional insurer.

dowidth.com

dowidth.com