Mental health insurance focuses on coverage for therapy, counseling, psychiatric services, and prescription medications related to mental health conditions, supporting emotional and psychological well-being. Business insurance protects companies from financial losses due to property damage, liability claims, employee injuries, and business interruptions, safeguarding operational continuity. Explore the differences and benefits of mental health and business insurance to optimize your protection strategy.

Why it is important

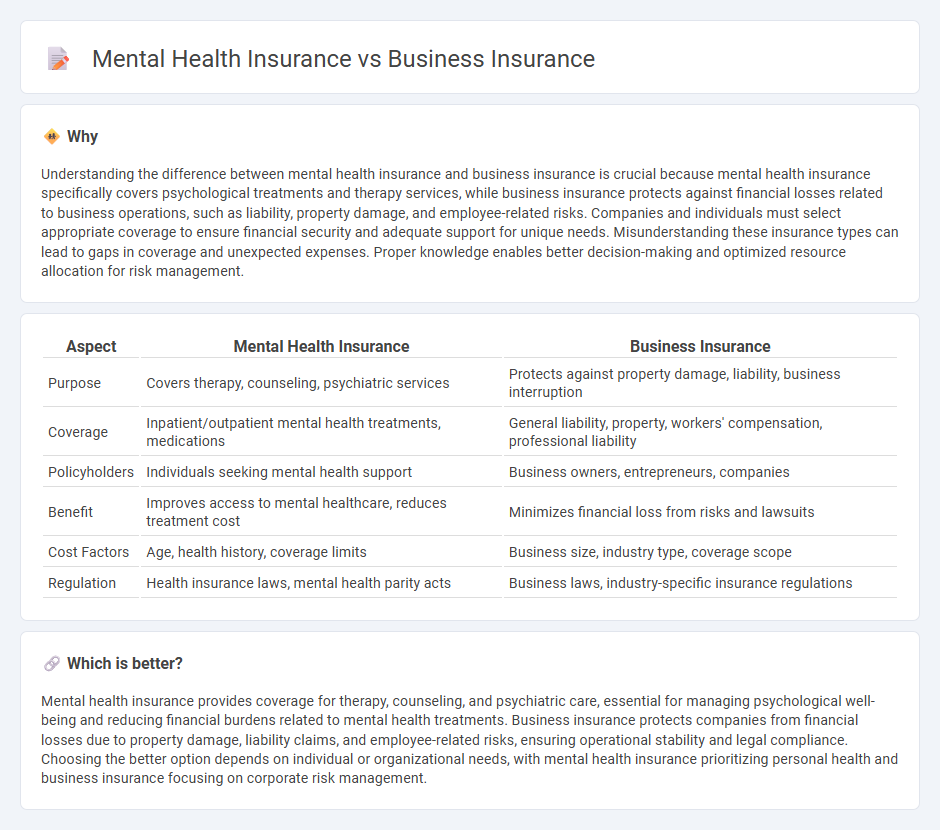

Understanding the difference between mental health insurance and business insurance is crucial because mental health insurance specifically covers psychological treatments and therapy services, while business insurance protects against financial losses related to business operations, such as liability, property damage, and employee-related risks. Companies and individuals must select appropriate coverage to ensure financial security and adequate support for unique needs. Misunderstanding these insurance types can lead to gaps in coverage and unexpected expenses. Proper knowledge enables better decision-making and optimized resource allocation for risk management.

Comparison Table

| Aspect | Mental Health Insurance | Business Insurance |

|---|---|---|

| Purpose | Covers therapy, counseling, psychiatric services | Protects against property damage, liability, business interruption |

| Coverage | Inpatient/outpatient mental health treatments, medications | General liability, property, workers' compensation, professional liability |

| Policyholders | Individuals seeking mental health support | Business owners, entrepreneurs, companies |

| Benefit | Improves access to mental healthcare, reduces treatment cost | Minimizes financial loss from risks and lawsuits |

| Cost Factors | Age, health history, coverage limits | Business size, industry type, coverage scope |

| Regulation | Health insurance laws, mental health parity acts | Business laws, industry-specific insurance regulations |

Which is better?

Mental health insurance provides coverage for therapy, counseling, and psychiatric care, essential for managing psychological well-being and reducing financial burdens related to mental health treatments. Business insurance protects companies from financial losses due to property damage, liability claims, and employee-related risks, ensuring operational stability and legal compliance. Choosing the better option depends on individual or organizational needs, with mental health insurance prioritizing personal health and business insurance focusing on corporate risk management.

Connection

Mental health insurance and business insurance intersect through employee wellness and productivity coverage, as mental health benefits mitigate workplace stress and absenteeism, directly influencing business operational efficiency. Integrating mental health insurance within employee benefits supports businesses by reducing turnover rates and healthcare costs, enhancing overall organizational resilience. Business insurance policies increasingly recognize mental health risks, promoting comprehensive protection that includes psychological wellbeing to sustain workforce performance.

Key Terms

**Business Insurance:**

Business insurance provides essential financial protection against risks such as property damage, liability claims, and business interruption, helping companies maintain stability and continuity. Policies vary widely, including general liability, commercial property, and workers' compensation insurance, tailored to industry-specific needs. Explore comprehensive business insurance options to safeguard your enterprise effectively.

Liability Coverage

Business insurance offers liability coverage protecting against claims like property damage, bodily injury, and legal defense costs arising from business operations, while mental health insurance typically provides coverage for therapy, counseling, and psychiatric services without direct liability protection. Liability coverage in business insurance is crucial for safeguarding assets and minimizing financial risks from lawsuits, whereas mental health insurance enhances employee well-being and productivity. Explore more about choosing the right insurance plan to balance liability protection with comprehensive mental health benefits.

Property Damage

Business insurance often includes property damage coverage that protects physical assets such as buildings, equipment, and inventory from risks like fire, theft, and natural disasters. Mental health insurance, on the other hand, primarily covers psychological treatments and counseling services without addressing property-related losses. Explore comprehensive insurance options that balance property protection with employee mental well-being for a resilient enterprise.

Source and External Links

Small Business Insurance Quotes - Progressive Commercial - Business insurance protects small businesses from financial losses due to accidents, property damage, or lawsuits, with common coverages including general liability, professional liability, workers' compensation, and commercial auto insurance tailored to specific business needs.

Business Insurance - Protect Your Small Business | NEXT - Business insurance provides a financial safety net covering liabilities, property damage, and other risks for small businesses, LLCs, and self-employed workers, with certain coverages required by law such as workers' compensation for businesses with employees.

Business Insurance for Liability and Commercial Needs | The Hartford - Business insurance includes various policies like Business Owner's Policy (BOP), General Liability, Workers' Compensation, and Professional Liability, helping protect business owners from unexpected financial losses depending on their operation and risk exposure.

dowidth.com

dowidth.com