Pet insurance platforms specialize in providing coverage for veterinary expenses, including accidents, illnesses, and preventive care, tailored specifically to pet owners. Liability insurance platforms focus on protecting individuals and businesses against legal claims related to bodily injury, property damage, or negligence. Explore the key features and benefits of each platform to determine the best insurance solution for your needs.

Why it is important

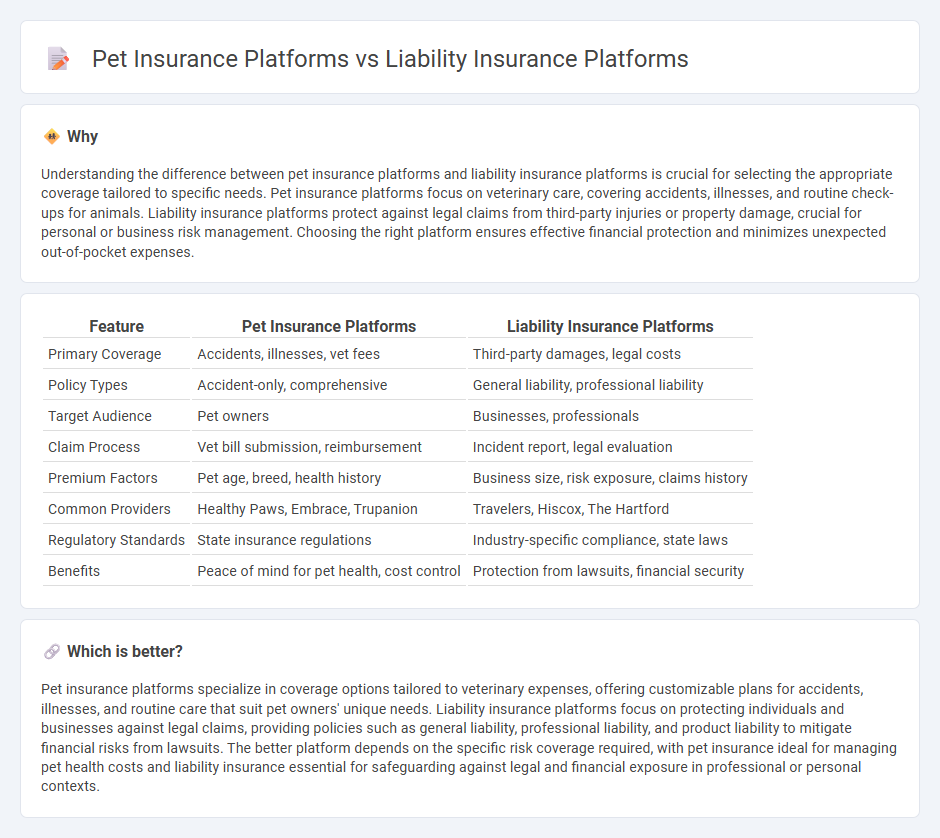

Understanding the difference between pet insurance platforms and liability insurance platforms is crucial for selecting the appropriate coverage tailored to specific needs. Pet insurance platforms focus on veterinary care, covering accidents, illnesses, and routine check-ups for animals. Liability insurance platforms protect against legal claims from third-party injuries or property damage, crucial for personal or business risk management. Choosing the right platform ensures effective financial protection and minimizes unexpected out-of-pocket expenses.

Comparison Table

| Feature | Pet Insurance Platforms | Liability Insurance Platforms |

|---|---|---|

| Primary Coverage | Accidents, illnesses, vet fees | Third-party damages, legal costs |

| Policy Types | Accident-only, comprehensive | General liability, professional liability |

| Target Audience | Pet owners | Businesses, professionals |

| Claim Process | Vet bill submission, reimbursement | Incident report, legal evaluation |

| Premium Factors | Pet age, breed, health history | Business size, risk exposure, claims history |

| Common Providers | Healthy Paws, Embrace, Trupanion | Travelers, Hiscox, The Hartford |

| Regulatory Standards | State insurance regulations | Industry-specific compliance, state laws |

| Benefits | Peace of mind for pet health, cost control | Protection from lawsuits, financial security |

Which is better?

Pet insurance platforms specialize in coverage options tailored to veterinary expenses, offering customizable plans for accidents, illnesses, and routine care that suit pet owners' unique needs. Liability insurance platforms focus on protecting individuals and businesses against legal claims, providing policies such as general liability, professional liability, and product liability to mitigate financial risks from lawsuits. The better platform depends on the specific risk coverage required, with pet insurance ideal for managing pet health costs and liability insurance essential for safeguarding against legal and financial exposure in professional or personal contexts.

Connection

Pet insurance platforms and liability insurance platforms intersect through the shared use of risk assessment technologies and data analytics to evaluate claims efficiently. Both types of platforms leverage advanced algorithms to process policyholder information, detect fraud, and calculate premiums based on individual risk profiles. Integration of IoT devices and real-time monitoring further enhances the accuracy of coverage decisions in pet and liability insurance sectors.

Key Terms

**Liability Insurance Platforms:**

Liability insurance platforms specialize in offering coverage that protects individuals and businesses from legal claims related to property damage, bodily injury, or negligence, utilizing advanced underwriting algorithms and real-time risk assessment tools. Unlike pet insurance platforms that focus on veterinary care and medical expense reimbursements, liability insurance platforms emphasize policy customization, automated claims processing, and integration with regulatory compliance databases. Discover how liability insurance platforms drive efficiency and risk management by exploring their technologies and service models in detail.

Claim Management

Liability insurance platforms prioritize robust claim management systems that streamline liability assessments, automate documentation, and expedite settlements to reduce financial exposure for policyholders and insurers. Pet insurance platforms emphasize user-friendly claim submissions, rapid approvals, and transparent communication to enhance pet owner satisfaction and ensure timely veterinary reimbursements. Explore the latest advancements in insurance claim management to optimize platform efficiency and customer experience.

Risk Assessment

Liability insurance platforms utilize advanced algorithms and data analytics to evaluate an insured's exposure to potential claims, focusing on factors like past incidents, industry risk profiles, and behavioral data to quantify overall risk. Pet insurance platforms, on the other hand, prioritize veterinary records, breed predispositions, age, and geographic disease prevalence to assess the likelihood of pet health issues and potential claim costs. Explore further to understand how these distinct risk assessment methodologies enhance coverage accuracy in their respective insurance sectors.

Source and External Links

Insurance Canopy - Connects small businesses to affordable general, professional, and product liability insurance through a streamlined, fully online purchasing process with access to top-rated carriers.

Insureon - Provides instant online quotes and digital policy management for business insurance, including liability coverage, with fast certificate issuance and direct communication with producers via phone, email, or text.

Thimble - Offers flexible, on-demand liability insurance by the job, month, or year for over 300 professions, with easy online policy modification, pausing, or cancellation.

dowidth.com

dowidth.com