Digital claim automation leverages advanced technologies like AI and machine learning to streamline claim submissions, reduce errors, and accelerate processing times compared to traditional manual claim processing. Manual claim processing often involves extensive paperwork and human intervention, leading to slower response times and higher administrative costs. Explore the benefits of digital claim automation to improve efficiency and customer satisfaction in insurance claims management.

Why it is important

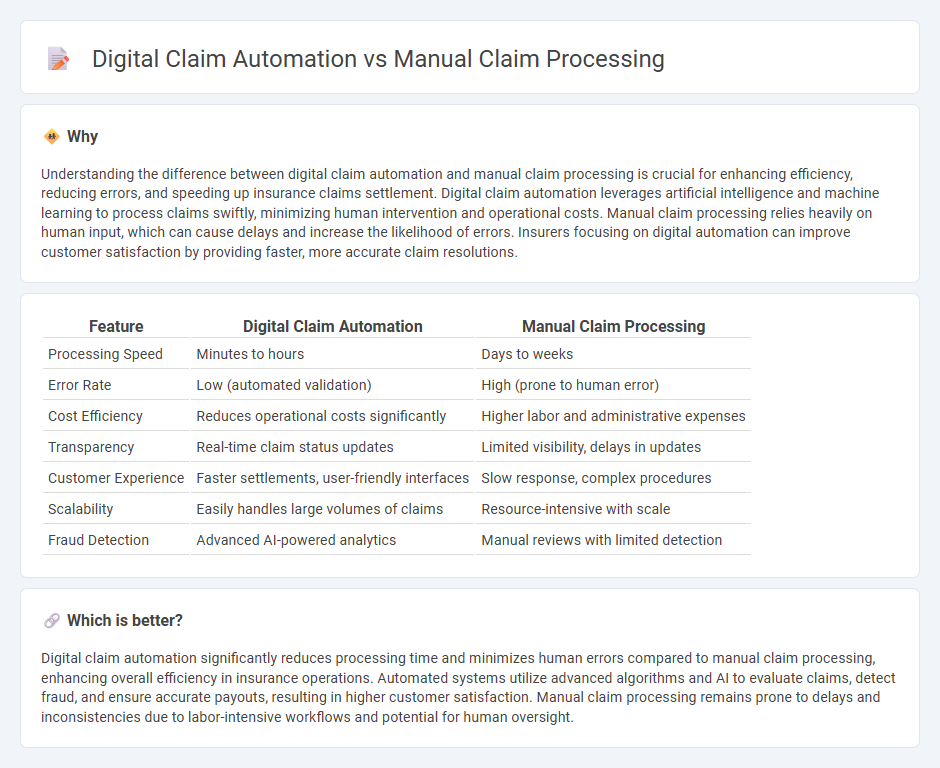

Understanding the difference between digital claim automation and manual claim processing is crucial for enhancing efficiency, reducing errors, and speeding up insurance claims settlement. Digital claim automation leverages artificial intelligence and machine learning to process claims swiftly, minimizing human intervention and operational costs. Manual claim processing relies heavily on human input, which can cause delays and increase the likelihood of errors. Insurers focusing on digital automation can improve customer satisfaction by providing faster, more accurate claim resolutions.

Comparison Table

| Feature | Digital Claim Automation | Manual Claim Processing |

|---|---|---|

| Processing Speed | Minutes to hours | Days to weeks |

| Error Rate | Low (automated validation) | High (prone to human error) |

| Cost Efficiency | Reduces operational costs significantly | Higher labor and administrative expenses |

| Transparency | Real-time claim status updates | Limited visibility, delays in updates |

| Customer Experience | Faster settlements, user-friendly interfaces | Slow response, complex procedures |

| Scalability | Easily handles large volumes of claims | Resource-intensive with scale |

| Fraud Detection | Advanced AI-powered analytics | Manual reviews with limited detection |

Which is better?

Digital claim automation significantly reduces processing time and minimizes human errors compared to manual claim processing, enhancing overall efficiency in insurance operations. Automated systems utilize advanced algorithms and AI to evaluate claims, detect fraud, and ensure accurate payouts, resulting in higher customer satisfaction. Manual claim processing remains prone to delays and inconsistencies due to labor-intensive workflows and potential for human oversight.

Connection

Digital claim automation and manual claim processing are interconnected through hybrid workflows that integrate automated data extraction with human oversight to ensure accuracy and compliance. Automated systems accelerate claim validation by using AI-driven algorithms, while manual processing addresses complex cases requiring expert judgment and personalized customer service. This connection optimizes operational efficiency, reduces processing time, and minimizes errors in insurance claims management.

Key Terms

Workflow Efficiency

Manual claim processing often results in prolonged cycle times and increased error rates due to human intervention in data entry and verification. Digital claim automation enhances workflow efficiency by using AI-driven tools to streamline data extraction, validation, and approval processes, reducing operational costs and accelerating claim settlements. Explore comprehensive insights on how digital automation transforms claim workflows for superior efficiency and accuracy.

Error Rate

Manual claim processing often results in higher error rates due to human oversight, data entry mistakes, and inconsistent compliance with policy guidelines. Digital claim automation significantly reduces errors by leveraging AI algorithms, real-time data validation, and standardized workflows, ensuring accuracy and regulatory adherence. Explore how transitioning to automated claims can enhance accuracy and operational efficiency in your organization.

Turnaround Time

Digital claim automation significantly reduces turnaround time by streamlining data entry, validation, and approval processes using AI and machine learning algorithms. Manual claim processing often suffers from delays due to human errors and repetitive tasks, leading to longer wait times for claimants. Explore how digital transformation accelerates claim management to enhance customer satisfaction and operational efficiency.

Source and External Links

Claims Handling Processes: Manual vs Automated | Insly - In manual claim processing, employees receive and handle claims information through various channels like phone, email, and chat, which is labor-intensive and involves processing unstructured data.

Medicare Claims Processing Manual - RCM Glossary | MD Clarity - Manual claim processing requires staff to ensure all claim data elements--such as patient demographics, diagnosis, and procedure codes--are accurately completed on paper forms like the CMS-1500, following detailed submission requirements.

Medicare Claims Processing Manual, Chapter 1 - CMS - The Medicare manual provides specific instructions for submitting paper claims, including guidance on how to complete the required CMS-1500 form and navigate related paperwork processes.

dowidth.com

dowidth.com