Silent cyber coverage addresses gaps in traditional insurance policies by explicitly covering cyber incidents that are not specifically excluded, while all-risk coverage provides broad protection against a wide range of perils unless explicitly excluded. Silent cyber coverage is increasingly critical as cyber threats evolve, highlighting the need for clear policy language to avoid coverage disputes. Explore our detailed comparison to understand which coverage best safeguards your business against cyber risks.

Why it is important

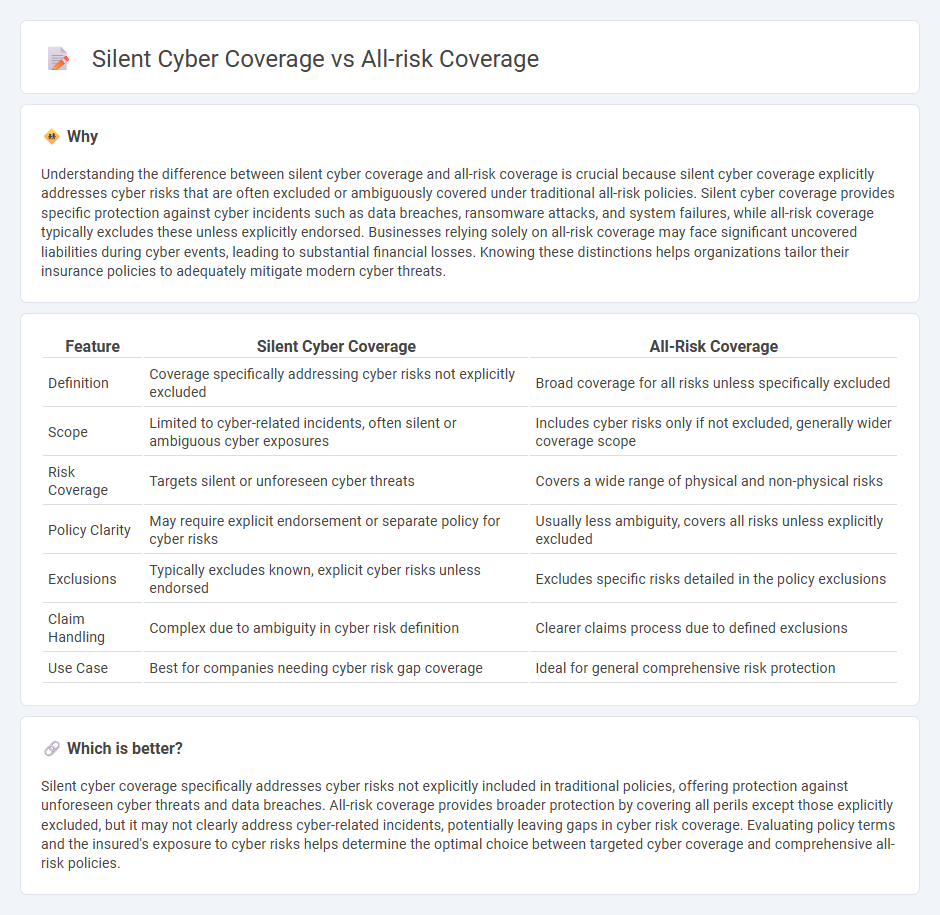

Understanding the difference between silent cyber coverage and all-risk coverage is crucial because silent cyber coverage explicitly addresses cyber risks that are often excluded or ambiguously covered under traditional all-risk policies. Silent cyber coverage provides specific protection against cyber incidents such as data breaches, ransomware attacks, and system failures, while all-risk coverage typically excludes these unless explicitly endorsed. Businesses relying solely on all-risk coverage may face significant uncovered liabilities during cyber events, leading to substantial financial losses. Knowing these distinctions helps organizations tailor their insurance policies to adequately mitigate modern cyber threats.

Comparison Table

| Feature | Silent Cyber Coverage | All-Risk Coverage |

|---|---|---|

| Definition | Coverage specifically addressing cyber risks not explicitly excluded | Broad coverage for all risks unless specifically excluded |

| Scope | Limited to cyber-related incidents, often silent or ambiguous cyber exposures | Includes cyber risks only if not excluded, generally wider coverage scope |

| Risk Coverage | Targets silent or unforeseen cyber threats | Covers a wide range of physical and non-physical risks |

| Policy Clarity | May require explicit endorsement or separate policy for cyber risks | Usually less ambiguity, covers all risks unless explicitly excluded |

| Exclusions | Typically excludes known, explicit cyber risks unless endorsed | Excludes specific risks detailed in the policy exclusions |

| Claim Handling | Complex due to ambiguity in cyber risk definition | Clearer claims process due to defined exclusions |

| Use Case | Best for companies needing cyber risk gap coverage | Ideal for general comprehensive risk protection |

Which is better?

Silent cyber coverage specifically addresses cyber risks not explicitly included in traditional policies, offering protection against unforeseen cyber threats and data breaches. All-risk coverage provides broader protection by covering all perils except those explicitly excluded, but it may not clearly address cyber-related incidents, potentially leaving gaps in cyber risk coverage. Evaluating policy terms and the insured's exposure to cyber risks helps determine the optimal choice between targeted cyber coverage and comprehensive all-risk policies.

Connection

Silent cyber coverage addresses cyber risks not explicitly included or excluded in traditional all-risk insurance policies, filling gaps in coverage for cyber incidents. All-risk coverage provides broad protection against physical damage and property loss but often lacks clear language regarding cyber exposures, creating potential coverage ambiguities. Integrating silent cyber coverage with all-risk policies enhances risk management by explicitly covering unforeseen cyber threats and mitigating potential financial losses from cyber events.

Key Terms

Perils Insured

All-risk coverage provides broad protection against a wide range of perils except those explicitly excluded, typically covering physical damage, theft, and natural disasters. Silent cyber coverage addresses cyber-related perils not specifically named in traditional policies, filling gaps for risks like data breaches, cyberattacks, and system failures without explicit cyber language. Explore the key differences and coverage details to determine the best fit for your risk management strategy.

Exclusions

All-risk coverage typically excludes losses arising from cyber events unless specifically endorsed, leaving gaps in protection for cyber-related incidents. Silent cyber coverage addresses these gaps by explicitly managing exposure to cyber risks that are not clearly covered or excluded in traditional property and casualty policies. Explore detailed differences in exclusions to tailor your risk management strategy effectively.

Cyber Events

All-risk coverage generally excludes cyber events unless specifically endorsed, leaving organizations vulnerable to cyber-related losses, whereas silent cyber coverage addresses these gaps by providing protection for cyber incidents not explicitly covered in traditional policies. Silent cyber coverage has gained importance as cyber attacks increase in frequency and sophistication, highlighting the need for explicit cyber risk management in insurance portfolios. Explore how integrating specialized cyber insurance solutions can safeguard your business from evolving cyber threats.

Source and External Links

All Risk Insurance - All-risk coverage (or all peril coverage) is a comprehensive insurance policy that covers all causes of loss unless specifically excluded; it contrasts with named peril policies that cover only listed risks, making all-risk policies generally more beneficial and broader in coverage for both personal and commercial lines.

Named Perils vs. All Risks Explained in Plain English - An all-risk insurance policy covers losses from any cause not explicitly excluded, shifting the burden of proof to the insurer to show exclusions apply, unlike named peril policies which only cover specified perils and require the insured to prove coverage applies.

All Risks Insurance - All risks insurance (also called open peril insurance) automatically covers any risk not specifically excluded in the contract, providing broad protection across various industries, but still typically contains exclusions such as flood, war, or intentional acts.

dowidth.com

dowidth.com