Climate risk insurance specifically addresses losses caused by extreme weather events linked to climate change, such as floods, droughts, and storms. Crop insurance focuses on protecting farmers against yield reductions and financial losses resulting from natural perils like pests, diseases, and adverse weather conditions. Explore the differences and benefits of these insurance types to safeguard agricultural investments effectively.

Why it is important

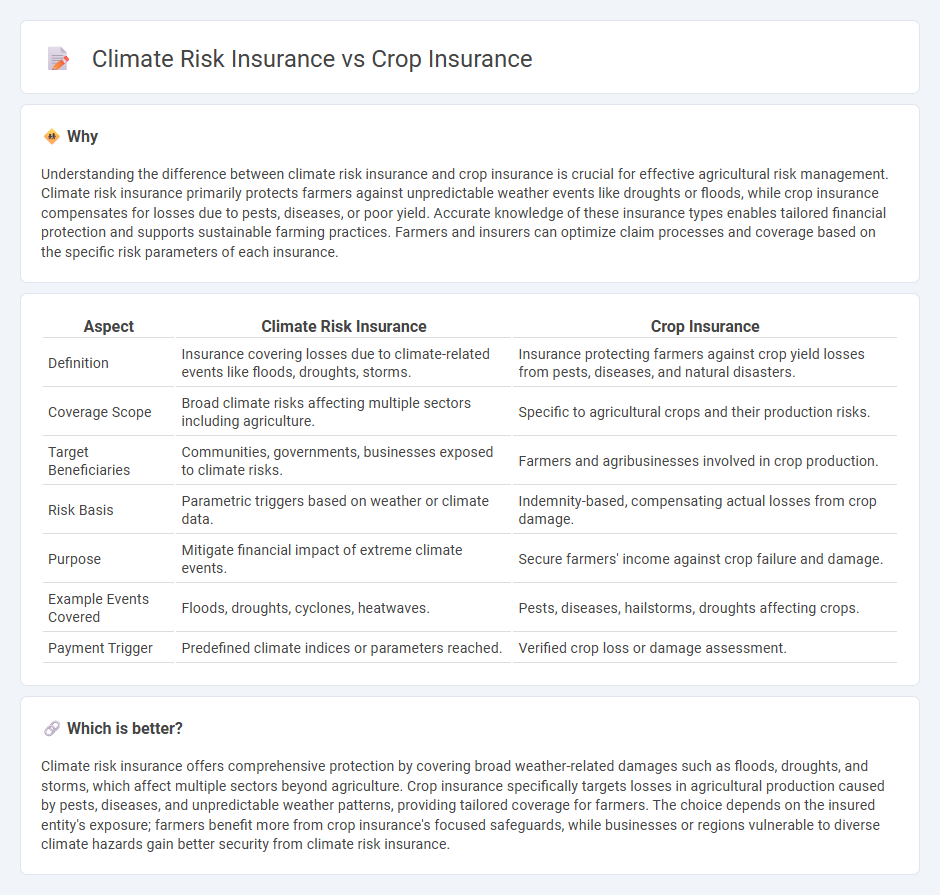

Understanding the difference between climate risk insurance and crop insurance is crucial for effective agricultural risk management. Climate risk insurance primarily protects farmers against unpredictable weather events like droughts or floods, while crop insurance compensates for losses due to pests, diseases, or poor yield. Accurate knowledge of these insurance types enables tailored financial protection and supports sustainable farming practices. Farmers and insurers can optimize claim processes and coverage based on the specific risk parameters of each insurance.

Comparison Table

| Aspect | Climate Risk Insurance | Crop Insurance |

|---|---|---|

| Definition | Insurance covering losses due to climate-related events like floods, droughts, storms. | Insurance protecting farmers against crop yield losses from pests, diseases, and natural disasters. |

| Coverage Scope | Broad climate risks affecting multiple sectors including agriculture. | Specific to agricultural crops and their production risks. |

| Target Beneficiaries | Communities, governments, businesses exposed to climate risks. | Farmers and agribusinesses involved in crop production. |

| Risk Basis | Parametric triggers based on weather or climate data. | Indemnity-based, compensating actual losses from crop damage. |

| Purpose | Mitigate financial impact of extreme climate events. | Secure farmers' income against crop failure and damage. |

| Example Events Covered | Floods, droughts, cyclones, heatwaves. | Pests, diseases, hailstorms, droughts affecting crops. |

| Payment Trigger | Predefined climate indices or parameters reached. | Verified crop loss or damage assessment. |

Which is better?

Climate risk insurance offers comprehensive protection by covering broad weather-related damages such as floods, droughts, and storms, which affect multiple sectors beyond agriculture. Crop insurance specifically targets losses in agricultural production caused by pests, diseases, and unpredictable weather patterns, providing tailored coverage for farmers. The choice depends on the insured entity's exposure; farmers benefit more from crop insurance's focused safeguards, while businesses or regions vulnerable to diverse climate hazards gain better security from climate risk insurance.

Connection

Climate risk insurance and crop insurance are interconnected by offering financial protection to farmers against adverse weather events such as droughts, floods, and hurricanes that directly impact agricultural yields. Climate risk insurance specifically addresses losses caused by climate variability and extreme weather, while crop insurance provides broader coverage for various agricultural risks including pest infestations and disease outbreaks. Integrating climate risk insurance with crop insurance enhances resilience in the agricultural sector by mitigating financial losses and promoting sustainable farming practices.

Key Terms

**Crop Insurance:**

Crop insurance provides financial protection to farmers against losses caused by natural events such as drought, floods, pests, and storms, securing yields and income stability. It typically covers risks specific to agriculture production, like crop failure or damage during the growing season, and is often subsidized by governments to encourage adoption. Explore the key differences between crop insurance and climate risk insurance to make informed decisions for agricultural risk management.

Yield Protection

Crop insurance primarily safeguards farmers against losses in crop yield due to natural perils such as drought, pests, or storms, emphasizing yield protection to stabilize farm income. Climate risk insurance extends coverage by incorporating broader climate-related events like floods, extreme temperature variations, and long-term shifts in weather patterns that affect agricultural productivity. Explore the key differences and benefits of yield protection in crop and climate risk insurance to better manage agricultural risks.

Sum Insured

Crop insurance typically offers coverage based on the Sum Insured, reflecting the estimated value of the crops and potential yield losses due to pests, diseases, or adverse weather conditions. Climate risk insurance, however, is designed to cover broader climatic threats such as droughts, floods, and extreme temperature events, with Sum Insured calibrated to the specific climate-related exposures of the insured area. Explore detailed comparisons and tailored options to understand which insurance type best protects your agricultural investment.

Source and External Links

Crop Insurance - Wikipedia provides an overview of crop insurance, including its history, types, and how it is subsidized by governments to protect farmers against crop losses.

Basics of Crop Insurance - ProAg explains how crop insurance works, including its role in protecting farmers from unpredictable weather and market fluctuations through federally subsidized policies.

Crop Insurance 101 - Offers a primer on crop insurance basics, covering risks, good farm practices, and different types of insured units available to farmers.

dowidth.com

dowidth.com