Gig worker insurance offers tailored coverage to meet the unique needs of independent contractors, freelancers, and part-time workers, often including flexible health plans and income protection. Individual health insurance provides a broader range of options for full-time employees or those seeking comprehensive medical coverage with standardized benefits. Explore more to understand which insurance option best safeguards your health and finances.

Why it is important

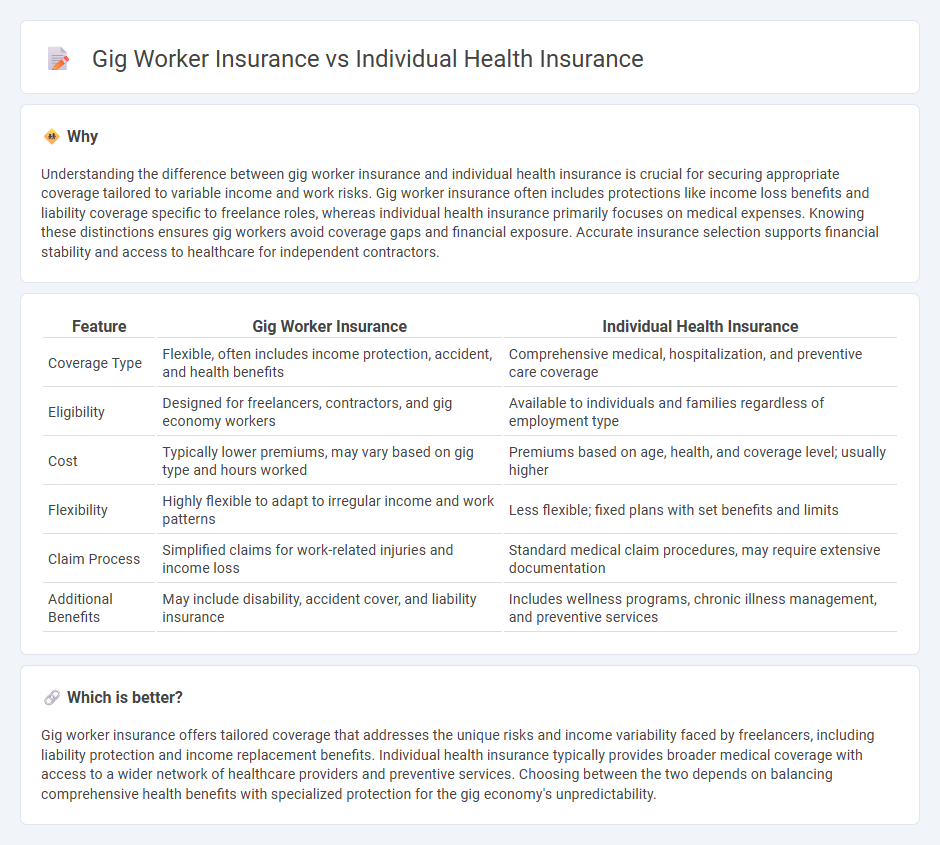

Understanding the difference between gig worker insurance and individual health insurance is crucial for securing appropriate coverage tailored to variable income and work risks. Gig worker insurance often includes protections like income loss benefits and liability coverage specific to freelance roles, whereas individual health insurance primarily focuses on medical expenses. Knowing these distinctions ensures gig workers avoid coverage gaps and financial exposure. Accurate insurance selection supports financial stability and access to healthcare for independent contractors.

Comparison Table

| Feature | Gig Worker Insurance | Individual Health Insurance |

|---|---|---|

| Coverage Type | Flexible, often includes income protection, accident, and health benefits | Comprehensive medical, hospitalization, and preventive care coverage |

| Eligibility | Designed for freelancers, contractors, and gig economy workers | Available to individuals and families regardless of employment type |

| Cost | Typically lower premiums, may vary based on gig type and hours worked | Premiums based on age, health, and coverage level; usually higher |

| Flexibility | Highly flexible to adapt to irregular income and work patterns | Less flexible; fixed plans with set benefits and limits |

| Claim Process | Simplified claims for work-related injuries and income loss | Standard medical claim procedures, may require extensive documentation |

| Additional Benefits | May include disability, accident cover, and liability insurance | Includes wellness programs, chronic illness management, and preventive services |

Which is better?

Gig worker insurance offers tailored coverage that addresses the unique risks and income variability faced by freelancers, including liability protection and income replacement benefits. Individual health insurance typically provides broader medical coverage with access to a wider network of healthcare providers and preventive services. Choosing between the two depends on balancing comprehensive health benefits with specialized protection for the gig economy's unpredictability.

Connection

Gig worker insurance and individual health insurance intersect by addressing the healthcare needs of independent contractors, freelancers, and self-employed individuals who lack employer-sponsored coverage. Individual health insurance policies offer gig workers tailored medical plans that provide essential benefits like preventive care, emergency services, and chronic condition management. Access to affordable individual health insurance enhances financial security for gig workers, mitigating risks associated with unpredictable income and health expenses.

Key Terms

**Premiums**

Individual health insurance premiums are typically steady and predictable, based on factors such as age, location, and coverage level, while gig worker insurance premiums may fluctuate due to variable income and less stable employment status. Gig worker insurance often offers more flexible payment options but can come with higher costs to accommodate irregular work patterns. Explore detailed comparisons to determine which premium structure aligns best with your financial and health coverage needs.

**Coverage Options**

Individual health insurance plans typically offer a broad range of coverage options, including preventive care, prescription drugs, hospital stays, and specialist visits, tailored to personal health needs. Gig worker insurance often emphasizes flexible coverage with customizable add-ons like accident protection, liability coverage, and income protection to suit variable work patterns. Explore more about coverage options to find the best fit for your lifestyle and health requirements.

**Portability**

Individual health insurance policies typically offer limited portability, often tied to the insured's state of residence and employer plan status. Gig worker insurance plans prioritize portability, allowing coverage across multiple states to accommodate the flexible work locations common in gig economy roles. Explore the nuances of portability in health insurance options to find the best fit for your lifestyle.

Source and External Links

Individual Health Insurance Plans & Quotes California | HFC - Offers individual health insurance plans and quotes in California, with options available through the Affordable Care Act.

Individual and Family Healthcare Plans | Blue Shield of CA - Provides a range of health plans, including HMO and PPO options for individuals and families in California.

Cigna Healthcare - Offers health insurance plans to individuals, including medical and dental coverage, with flexible options to meet changing health needs.

dowidth.com

dowidth.com