Flood insurance integration focuses on mitigating financial risks from water-related disasters by offering coverage specifically for property damage caused by floods, while life insurance integration centers on providing financial security and support for beneficiaries upon the policyholder's death. The complexities of flood insurance involve assessments of geographic flood risk zones and property values, whereas life insurance integration emphasizes health evaluations and long-term financial planning. Discover how tailored insurance solutions can safeguard your assets and loved ones effectively.

Why it is important

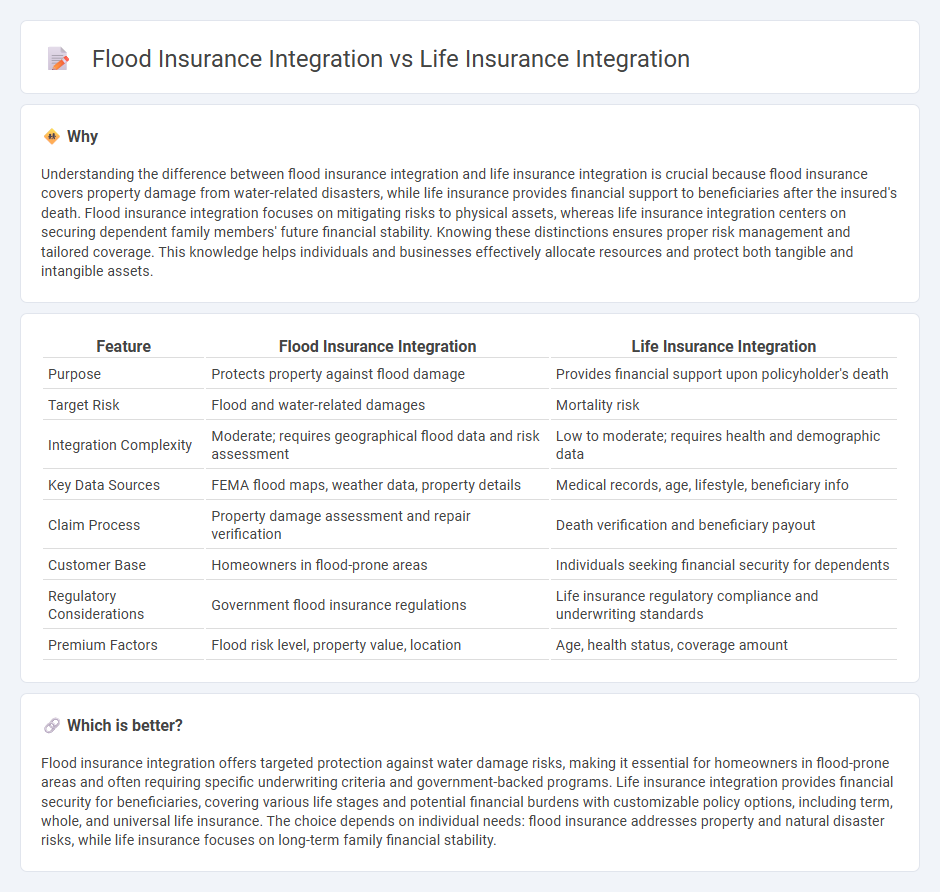

Understanding the difference between flood insurance integration and life insurance integration is crucial because flood insurance covers property damage from water-related disasters, while life insurance provides financial support to beneficiaries after the insured's death. Flood insurance integration focuses on mitigating risks to physical assets, whereas life insurance integration centers on securing dependent family members' future financial stability. Knowing these distinctions ensures proper risk management and tailored coverage. This knowledge helps individuals and businesses effectively allocate resources and protect both tangible and intangible assets.

Comparison Table

| Feature | Flood Insurance Integration | Life Insurance Integration |

|---|---|---|

| Purpose | Protects property against flood damage | Provides financial support upon policyholder's death |

| Target Risk | Flood and water-related damages | Mortality risk |

| Integration Complexity | Moderate; requires geographical flood data and risk assessment | Low to moderate; requires health and demographic data |

| Key Data Sources | FEMA flood maps, weather data, property details | Medical records, age, lifestyle, beneficiary info |

| Claim Process | Property damage assessment and repair verification | Death verification and beneficiary payout |

| Customer Base | Homeowners in flood-prone areas | Individuals seeking financial security for dependents |

| Regulatory Considerations | Government flood insurance regulations | Life insurance regulatory compliance and underwriting standards |

| Premium Factors | Flood risk level, property value, location | Age, health status, coverage amount |

Which is better?

Flood insurance integration offers targeted protection against water damage risks, making it essential for homeowners in flood-prone areas and often requiring specific underwriting criteria and government-backed programs. Life insurance integration provides financial security for beneficiaries, covering various life stages and potential financial burdens with customizable policy options, including term, whole, and universal life insurance. The choice depends on individual needs: flood insurance addresses property and natural disaster risks, while life insurance focuses on long-term family financial stability.

Connection

Flood insurance integration and life insurance integration both enhance comprehensive risk management by addressing distinct but interconnected vulnerabilities within an individual's overall financial protection plan. Leveraging data analytics and policy bundling, insurers can offer tailored coverage that mitigates the financial impact of property damage and personal loss simultaneously. This interconnected approach ensures policyholders benefit from streamlined claims processes and optimized premium structures.

Key Terms

Beneficiary Designation (Life Insurance)

Beneficiary designation in life insurance integration ensures policyholders can specify individuals or entities to receive benefits upon their death, streamlining claim settlements and protecting financial interests. Flood insurance integration primarily addresses property protection and does not involve beneficiary designations since payouts go directly to the policyholder or mortgagee. Discover how precise beneficiary management in life insurance integration enhances estate planning and risk mitigation strategies.

Flood Zone Determination (Flood Insurance)

Flood insurance integration specifically centers around Flood Zone Determination, a critical process that identifies property locations within FEMA-designated flood zones to assess flood risk and insurance requirements. In contrast, life insurance integration does not involve property-specific risk assessments like flood zoning but focuses on individual health and mortality data. Explore how Flood Zone Determination enhances flood insurance accuracy and compliance for comprehensive risk management.

Coverage Exclusions

Life insurance integration typically excludes coverage for natural disasters such as floods, as its primary focus is on providing financial security against the insured's death or disability. Flood insurance integration specifically targets flood-related damages, but excludes other perils like earthquakes or fires, necessitating separate policies for comprehensive protection. Discover more about how to bridge coverage gaps and enhance your insurance portfolio effectively.

Source and External Links

Integrating Insurance Products into a Retirement Plan - This strategy involves allocating retirement assets to insurance premiums, such as whole life insurance paid up by age 65, to enhance retirement security.

Integrating Life Insurance into Estate and Investment Planning - This approach integrates life insurance into estate planning to meet specific beneficiary needs, often resulting in higher initial death benefits with shorter coverage durations.

Pre-Built Payment Integration for Life Insurance - One Inc offers a pre-built payment integration for Verisk's FAST platform, streamlining digital payments for life insurers by eliminating custom integration barriers.

dowidth.com

dowidth.com