Digital nomad insurance offers tailored coverage for travelers working remotely across multiple countries, focusing on flexibility and short-term health, travel, and equipment protection. Long-term insurance typically provides comprehensive benefits including extensive medical coverage, disability, and retirement planning designed for extended residency within a specific region. Explore the key differences to select the best insurance option for your lifestyle and needs.

Why it is important

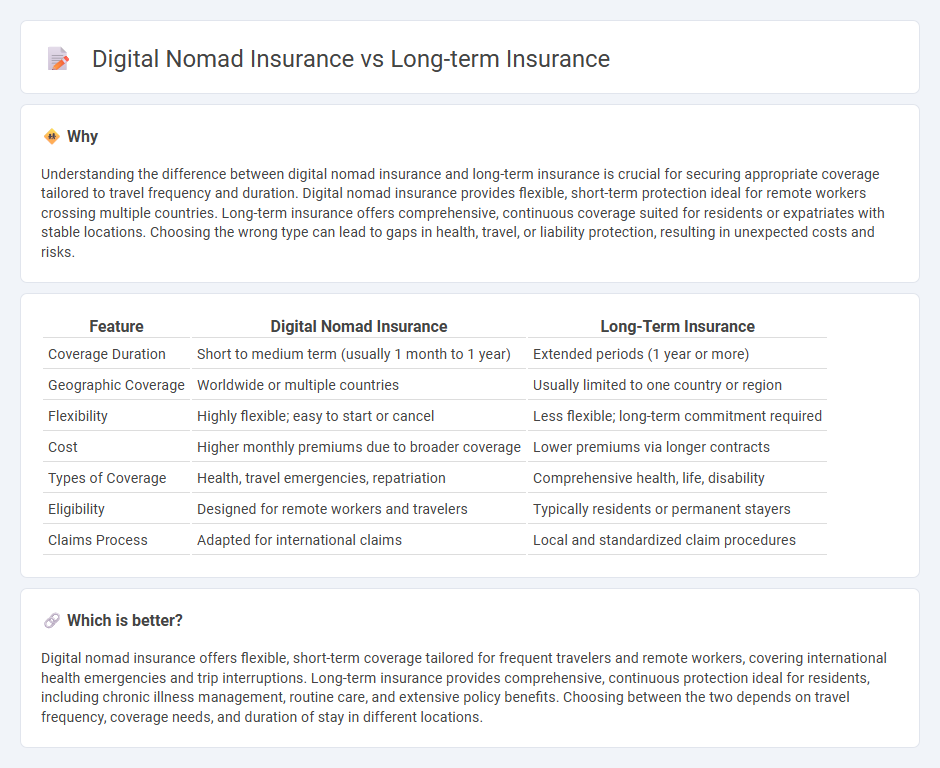

Understanding the difference between digital nomad insurance and long-term insurance is crucial for securing appropriate coverage tailored to travel frequency and duration. Digital nomad insurance provides flexible, short-term protection ideal for remote workers crossing multiple countries. Long-term insurance offers comprehensive, continuous coverage suited for residents or expatriates with stable locations. Choosing the wrong type can lead to gaps in health, travel, or liability protection, resulting in unexpected costs and risks.

Comparison Table

| Feature | Digital Nomad Insurance | Long-Term Insurance |

|---|---|---|

| Coverage Duration | Short to medium term (usually 1 month to 1 year) | Extended periods (1 year or more) |

| Geographic Coverage | Worldwide or multiple countries | Usually limited to one country or region |

| Flexibility | Highly flexible; easy to start or cancel | Less flexible; long-term commitment required |

| Cost | Higher monthly premiums due to broader coverage | Lower premiums via longer contracts |

| Types of Coverage | Health, travel emergencies, repatriation | Comprehensive health, life, disability |

| Eligibility | Designed for remote workers and travelers | Typically residents or permanent stayers |

| Claims Process | Adapted for international claims | Local and standardized claim procedures |

Which is better?

Digital nomad insurance offers flexible, short-term coverage tailored for frequent travelers and remote workers, covering international health emergencies and trip interruptions. Long-term insurance provides comprehensive, continuous protection ideal for residents, including chronic illness management, routine care, and extensive policy benefits. Choosing between the two depends on travel frequency, coverage needs, and duration of stay in different locations.

Connection

Digital nomad insurance and long-term insurance share the objective of providing comprehensive health and travel coverage for individuals who spend extended periods abroad. Both types of insurance emphasize flexibility, worldwide protection, and access to medical services, addressing the unique risks associated with remote work and prolonged international stays. Insurers often offer tailored plans that combine elements of digital nomad and long-term insurance to accommodate evolving lifestyles and global mobility trends.

Key Terms

Coverage Duration

Long-term insurance typically offers extended coverage periods ranging from one year to multiple decades, ideal for individuals with stable, long-term residency and continuous risk protection needs. Digital nomad insurance provides flexible coverage spanning days to several months, tailored to accommodate frequent travelers and remote workers constantly on the move. Explore detailed comparisons to understand which insurance type aligns with your lifestyle and risk profile.

Portability

Long-term insurance typically offers extensive coverage with fixed terms, but it often lacks flexibility and portability for individuals frequently relocating, such as digital nomads. Digital nomad insurance prioritizes global portability, providing adaptable health and travel coverage across multiple countries without the constraints of traditional insurance territories. Explore how portable insurance solutions can safeguard your health worldwide while supporting a mobile lifestyle.

Policy Flexibility

Long-term insurance typically offers stable coverage with fixed terms suited for residents or those with permanent addresses, whereas digital nomad insurance emphasizes policy flexibility to accommodate frequent travel and varying locations. Digital nomad insurance often includes adaptable coverage dates, multi-region protection, and customizable health benefits tailored for remote workers. Explore detailed comparisons to find insurance policies that best match your lifestyle needs.

Source and External Links

What Are the Three Types of Long-Term Care Insurance? - This page describes three types of long-term care insurance options: traditional policies, hybrid policies with life insurance or annuity riders, and riders that can be added to existing policies to cover long-term care needs.

What is Long-term Care Insurance? - This article explains that long-term care insurance covers services such as personal and custodial care in various settings, reimbursing up to a daily limit for activities like bathing and dressing, with costs and benefits depending on age, coverage amount, and optional features.

Long-term care costs & options - Fidelity Investments - This page outlines four ways to pay for long-term care: government assistance (Medicaid, VA), traditional and hybrid insurance policies, and personal savings, noting that Medicare does not cover long-term care and traditional policies let you choose coverage amount and duration.

dowidth.com

dowidth.com