Cyber risk underwriting focuses on evaluating threats related to data breaches, ransomware attacks, and system vulnerabilities, using advanced analytics and real-time threat intelligence to assess potential financial losses. Casualty underwriting, on the other hand, deals with liability risks stemming from bodily injury or property damage, prioritizing legal exposure and claims history. Explore the key differences and specialized strategies in underwriting by diving deeper into cyber risk versus casualty insurance.

Why it is important

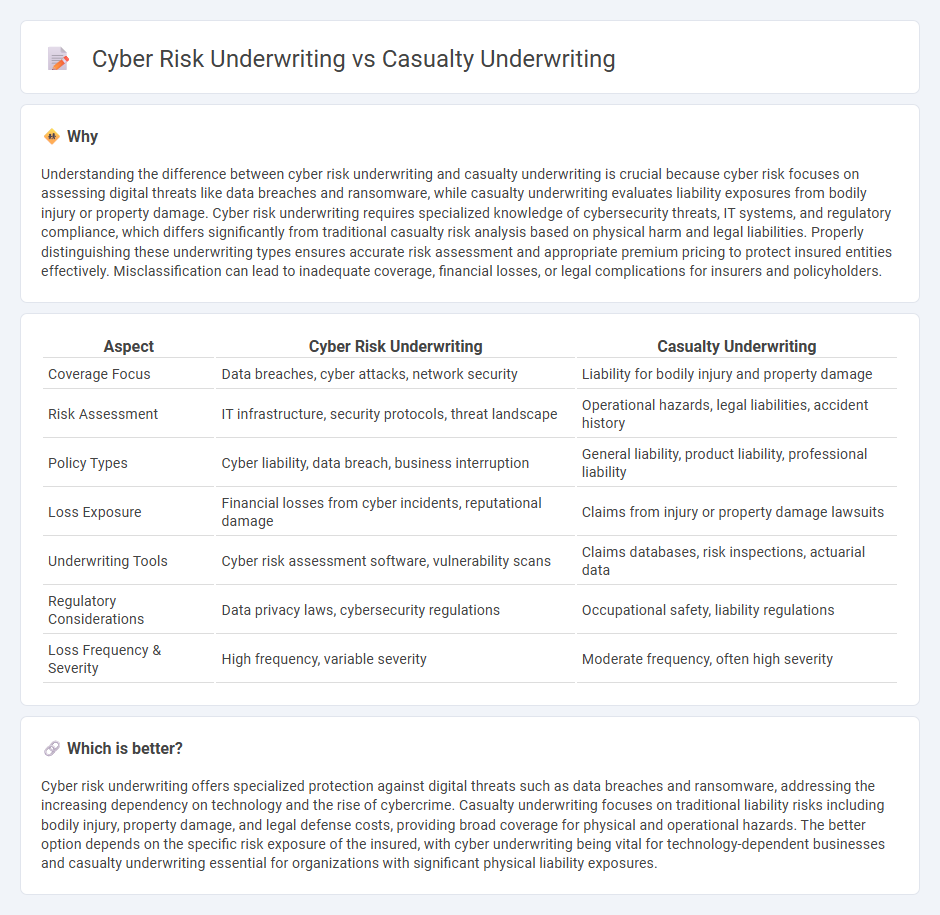

Understanding the difference between cyber risk underwriting and casualty underwriting is crucial because cyber risk focuses on assessing digital threats like data breaches and ransomware, while casualty underwriting evaluates liability exposures from bodily injury or property damage. Cyber risk underwriting requires specialized knowledge of cybersecurity threats, IT systems, and regulatory compliance, which differs significantly from traditional casualty risk analysis based on physical harm and legal liabilities. Properly distinguishing these underwriting types ensures accurate risk assessment and appropriate premium pricing to protect insured entities effectively. Misclassification can lead to inadequate coverage, financial losses, or legal complications for insurers and policyholders.

Comparison Table

| Aspect | Cyber Risk Underwriting | Casualty Underwriting |

|---|---|---|

| Coverage Focus | Data breaches, cyber attacks, network security | Liability for bodily injury and property damage |

| Risk Assessment | IT infrastructure, security protocols, threat landscape | Operational hazards, legal liabilities, accident history |

| Policy Types | Cyber liability, data breach, business interruption | General liability, product liability, professional liability |

| Loss Exposure | Financial losses from cyber incidents, reputational damage | Claims from injury or property damage lawsuits |

| Underwriting Tools | Cyber risk assessment software, vulnerability scans | Claims databases, risk inspections, actuarial data |

| Regulatory Considerations | Data privacy laws, cybersecurity regulations | Occupational safety, liability regulations |

| Loss Frequency & Severity | High frequency, variable severity | Moderate frequency, often high severity |

Which is better?

Cyber risk underwriting offers specialized protection against digital threats such as data breaches and ransomware, addressing the increasing dependency on technology and the rise of cybercrime. Casualty underwriting focuses on traditional liability risks including bodily injury, property damage, and legal defense costs, providing broad coverage for physical and operational hazards. The better option depends on the specific risk exposure of the insured, with cyber underwriting being vital for technology-dependent businesses and casualty underwriting essential for organizations with significant physical liability exposures.

Connection

Cyber risk underwriting and casualty underwriting intersect through the evaluation of liabilities arising from cyber incidents impacting third parties, such as data breaches causing bodily injury or property damage. Both underwriting processes analyze exposure to legal claims and financial losses related to negligence or failure to protect sensitive information. Integrating cyber risk data enhances casualty underwriting accuracy by addressing emerging threats in the digital landscape.

Key Terms

**Casualty Underwriting:**

Casualty underwriting evaluates liability risks related to bodily injury, property damage, and legal expenses, emphasizing claim history, risk exposure, and regulatory compliance. Underwriters analyze factors such as occupation, safety protocols, and past loss experiences to determine coverage terms and premiums. Discover more about how casualty underwriting safeguards businesses and individuals against financial losses.

Liability Exposure

Casualty underwriting primarily addresses liability exposures arising from bodily injury, property damage, and related legal claims, emphasizing historical loss data and regulatory compliance to assess risk. Cyber risk underwriting focuses on liability exposure originating from data breaches, privacy violations, and network security failures, requiring expertise in digital threat landscapes and third-party liabilities. Explore this comparison to deepen your understanding of liability nuances in these specialized underwriting fields.

Claims History

Casualty underwriting relies heavily on detailed claims history to assess risk exposure and predict future liabilities, using past incidents such as bodily injury or property damage claims as critical indicators. Cyber risk underwriting, however, faces challenges due to the often limited or non-transparent claims data, relying more on security protocols, breach detection systems, and cyber resilience measures to evaluate risk. Explore how evolving claims data and analytics are shaping both underwriting practices in greater depth.

Source and External Links

Casualty Underwriter - Berkshire Hathaway Specialty Insurance - Casualty underwriting involves the evaluation, selection, and pricing of casualty risks, requiring strong technical skills, knowledge of policy forms, and interaction with brokers and customers to grow a profitable book of business.

Chapter 3 - Underwriting Property and Casualty Insurance - Casualty underwriting includes assessing liability losses similarly to property losses, analyzing patterns of loss or safety conditions, and recommending improvements rather than just rejecting risks or raising premiums.

Casualty & Financial Lines Underwriting Solutions - Moody's - Modern casualty underwriting leverages advanced data analytics, liability modeling, and technology to improve risk assessment and streamline underwriting workflows for faster, more accurate decisions.

dowidth.com

dowidth.com