Reciprocal insurance involves a group of policyholders who share risk collectively through an attorney-in-fact, facilitating personalized coverage with mutual benefits. Lloyd's of London operates as a marketplace where multiple underwriters assume portions of risk, specializing in complex and high-value policies across diverse sectors. Explore the nuances and advantages of each to determine the best insurance solution for your needs.

Why it is important

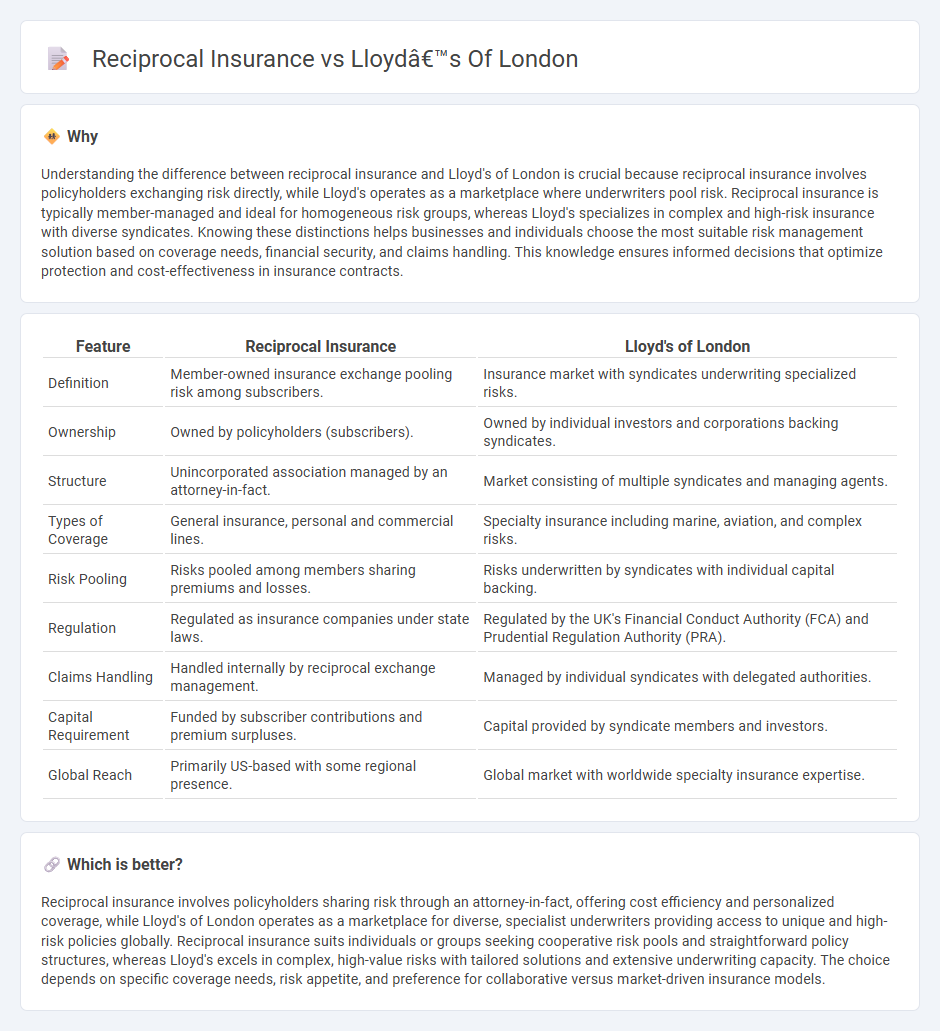

Understanding the difference between reciprocal insurance and Lloyd's of London is crucial because reciprocal insurance involves policyholders exchanging risk directly, while Lloyd's operates as a marketplace where underwriters pool risk. Reciprocal insurance is typically member-managed and ideal for homogeneous risk groups, whereas Lloyd's specializes in complex and high-risk insurance with diverse syndicates. Knowing these distinctions helps businesses and individuals choose the most suitable risk management solution based on coverage needs, financial security, and claims handling. This knowledge ensures informed decisions that optimize protection and cost-effectiveness in insurance contracts.

Comparison Table

| Feature | Reciprocal Insurance | Lloyd's of London |

|---|---|---|

| Definition | Member-owned insurance exchange pooling risk among subscribers. | Insurance market with syndicates underwriting specialized risks. |

| Ownership | Owned by policyholders (subscribers). | Owned by individual investors and corporations backing syndicates. |

| Structure | Unincorporated association managed by an attorney-in-fact. | Market consisting of multiple syndicates and managing agents. |

| Types of Coverage | General insurance, personal and commercial lines. | Specialty insurance including marine, aviation, and complex risks. |

| Risk Pooling | Risks pooled among members sharing premiums and losses. | Risks underwritten by syndicates with individual capital backing. |

| Regulation | Regulated as insurance companies under state laws. | Regulated by the UK's Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA). |

| Claims Handling | Handled internally by reciprocal exchange management. | Managed by individual syndicates with delegated authorities. |

| Capital Requirement | Funded by subscriber contributions and premium surpluses. | Capital provided by syndicate members and investors. |

| Global Reach | Primarily US-based with some regional presence. | Global market with worldwide specialty insurance expertise. |

Which is better?

Reciprocal insurance involves policyholders sharing risk through an attorney-in-fact, offering cost efficiency and personalized coverage, while Lloyd's of London operates as a marketplace for diverse, specialist underwriters providing access to unique and high-risk policies globally. Reciprocal insurance suits individuals or groups seeking cooperative risk pools and straightforward policy structures, whereas Lloyd's excels in complex, high-value risks with tailored solutions and extensive underwriting capacity. The choice depends on specific coverage needs, risk appetite, and preference for collaborative versus market-driven insurance models.

Connection

Reciprocal insurance exchanges operate on the principle of shared risk among policyholders, similar to Lloyd's of London, which functions as a marketplace where underwriters pool and share risks collectively. Lloyd's uses specialized syndicates that resemble the reciprocal model by mutually assuming liabilities, enhancing risk diversification across complex insurance policies. Both systems emphasize collaboration among members to provide coverage, ensuring shared responsibility and risk management in the insurance industry.

Key Terms

Syndicate (Lloyd’s of London)

Lloyd's of London operates through syndicates, which are groups of investors that underwrite insurance risks collectively, offering specialized coverage across various sectors. Unlike reciprocal insurance exchanges where members insure each other directly, Lloyd's syndicates leverage capital from multiple backers, including corporations and wealthy individuals, enhancing risk diversification and financial strength. Explore more about how Lloyd's syndicates provide unique market solutions and underwriting expertise.

Attorney-in-Fact (Reciprocal Insurance)

Lloyd's of London operates as a marketplace for syndicates underwriting insurance, whereas reciprocal insurance involves policyholders exchanging risks directly through an Attorney-in-Fact who manages administrative and financial operations. The Attorney-in-Fact in reciprocal insurance holds fiduciary responsibility, coordinates claims, and ensures compliance, contrasting with Lloyd's broker-driven syndicate model. Explore deeper distinctions and operational nuances between these insurance structures to understand their strategic applications.

Policyholder (Both structures)

Lloyd's of London operates as a marketplace where multiple syndicates underwrite risks, providing policyholders with diverse options and specialized coverage tailored to niche industries. Reciprocal insurance involves policyholders who are also insurers within an exchange, sharing risks and premiums collectively, offering more direct control and potential cost savings. Explore the differences in protection mechanisms and benefits to understand which structure best aligns with your insurance needs.

Source and External Links

Lloyd's of London - Lloyd's is a historic insurance and reinsurance marketplace in London, operating as a corporate body where multiple financial backers (syndicates) pool and spread risk, distinct from being a traditional insurance company.

Lloyd's: Homepage - Lloyd's serves as the world's leading insurance marketplace, bringing together experts to share intelligence, capital, and risk management solutions globally.

What is Lloyd's of London? - Originating from Edward Lloyd's 17th-century coffee house, Lloyd's evolved into a formalized subscription market for marine and general insurance, maintaining its role as a hub for complex and large-scale risk underwriting.

dowidth.com

dowidth.com