Telematics insurance uses real-time data from vehicle sensors to customize premiums based on driving behavior, whereas traditional insurance relies mainly on demographic and historical data to set rates. This usage-based model often rewards safe driving habits with lower costs, promoting safer roads and more personalized coverage. Discover how telematics insurance can transform your policy by exploring its benefits and working mechanisms.

Why it is important

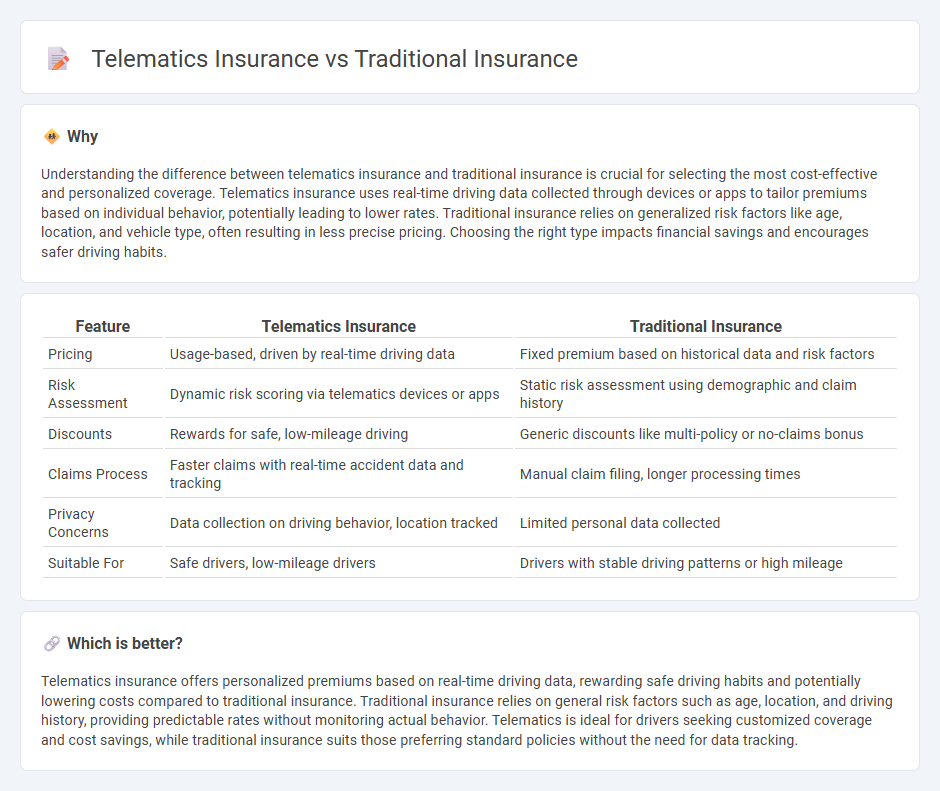

Understanding the difference between telematics insurance and traditional insurance is crucial for selecting the most cost-effective and personalized coverage. Telematics insurance uses real-time driving data collected through devices or apps to tailor premiums based on individual behavior, potentially leading to lower rates. Traditional insurance relies on generalized risk factors like age, location, and vehicle type, often resulting in less precise pricing. Choosing the right type impacts financial savings and encourages safer driving habits.

Comparison Table

| Feature | Telematics Insurance | Traditional Insurance |

|---|---|---|

| Pricing | Usage-based, driven by real-time driving data | Fixed premium based on historical data and risk factors |

| Risk Assessment | Dynamic risk scoring via telematics devices or apps | Static risk assessment using demographic and claim history |

| Discounts | Rewards for safe, low-mileage driving | Generic discounts like multi-policy or no-claims bonus |

| Claims Process | Faster claims with real-time accident data and tracking | Manual claim filing, longer processing times |

| Privacy Concerns | Data collection on driving behavior, location tracked | Limited personal data collected |

| Suitable For | Safe drivers, low-mileage drivers | Drivers with stable driving patterns or high mileage |

Which is better?

Telematics insurance offers personalized premiums based on real-time driving data, rewarding safe driving habits and potentially lowering costs compared to traditional insurance. Traditional insurance relies on general risk factors such as age, location, and driving history, providing predictable rates without monitoring actual behavior. Telematics is ideal for drivers seeking customized coverage and cost savings, while traditional insurance suits those preferring standard policies without the need for data tracking.

Connection

Telematics insurance and traditional insurance are connected through their shared goal of risk assessment and premium calculation, but telematics insurance leverages real-time driving data collected via devices or smartphone apps to personalize policies more accurately. This integration of telematics data allows insurers to offer usage-based insurance (UBI), enhancing risk prediction compared to traditional methods relying on historical and demographic information. By combining telematics technology with conventional underwriting, insurance companies improve claims management, customer engagement, and tailored pricing strategies.

Key Terms

Premium Calculation

Traditional insurance calculates premiums based on historical data, age, driving record, and geographic location, using broad risk categories and averages. Telematics insurance leverages real-time driving data such as speed, braking patterns, and mileage through in-car devices, offering personalized premium rates that reflect actual driver behavior. Discover how telematics is transforming premium calculation with enhanced accuracy and fairness.

Risk Assessment

Traditional insurance relies on generalized risk profiles based on demographic data, historical claim averages, and broad categories such as age, gender, and location to determine premiums. Telematics insurance uses real-time driving behavior data collected through devices or apps, analyzing factors like speed, braking patterns, and mileage to offer personalized risk assessment and dynamic pricing. Explore how telematics insurance is transforming risk evaluation and premium customization for safer driving experiences.

Data Collection

Traditional insurance relies on demographic data such as age, location, and driving history to assess risk, offering fixed premiums based on broad risk categories. Telematics insurance uses real-time data collected through devices like GPS trackers and smartphone apps to monitor driving behavior, including speed, braking patterns, and mileage, allowing for personalized premium adjustments. Discover how telematics technology transforms risk assessment and premium calculations in modern insurance models.

Source and External Links

Traditional Indemnity Insurance Plans - Traditional indemnity insurance plans reimburse patients based on usual, customary, and reasonable fees, allowing choice of healthcare providers without restrictions.

Traditional vs Managed Care - Traditional health insurance provides flexibility in choosing healthcare providers, often requiring payment upfront with subsequent reimbursement from the insurance company.

Traditional Health Insurance vs Healthcare Sharing Ministries - Traditional health insurance involves a contractual agreement between an individual and an insurance company, covering specified healthcare services after premium payments.

dowidth.com

dowidth.com