Crop microinsurance offers targeted financial protection to small-scale farmers against losses caused by natural disasters or pests, ensuring stability for vulnerable agricultural communities. Agricultural input insurance focuses on safeguarding investments in seeds, fertilizers, and pesticides, minimizing risk related to input failure or price fluctuations. Explore these innovative insurance solutions to enhance agricultural resilience and secure farm productivity.

Why it is important

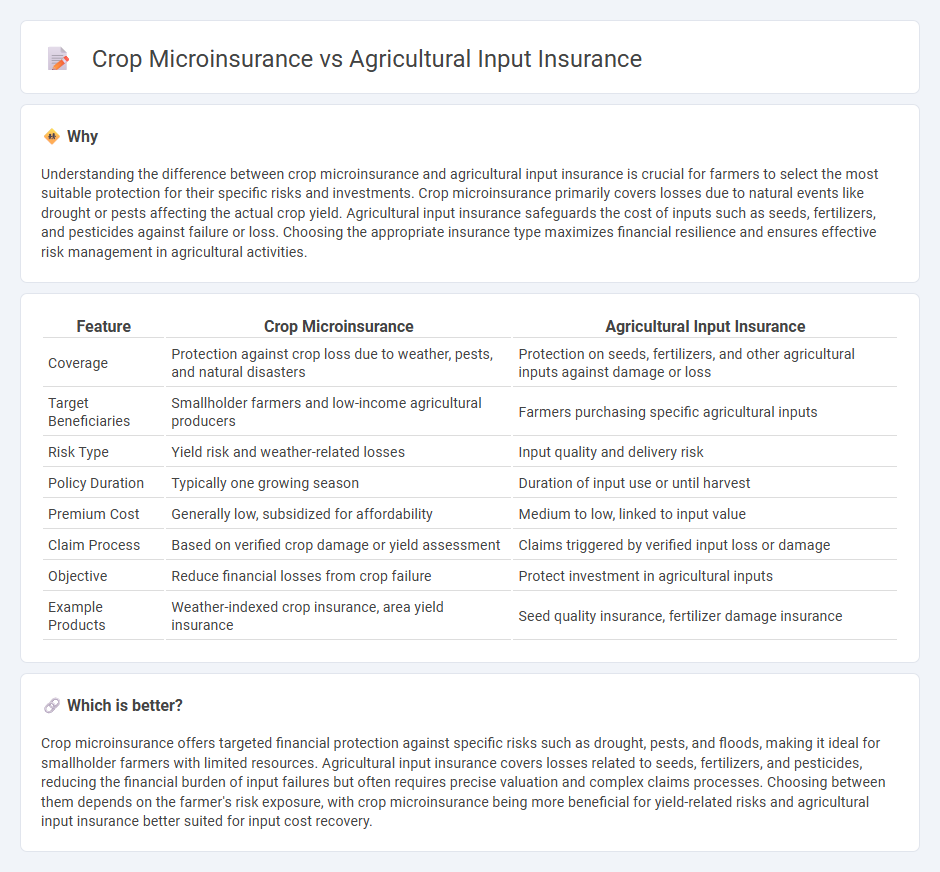

Understanding the difference between crop microinsurance and agricultural input insurance is crucial for farmers to select the most suitable protection for their specific risks and investments. Crop microinsurance primarily covers losses due to natural events like drought or pests affecting the actual crop yield. Agricultural input insurance safeguards the cost of inputs such as seeds, fertilizers, and pesticides against failure or loss. Choosing the appropriate insurance type maximizes financial resilience and ensures effective risk management in agricultural activities.

Comparison Table

| Feature | Crop Microinsurance | Agricultural Input Insurance |

|---|---|---|

| Coverage | Protection against crop loss due to weather, pests, and natural disasters | Protection on seeds, fertilizers, and other agricultural inputs against damage or loss |

| Target Beneficiaries | Smallholder farmers and low-income agricultural producers | Farmers purchasing specific agricultural inputs |

| Risk Type | Yield risk and weather-related losses | Input quality and delivery risk |

| Policy Duration | Typically one growing season | Duration of input use or until harvest |

| Premium Cost | Generally low, subsidized for affordability | Medium to low, linked to input value |

| Claim Process | Based on verified crop damage or yield assessment | Claims triggered by verified input loss or damage |

| Objective | Reduce financial losses from crop failure | Protect investment in agricultural inputs |

| Example Products | Weather-indexed crop insurance, area yield insurance | Seed quality insurance, fertilizer damage insurance |

Which is better?

Crop microinsurance offers targeted financial protection against specific risks such as drought, pests, and floods, making it ideal for smallholder farmers with limited resources. Agricultural input insurance covers losses related to seeds, fertilizers, and pesticides, reducing the financial burden of input failures but often requires precise valuation and complex claims processes. Choosing between them depends on the farmer's risk exposure, with crop microinsurance being more beneficial for yield-related risks and agricultural input insurance better suited for input cost recovery.

Connection

Crop microinsurance and agricultural input insurance are interconnected by their shared goal of mitigating risks faced by smallholder farmers through financial protection. Crop microinsurance specifically covers losses related to crop yield or damage due to natural disasters, while agricultural input insurance focuses on safeguarding investments in essential inputs like seeds, fertilizers, and pesticides. Together, they enhance farmers' resilience by ensuring both the protection of crops and the critical inputs needed for successful cultivation.

Key Terms

**Agricultural input insurance:**

Agricultural input insurance specifically covers the risks associated with the purchase and use of seeds, fertilizers, and pesticides, protecting farmers from financial losses due to poor input performance caused by adverse weather or pest infestations. This insurance type helps stabilize farmers' investment in essential inputs, ensuring continuity in crop production despite unpredictable agricultural conditions. Explore more about how agricultural input insurance can safeguard your farm's investment and enhance productivity resilience.

Input replacement coverage

Agricultural input insurance primarily protects farmers against losses related to the purchase and use of essential farming inputs such as seeds, fertilizers, and pesticides, ensuring financial stability for input replacement. Crop microinsurance, on the other hand, offers broader protection against risks impacting overall crop yield, often incorporating coverage for smallholder farmers with tailored premiums and simplified claims processes. Explore detailed comparisons and tailored solutions to enhance risk management in agriculture.

Weather index

Weather index-based agricultural input insurance offers coverage by triggering payouts when weather parameters, such as rainfall or temperature, deviate from predefined thresholds affecting crop inputs like seeds and fertilizers. Crop microinsurance, targeting smallholder farmers, uses weather index triggers similarly but emphasizes affordable, tailored coverage to protect against localized weather risks impacting crop yields. Explore detailed comparisons to understand how weather index mechanisms optimize risk mitigation in agricultural insurance products.

Source and External Links

Protect Input Investments with Customized Crop Coverage - Farmers can customize crop insurance to protect agricultural inputs such as seeds and fungicides, with options for multi-peril crop insurance and supplemental coverage that fits unique risk profiles and budgets.

Pula: Reimagining the landscape of agricultural insurance - Pula bundles free insurance with agricultural inputs like seeds and fertilizer for smallholder farmers, with input companies paying premiums to differentiate products while underwriters provide coverage, focusing on protecting income and boosting yields in underserved markets.

The Ultimate Guide to Agricultural Insurance for Modern Farmers - Agricultural input insurance typically includes multi-peril crop insurance, which covers yield and revenue losses from various causes, and supplemental policies that protect specific risks such as hail or fire, helping farmers manage input-related risks effectively.

dowidth.com

dowidth.com