Digital claim automation streamlines the insurance process by enabling faster, more accurate data capture and reducing human error compared to traditional call center claim intake. Advanced technologies such as AI-driven document recognition and real-time status updates enhance customer satisfaction and operational efficiency. Discover how integrating digital claim automation can transform your insurance services.

Why it is important

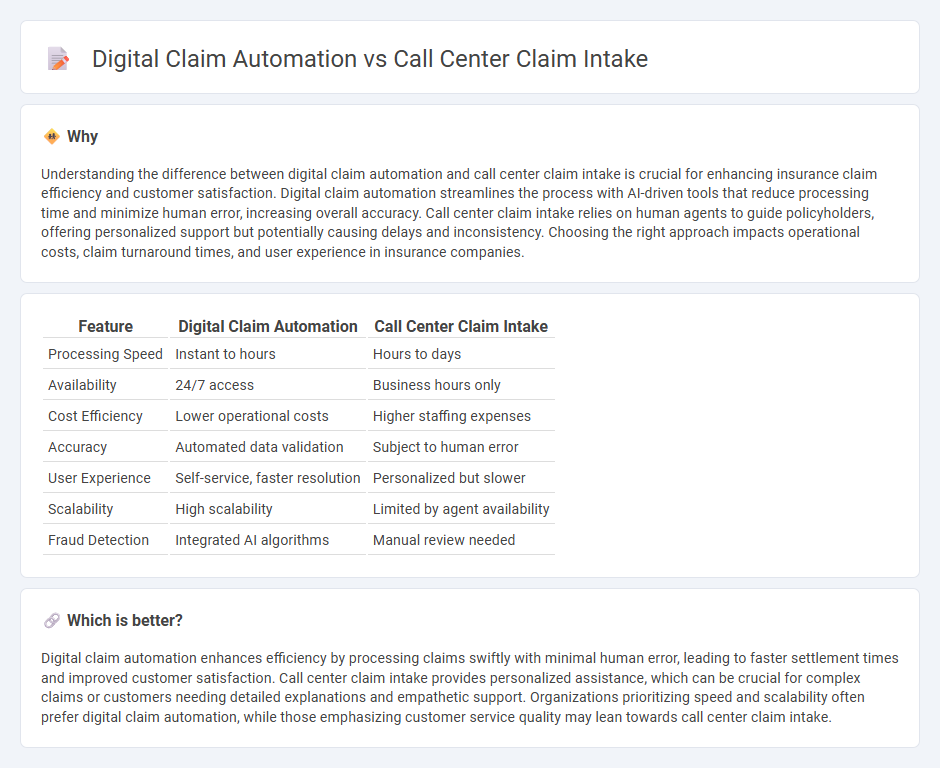

Understanding the difference between digital claim automation and call center claim intake is crucial for enhancing insurance claim efficiency and customer satisfaction. Digital claim automation streamlines the process with AI-driven tools that reduce processing time and minimize human error, increasing overall accuracy. Call center claim intake relies on human agents to guide policyholders, offering personalized support but potentially causing delays and inconsistency. Choosing the right approach impacts operational costs, claim turnaround times, and user experience in insurance companies.

Comparison Table

| Feature | Digital Claim Automation | Call Center Claim Intake |

|---|---|---|

| Processing Speed | Instant to hours | Hours to days |

| Availability | 24/7 access | Business hours only |

| Cost Efficiency | Lower operational costs | Higher staffing expenses |

| Accuracy | Automated data validation | Subject to human error |

| User Experience | Self-service, faster resolution | Personalized but slower |

| Scalability | High scalability | Limited by agent availability |

| Fraud Detection | Integrated AI algorithms | Manual review needed |

Which is better?

Digital claim automation enhances efficiency by processing claims swiftly with minimal human error, leading to faster settlement times and improved customer satisfaction. Call center claim intake provides personalized assistance, which can be crucial for complex claims or customers needing detailed explanations and empathetic support. Organizations prioritizing speed and scalability often prefer digital claim automation, while those emphasizing customer service quality may lean towards call center claim intake.

Connection

Digital claim automation integrates seamlessly with call center claim intake by streamlining data capture and enhancing accuracy during the initial reporting phase. Automated systems reduce manual entry errors and expedite claim processing times, improving customer satisfaction and operational efficiency. Real-time data synchronization between call centers and digital platforms ensures transparent and consistent claim handling across channels.

Key Terms

**Call Center Claim Intake:**

Call center claim intake involves agents manually gathering claim information through phone interactions, ensuring personalized customer service and immediate clarifications. This method relies heavily on trained representatives to accurately capture details, manage complex cases, and provide empathic support during the claim process. Discover how call center claim intake enhances customer experience and claim accuracy by learning more about its benefits and applications.

Customer Service Representative

Customer Service Representatives (CSRs) play a critical role in call center claim intake by providing personalized assistance, answering inquiries, and guiding customers through the claims process. Digital claim automation reduces CSR workload by streamlining data entry and claim validation, enabling faster processing and minimizing human errors. Explore how integrating digital claim automation can enhance CSR efficiency and improve customer satisfaction.

Manual Data Entry

Manual data entry in call center claim intake often leads to higher error rates and slower processing times compared to digital claim automation, which utilizes advanced OCR and AI to streamline data capture accurately. Digital automation reduces human intervention, enhancing operational efficiency and enabling faster claim resolution with minimal manual input. Explore the benefits of digital claim automation to transform your claims processing workflow.

Source and External Links

Claim Intake & 24/7 Claim Reporting - Actec Systems - Actec provides 24/7/365 full-service contact center claim intake specializing in FNOL with advanced call management technology and seamless CMS integration to reduce claim lag time and payouts.

QRM - White Glove Claim Services - FNOL Contact Center - QRM is a 24/7/365 claim intake and response center offering a single-call, high-quality customer claim experience with geographically redundant offices in Tennessee and Alabama, never outsourcing calls offshore.

Call Center Services - Team One Claims - Team One provides specialized 24/7 claim intake and customer service with trained representatives and scalable infrastructure across three Texas locations, proven capable of handling high call volumes during disasters.

dowidth.com

dowidth.com