Behavioral policy pricing leverages individual data such as driving habits and lifestyle choices to tailor insurance premiums, enhancing accuracy and fairness in risk assessment. Group underwriting pools risks from a collective, often using demographic factors to determine rates, which can lead to generalized pricing but offers simplicity and broader coverage. Explore how these approaches impact premium costs and risk management strategies.

Why it is important

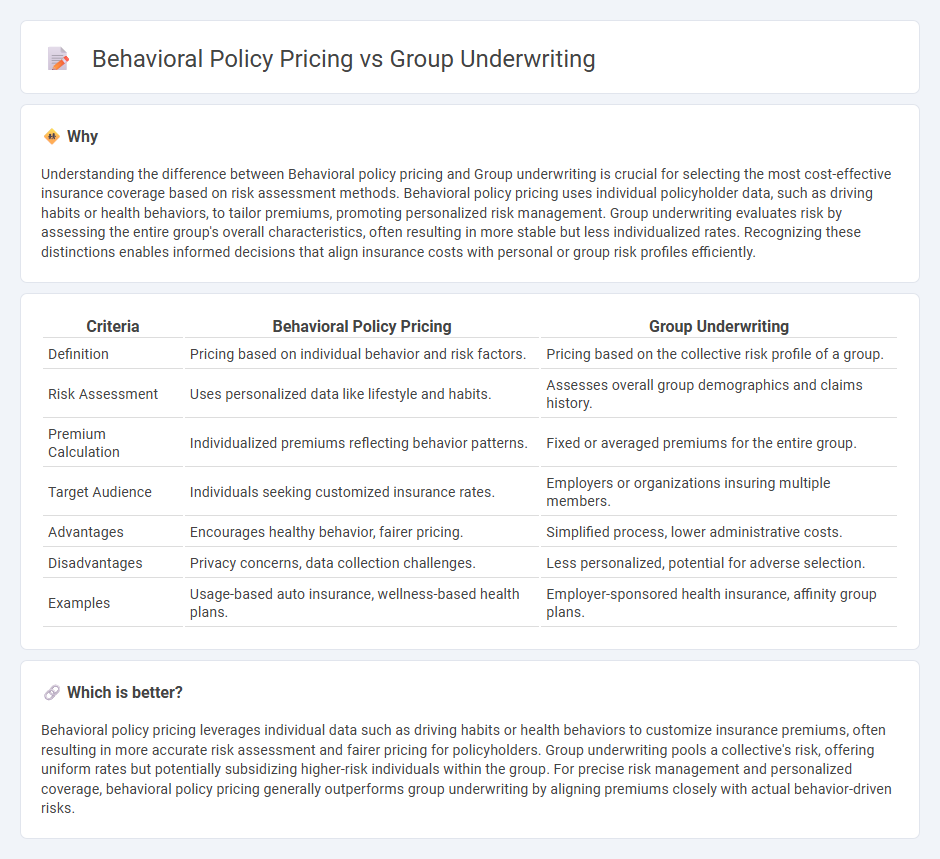

Understanding the difference between Behavioral policy pricing and Group underwriting is crucial for selecting the most cost-effective insurance coverage based on risk assessment methods. Behavioral policy pricing uses individual policyholder data, such as driving habits or health behaviors, to tailor premiums, promoting personalized risk management. Group underwriting evaluates risk by assessing the entire group's overall characteristics, often resulting in more stable but less individualized rates. Recognizing these distinctions enables informed decisions that align insurance costs with personal or group risk profiles efficiently.

Comparison Table

| Criteria | Behavioral Policy Pricing | Group Underwriting |

|---|---|---|

| Definition | Pricing based on individual behavior and risk factors. | Pricing based on the collective risk profile of a group. |

| Risk Assessment | Uses personalized data like lifestyle and habits. | Assesses overall group demographics and claims history. |

| Premium Calculation | Individualized premiums reflecting behavior patterns. | Fixed or averaged premiums for the entire group. |

| Target Audience | Individuals seeking customized insurance rates. | Employers or organizations insuring multiple members. |

| Advantages | Encourages healthy behavior, fairer pricing. | Simplified process, lower administrative costs. |

| Disadvantages | Privacy concerns, data collection challenges. | Less personalized, potential for adverse selection. |

| Examples | Usage-based auto insurance, wellness-based health plans. | Employer-sponsored health insurance, affinity group plans. |

Which is better?

Behavioral policy pricing leverages individual data such as driving habits or health behaviors to customize insurance premiums, often resulting in more accurate risk assessment and fairer pricing for policyholders. Group underwriting pools a collective's risk, offering uniform rates but potentially subsidizing higher-risk individuals within the group. For precise risk management and personalized coverage, behavioral policy pricing generally outperforms group underwriting by aligning premiums closely with actual behavior-driven risks.

Connection

Behavioral policy pricing leverages data on individual behavior patterns to tailor insurance premiums, enhancing risk accuracy by aligning rates with predictive actions. Group underwriting aggregates risk across a collective, using shared characteristics to determine premiums while factoring in behavioral data trends to refine group risk profiles. The integration of behavioral policy pricing within group underwriting enables insurers to optimize pricing strategies, balancing individual risk insights with group-level risk pooling for improved underwriting precision.

Key Terms

Risk Pooling

Group underwriting aggregates risks by assessing the collective health and characteristics of a group, thereby enabling more predictable premiums through risk pooling. Behavioral policy pricing uses individual data, such as driving habits or lifestyle choices, to tailor premiums closely to personal risk profiles, potentially impacting the overall risk pool's stability. Explore the nuances and benefits of these approaches to optimize insurance risk management strategies.

Claims Experience

Group underwriting evaluates risk based on aggregate claims experience and demographic data, providing insurers with a broad overview of potential liabilities. Behavioral policy pricing leverages individual claims history and real-time behavioral data to tailor premiums more accurately, reducing adverse selection and encouraging risk mitigation. Discover how integrating claims experience in these methodologies can optimize insurance pricing strategies.

Individual Risk Assessment

Group underwriting evaluates risk by assessing the collective profile of employees, often resulting in standardized premiums based on aggregated data such as age, occupation, and claims history. Behavioral policy pricing emphasizes individual risk assessment by analyzing personal behaviors, lifestyle choices, and real-time data from wearables or telematics to tailor premiums more precisely. Explore the nuances of individual risk assessment and its impact on insurance pricing strategies for deeper insights.

Source and External Links

Guidelines for Group Health Insurance Underwriting - Group underwriting assesses the collective health risk of a group by evaluating members' medical history, age, occupation, and lifestyle to determine premiums and coverage options for group health insurance policies.

What is Group Insurance Underwriting? - Group insurance underwriting involves assessing financial risk for an entire organization's coverage by analyzing factors such as industry risk, employee occupations, and demographic stability to price group insurance plans appropriately.

Both Sides Now: Sharing Group Claims and Underwriting - In group underwriting, assessing past claims and demographic data is critical to forecasting future risks, and pricing is influenced by factors like large claims, geographic trends, and administration changes, with market forces affecting proposal packaging and competitiveness.

dowidth.com

dowidth.com