Flood insurance integration focuses on protecting property and assets from water damage caused by natural floods, often requiring additional policies beyond standard coverage. Renters insurance integration primarily safeguards tenants' personal belongings and liability, typically excluding flood damage but essential for comprehensive rental protection. Explore the key differences and benefits to determine the best insurance integration for your needs.

Why it is important

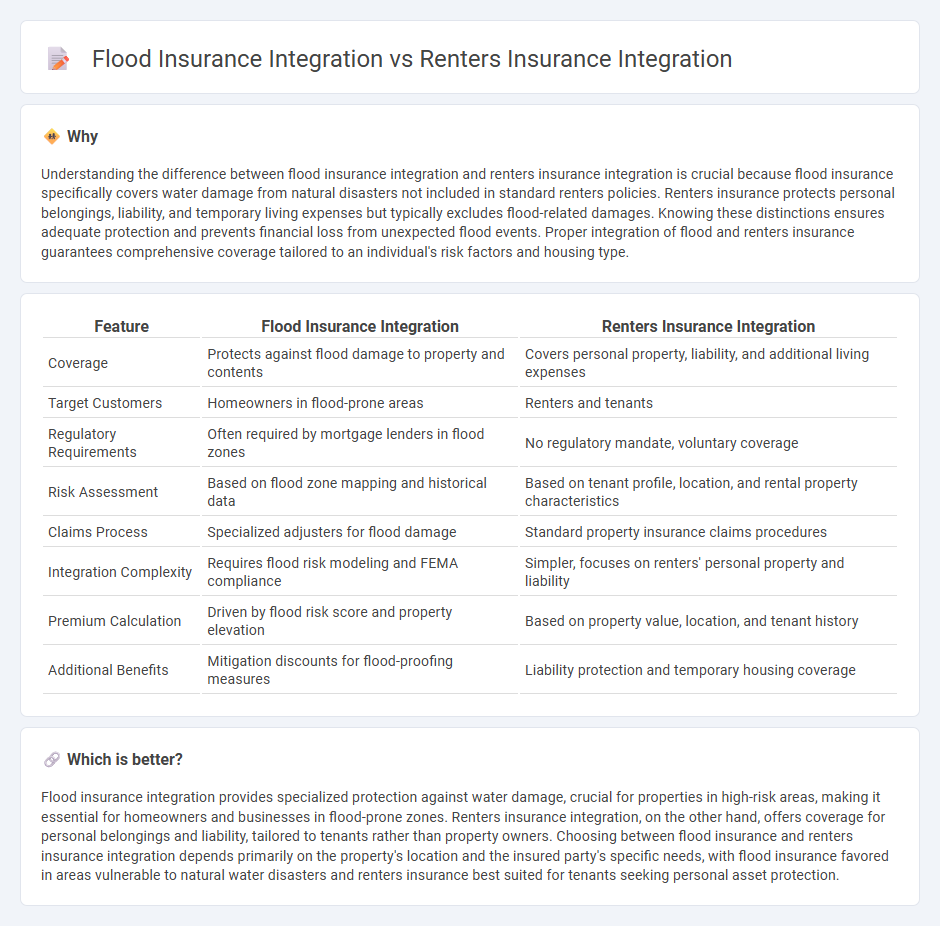

Understanding the difference between flood insurance integration and renters insurance integration is crucial because flood insurance specifically covers water damage from natural disasters not included in standard renters policies. Renters insurance protects personal belongings, liability, and temporary living expenses but typically excludes flood-related damages. Knowing these distinctions ensures adequate protection and prevents financial loss from unexpected flood events. Proper integration of flood and renters insurance guarantees comprehensive coverage tailored to an individual's risk factors and housing type.

Comparison Table

| Feature | Flood Insurance Integration | Renters Insurance Integration |

|---|---|---|

| Coverage | Protects against flood damage to property and contents | Covers personal property, liability, and additional living expenses |

| Target Customers | Homeowners in flood-prone areas | Renters and tenants |

| Regulatory Requirements | Often required by mortgage lenders in flood zones | No regulatory mandate, voluntary coverage |

| Risk Assessment | Based on flood zone mapping and historical data | Based on tenant profile, location, and rental property characteristics |

| Claims Process | Specialized adjusters for flood damage | Standard property insurance claims procedures |

| Integration Complexity | Requires flood risk modeling and FEMA compliance | Simpler, focuses on renters' personal property and liability |

| Premium Calculation | Driven by flood risk score and property elevation | Based on property value, location, and tenant history |

| Additional Benefits | Mitigation discounts for flood-proofing measures | Liability protection and temporary housing coverage |

Which is better?

Flood insurance integration provides specialized protection against water damage, crucial for properties in high-risk areas, making it essential for homeowners and businesses in flood-prone zones. Renters insurance integration, on the other hand, offers coverage for personal belongings and liability, tailored to tenants rather than property owners. Choosing between flood insurance and renters insurance integration depends primarily on the property's location and the insured party's specific needs, with flood insurance favored in areas vulnerable to natural water disasters and renters insurance best suited for tenants seeking personal asset protection.

Connection

Flood insurance integration and renters insurance integration are connected through their mutual goal of providing comprehensive protection for property and personal belongings against diverse risks. Both types of insurance can be bundled or coordinated within a broader renters insurance policy to cover damages from flooding, which is typically excluded from standard renters plans. This integration enhances risk management by ensuring tenants have coverage for water-related disasters alongside general liability and personal property protection.

Key Terms

Coverage Scope

Renters insurance integration primarily covers personal property protection, liability, and additional living expenses, while flood insurance integration focuses exclusively on damages caused by flooding, typically excluded from standard renters policies. Understanding the distinct coverage scopes helps ensure comprehensive protection against diverse risks faced by renters. Explore more to effectively differentiate and combine these insurance options for complete risk management.

Policy Endorsement

Policy endorsement in renters insurance integration allows seamless modification of coverage terms to include additional risks such as personal property protection or liability extensions without disrupting the core policy framework. Flood insurance integration requires specialized endorsements that specifically address flood-related damages, often governed by different regulatory standards and requiring coordination with the National Flood Insurance Program (NFIP). Explore the detailed differences in policy endorsements between renters and flood insurance integrations for a comprehensive understanding.

Risk Assessment

Renters insurance integration primarily centers on evaluating personal property risks and liability exposures specific to tenants, including theft, fire, and accidental damage within rental units. Flood insurance integration focuses on analyzing geographic flood zones, historical water damage data, and floodplain mapping to assess susceptibility to water-related losses. Explore comprehensive insights on how advanced risk assessment technologies enhance both renters and flood insurance integrations.

Source and External Links

Progressive Renters Insurance Integration - Offers a seamless integration of renters insurance into platforms, allowing users to purchase coverage as part of their leasing process.

Assurant Cover360 - Provides a suite of solutions for property management companies to streamline renters insurance tracking and maintenance.

Get Covered - Automates renters insurance compliance by integrating insurance into the lease signing process, offering customizable branded experiences.

dowidth.com

dowidth.com