Climate risk insurance specifically addresses financial losses caused by extreme weather events and climate variability, offering protection against unpredictable natural disasters. Agricultural insurance, on the other hand, covers a broader range of risks affecting crops and livestock, including pests, diseases, and market fluctuations. Explore the differences and benefits of these insurance types to safeguard your assets effectively.

Why it is important

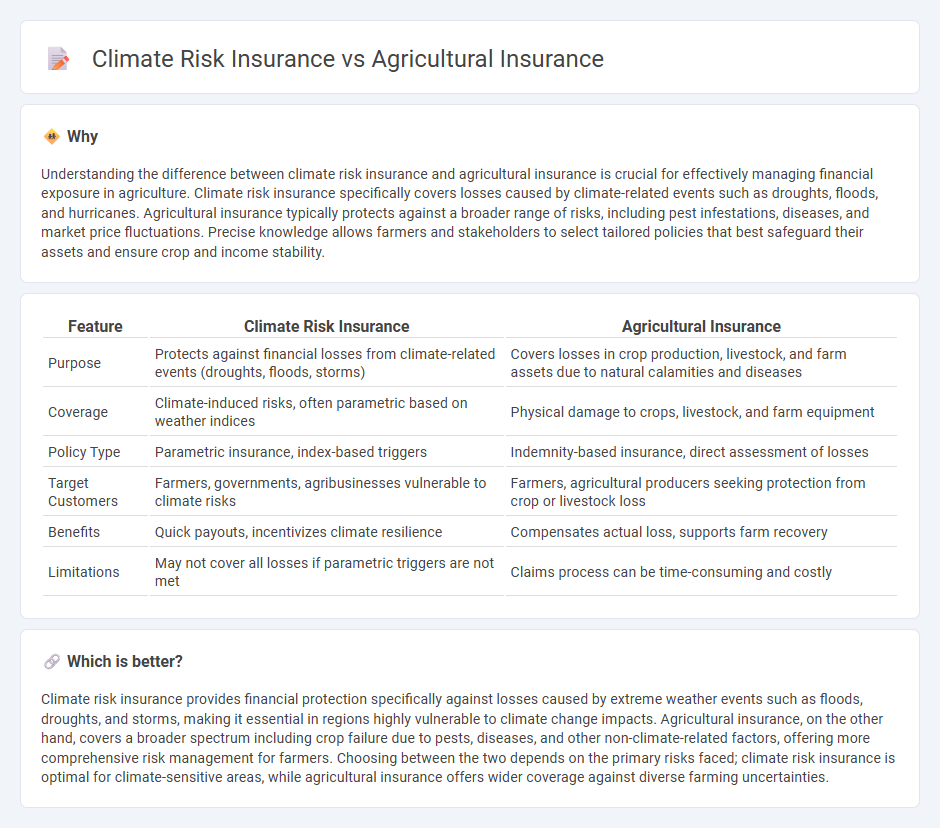

Understanding the difference between climate risk insurance and agricultural insurance is crucial for effectively managing financial exposure in agriculture. Climate risk insurance specifically covers losses caused by climate-related events such as droughts, floods, and hurricanes. Agricultural insurance typically protects against a broader range of risks, including pest infestations, diseases, and market price fluctuations. Precise knowledge allows farmers and stakeholders to select tailored policies that best safeguard their assets and ensure crop and income stability.

Comparison Table

| Feature | Climate Risk Insurance | Agricultural Insurance |

|---|---|---|

| Purpose | Protects against financial losses from climate-related events (droughts, floods, storms) | Covers losses in crop production, livestock, and farm assets due to natural calamities and diseases |

| Coverage | Climate-induced risks, often parametric based on weather indices | Physical damage to crops, livestock, and farm equipment |

| Policy Type | Parametric insurance, index-based triggers | Indemnity-based insurance, direct assessment of losses |

| Target Customers | Farmers, governments, agribusinesses vulnerable to climate risks | Farmers, agricultural producers seeking protection from crop or livestock loss |

| Benefits | Quick payouts, incentivizes climate resilience | Compensates actual loss, supports farm recovery |

| Limitations | May not cover all losses if parametric triggers are not met | Claims process can be time-consuming and costly |

Which is better?

Climate risk insurance provides financial protection specifically against losses caused by extreme weather events such as floods, droughts, and storms, making it essential in regions highly vulnerable to climate change impacts. Agricultural insurance, on the other hand, covers a broader spectrum including crop failure due to pests, diseases, and other non-climate-related factors, offering more comprehensive risk management for farmers. Choosing between the two depends on the primary risks faced; climate risk insurance is optimal for climate-sensitive areas, while agricultural insurance offers wider coverage against diverse farming uncertainties.

Connection

Climate risk insurance and agricultural insurance are intrinsically linked as both address the financial vulnerabilities faced by farmers due to climate-related events such as droughts, floods, and storms. Climate risk insurance specifically targets weather-induced losses by providing payouts based on predefined climate triggers, while agricultural insurance broadly covers various risks including pests, diseases, and market fluctuations. Together, these insurances enhance the resilience of the agricultural sector by mitigating economic losses caused by environmental uncertainties and improving farmers' access to credit and investment opportunities.

Key Terms

**Agricultural Insurance:**

Agricultural insurance provides financial protection to farmers against crop loss, livestock death, and damage due to natural perils such as drought, pests, and floods, stabilizing income in uncertain farming conditions. It specifically covers risks inherent to agricultural production, helping to secure food supply and promote investment in sustainable farming practices. Explore detailed insights on how agricultural insurance mitigates farm risks and supports rural economies.

Crop Yield

Agricultural insurance primarily covers risks related to crop yield losses caused by factors like pests, diseases, and extreme weather events, ensuring financial stability for farmers. Climate risk insurance specifically targets damages stemming from climate change impacts, such as prolonged droughts or floods, offering protection against increasingly unpredictable weather patterns affecting crop productivity. Explore the differences in coverage and benefits to understand which insurance best safeguards your crop yield.

Pest Damage

Agricultural insurance primarily covers losses from pest damage affecting crop yields, providing farmers with financial protection against unexpected infestations. Climate risk insurance extends this coverage by including pest outbreaks linked to climate variability and extreme weather events, addressing the increasing threat of pest proliferation due to changing climate conditions. Discover how these insurance solutions can safeguard your farming operations against evolving pest-related risks.

Source and External Links

The Ultimate Guide to Agricultural Insurance for Modern Farmers - This guide provides an overview of agricultural insurance, highlighting its importance for farmers and the various types of insurance available, such as Multi-Peril Crop Insurance and Whole-Farm Revenue Protection.

Insurance Plans - USDA Risk Management Agency - Offers details on crop insurance policies managed by the RMA, covering over 100 crops and providing risk management tools for farmers.

Agricultural Insurance - Midwest Bank - Provides comprehensive agricultural insurance solutions for farm operations, including Multi-Peril Crop Insurance and Livestock Risk Protection.

dowidth.com

dowidth.com