Insurtech sandboxes provide a controlled regulatory environment where innovative insurance technologies can be tested, enabling startups to develop customizable policies and enhance customer experience. Reinsurance involves transferring portions of risk from primary insurers to reinsurers, stabilizing financial performance and protecting against large claims. Explore the distinct roles of insurtech sandboxes and reinsurance in transforming the insurance industry.

Why it is important

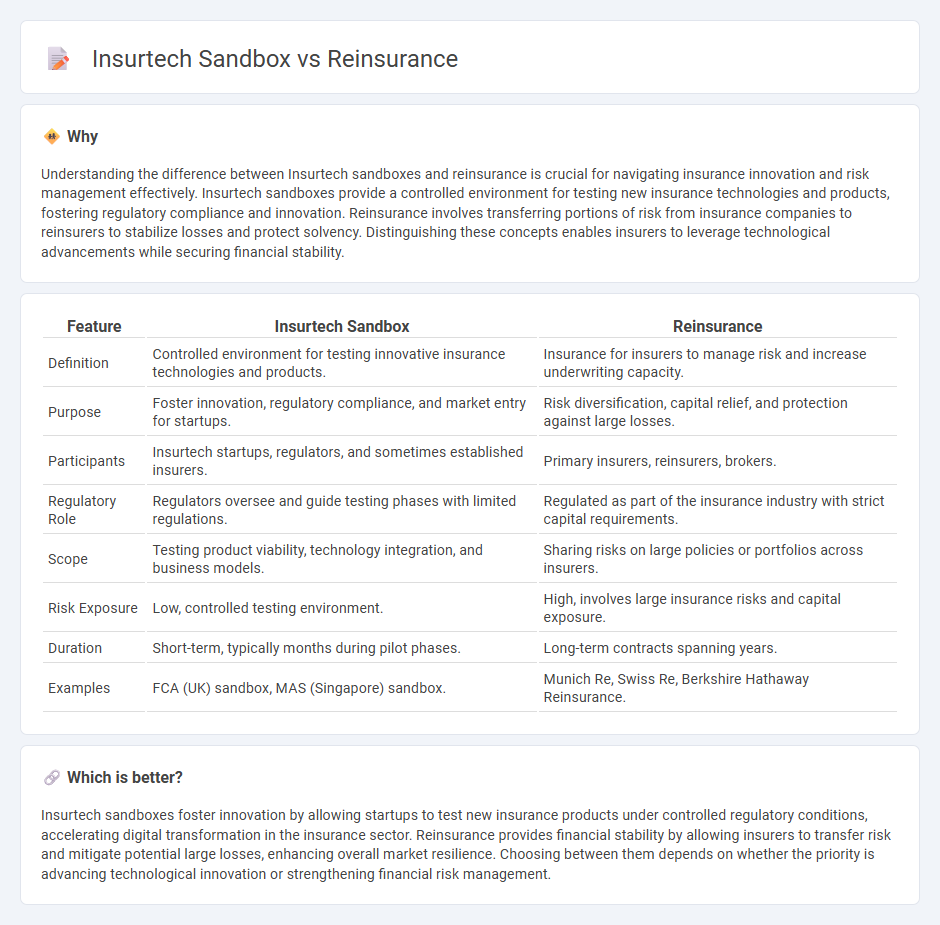

Understanding the difference between Insurtech sandboxes and reinsurance is crucial for navigating insurance innovation and risk management effectively. Insurtech sandboxes provide a controlled environment for testing new insurance technologies and products, fostering regulatory compliance and innovation. Reinsurance involves transferring portions of risk from insurance companies to reinsurers to stabilize losses and protect solvency. Distinguishing these concepts enables insurers to leverage technological advancements while securing financial stability.

Comparison Table

| Feature | Insurtech Sandbox | Reinsurance |

|---|---|---|

| Definition | Controlled environment for testing innovative insurance technologies and products. | Insurance for insurers to manage risk and increase underwriting capacity. |

| Purpose | Foster innovation, regulatory compliance, and market entry for startups. | Risk diversification, capital relief, and protection against large losses. |

| Participants | Insurtech startups, regulators, and sometimes established insurers. | Primary insurers, reinsurers, brokers. |

| Regulatory Role | Regulators oversee and guide testing phases with limited regulations. | Regulated as part of the insurance industry with strict capital requirements. |

| Scope | Testing product viability, technology integration, and business models. | Sharing risks on large policies or portfolios across insurers. |

| Risk Exposure | Low, controlled testing environment. | High, involves large insurance risks and capital exposure. |

| Duration | Short-term, typically months during pilot phases. | Long-term contracts spanning years. |

| Examples | FCA (UK) sandbox, MAS (Singapore) sandbox. | Munich Re, Swiss Re, Berkshire Hathaway Reinsurance. |

Which is better?

Insurtech sandboxes foster innovation by allowing startups to test new insurance products under controlled regulatory conditions, accelerating digital transformation in the insurance sector. Reinsurance provides financial stability by allowing insurers to transfer risk and mitigate potential large losses, enhancing overall market resilience. Choosing between them depends on whether the priority is advancing technological innovation or strengthening financial risk management.

Connection

Insurtech sandboxes provide a controlled environment where innovative insurance technologies can be tested under regulatory supervision, facilitating the development of advanced reinsurance models. These sandboxes enable reinsurance companies to experiment with data analytics, blockchain, and AI-driven risk assessment tools, improving underwriting accuracy and claims management. Collaboration between insurtech startups and reinsurers within these frameworks accelerates the creation of scalable, efficient, and adaptive reinsurance solutions.

Key Terms

Risk Transfer

Reinsurance plays a critical role in risk transfer by providing insurers with a financial safety net to manage large-scale exposures and catastrophic events. The insurtech sandbox fosters innovation by allowing experimental technologies and models that enhance risk assessment and transfer mechanisms in a controlled regulatory environment. Explore the evolving dynamics of reinsurance and insurtech sandboxes to understand their impact on modern risk transfer strategies.

Regulatory Innovation

Reinsurance regulatory innovation streamlines risk management by allowing insurers to transfer portions of risk portfolios, enhancing capital efficiency and market stability. Insurtech sandboxes promote regulatory experimentation by enabling startups to test innovative insurance solutions under relaxed rules, accelerating digital transformation. Explore how both frameworks reshape the insurance landscape and drive industry modernization.

Underwriting Technology

Reinsurance increasingly integrates advanced underwriting technology to optimize risk assessment and pricing accuracy, leveraging big data and AI-driven algorithms. Insurtech sandboxes provide innovative environments for testing these underwriting models under regulatory oversight, accelerating technology adoption and compliance refinement. Explore the evolving intersection of reinsurance and insurtech sandboxes to understand breakthroughs in underwriting technology.

Source and External Links

REINSURANCE - The American Council of Life Insurers - Reinsurance is a tool used by insurers to manage risk by transferring some or all of the risk to another insurer, known as a reinsurer.

Insurance Topics | Reinsurance - NAIC - Reinsurance is a contract where the insurer transfers risk to a reinsurer, helping to manage risks and capital requirements.

Background on: Reinsurance | III - Reinsurance is insurance for insurance companies, allowing them to transfer financial risks to another insurer, known as the reinsurer.

dowidth.com

dowidth.com