Credit life insurance provides coverage that pays off a borrower's outstanding loan balance if they pass away, ensuring debt does not become a burden on their family. Group life insurance offers collective coverage to members of an organization, typically employees, providing financial protection to beneficiaries at a lower cost due to pooled risk. Explore the key differences and benefits of credit life insurance versus group life insurance to determine the best fit for your needs.

Why it is important

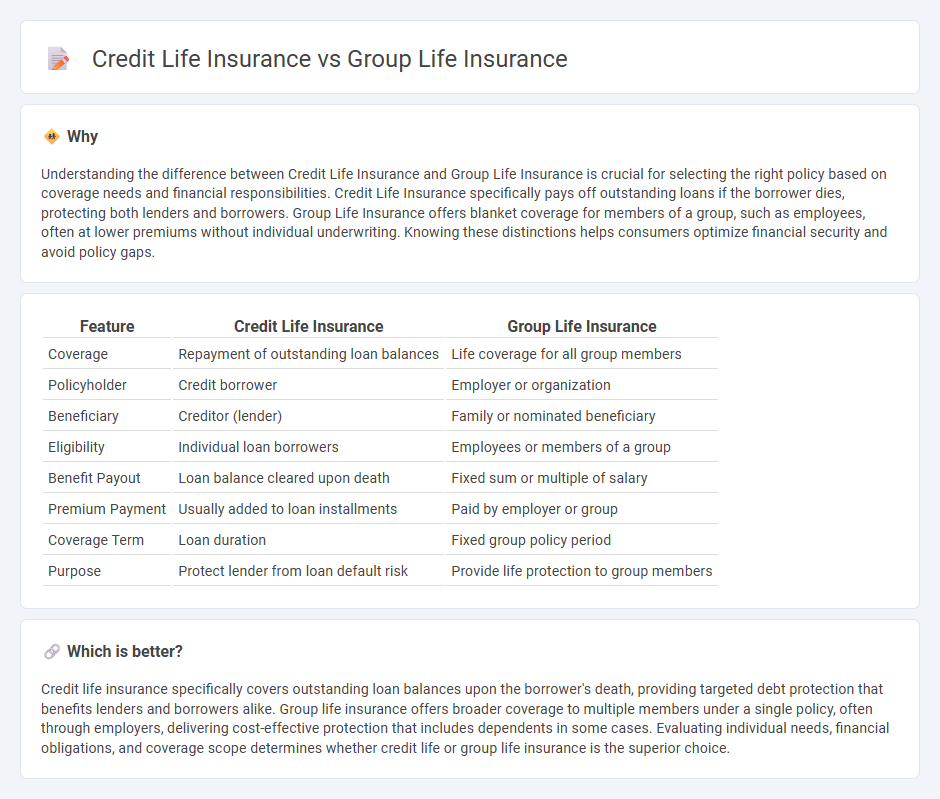

Understanding the difference between Credit Life Insurance and Group Life Insurance is crucial for selecting the right policy based on coverage needs and financial responsibilities. Credit Life Insurance specifically pays off outstanding loans if the borrower dies, protecting both lenders and borrowers. Group Life Insurance offers blanket coverage for members of a group, such as employees, often at lower premiums without individual underwriting. Knowing these distinctions helps consumers optimize financial security and avoid policy gaps.

Comparison Table

| Feature | Credit Life Insurance | Group Life Insurance |

|---|---|---|

| Coverage | Repayment of outstanding loan balances | Life coverage for all group members |

| Policyholder | Credit borrower | Employer or organization |

| Beneficiary | Creditor (lender) | Family or nominated beneficiary |

| Eligibility | Individual loan borrowers | Employees or members of a group |

| Benefit Payout | Loan balance cleared upon death | Fixed sum or multiple of salary |

| Premium Payment | Usually added to loan installments | Paid by employer or group |

| Coverage Term | Loan duration | Fixed group policy period |

| Purpose | Protect lender from loan default risk | Provide life protection to group members |

Which is better?

Credit life insurance specifically covers outstanding loan balances upon the borrower's death, providing targeted debt protection that benefits lenders and borrowers alike. Group life insurance offers broader coverage to multiple members under a single policy, often through employers, delivering cost-effective protection that includes dependents in some cases. Evaluating individual needs, financial obligations, and coverage scope determines whether credit life or group life insurance is the superior choice.

Connection

Credit life insurance and group life insurance both provide financial protection by covering the insured's life risk, though credit life insurance is specifically designed to pay off outstanding loans upon the borrower's death. Group life insurance offers coverage to a collective group, such as employees of a company, often at a lower cost due to risk pooling. The connection lies in their shared goal of financial security, with credit life insurance sometimes included as a rider or benefit within group life insurance plans to safeguard loan repayment.

Key Terms

Beneficiary

Group life insurance designates a beneficiary who receives the death benefit directly, allowing flexibility in distribution and control over proceeds. Credit life insurance names the creditor as the beneficiary, ensuring the outstanding loan balance is paid off upon the insured's death, with no funds paid to family members. Learn more about how beneficiary designations impact your coverage and survivor benefits.

Policyholder

Group life insurance provides coverage to multiple individuals under a single policy, typically offered by employers, ensuring financial protection for employees and their beneficiaries. Credit life insurance, on the other hand, is designed to pay off a borrower's outstanding loan balance in the event of their death, protecting lenders rather than individual policyholders. Explore detailed differences and benefits to determine which policy aligns best with your financial needs.

Coverage amount

Group life insurance typically offers higher coverage amounts as it is designed to protect multiple employees under one policy, providing financial security that often exceeds standard credit balances. Credit life insurance is usually limited to the outstanding loan amount, ensuring debt repayment but not offering broader financial protection. Explore how coverage limits impact your decision on the best insurance type for your needs.

Source and External Links

What is Group Term Life Insurance? | New York Life - Group life insurance is a single policy covering many people, typically provided by an employer, offering a federal income tax-free lump sum to beneficiaries if the insured dies during the policy term; often employer-paid, it enhances employee benefits and financial security.

Group life insurance explained - Group life insurance covers all eligible members under one policy owned by the employer, often costing less than individual policies, but is usually not portable beyond employment unless otherwise arranged.

Life Insurance Group Benefits - MetLife - MetLife provides a range of group life insurance products tailored to employee needs, including term life and permanent options with added features such as accidental death coverage and cash-value accumulation.

dowidth.com

dowidth.com