Behavioral policy pricing leverages individual customer actions and data analytics to set personalized insurance premiums, enhancing accuracy in risk assessment. Risk pool segmentation categorizes insured groups based on shared characteristics to distribute risk more evenly across segments. Explore the differences and advantages of both methods to understand their impact on modern insurance pricing.

Why it is important

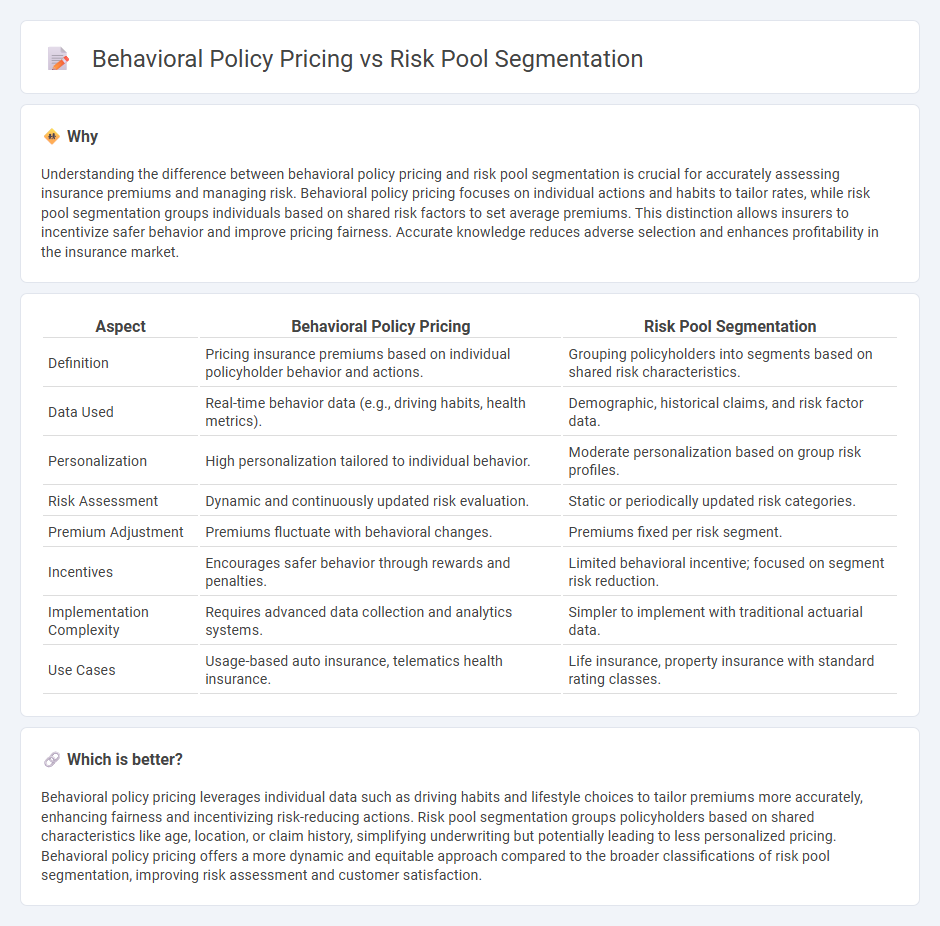

Understanding the difference between behavioral policy pricing and risk pool segmentation is crucial for accurately assessing insurance premiums and managing risk. Behavioral policy pricing focuses on individual actions and habits to tailor rates, while risk pool segmentation groups individuals based on shared risk factors to set average premiums. This distinction allows insurers to incentivize safer behavior and improve pricing fairness. Accurate knowledge reduces adverse selection and enhances profitability in the insurance market.

Comparison Table

| Aspect | Behavioral Policy Pricing | Risk Pool Segmentation |

|---|---|---|

| Definition | Pricing insurance premiums based on individual policyholder behavior and actions. | Grouping policyholders into segments based on shared risk characteristics. |

| Data Used | Real-time behavior data (e.g., driving habits, health metrics). | Demographic, historical claims, and risk factor data. |

| Personalization | High personalization tailored to individual behavior. | Moderate personalization based on group risk profiles. |

| Risk Assessment | Dynamic and continuously updated risk evaluation. | Static or periodically updated risk categories. |

| Premium Adjustment | Premiums fluctuate with behavioral changes. | Premiums fixed per risk segment. |

| Incentives | Encourages safer behavior through rewards and penalties. | Limited behavioral incentive; focused on segment risk reduction. |

| Implementation Complexity | Requires advanced data collection and analytics systems. | Simpler to implement with traditional actuarial data. |

| Use Cases | Usage-based auto insurance, telematics health insurance. | Life insurance, property insurance with standard rating classes. |

Which is better?

Behavioral policy pricing leverages individual data such as driving habits and lifestyle choices to tailor premiums more accurately, enhancing fairness and incentivizing risk-reducing actions. Risk pool segmentation groups policyholders based on shared characteristics like age, location, or claim history, simplifying underwriting but potentially leading to less personalized pricing. Behavioral policy pricing offers a more dynamic and equitable approach compared to the broader classifications of risk pool segmentation, improving risk assessment and customer satisfaction.

Connection

Behavioral policy pricing leverages data on individual behavior patterns to tailor insurance premiums, thereby enhancing the accuracy of risk assessment. Risk pool segmentation categorizes policyholders into groups with similar risk profiles, allowing insurers to optimize pricing strategies based on collective behavior trends. Together, these methods improve underwriting efficiency by aligning premiums more closely with actual risk, reducing adverse selection and promoting fairer pricing.

Key Terms

Underwriting

Risk pool segmentation categorizes policyholders based on shared characteristics such as age, location, or claim history to predict risk more accurately and set premiums accordingly. Behavioral policy pricing, on the other hand, leverages individual policyholder behavior data like driving habits or health activities to tailor premiums dynamically, enhancing underwriting precision. Explore how integrating these approaches can revolutionize underwriting strategies and optimize risk management.

Adverse Selection

Risk pool segmentation divides insured individuals into groups based on similar risk characteristics to balance premiums and claims effectively, aiming to minimize adverse selection where high-risk individuals disproportionately enroll. Behavioral policy pricing adjusts premiums according to policyholders' actions and habits, incentivizing safer behavior and reducing moral hazard that intensifies adverse selection. Explore in-depth strategies to mitigate adverse selection and optimize insurance pricing models.

Predictive Analytics

Risk pool segmentation divides insured groups based on shared characteristics to predict claims risk, while behavioral policy pricing uses data-driven insights into individual customer behaviors to tailor premiums. Predictive analytics enhances both methods by leveraging machine learning models to analyze historical data, improving accuracy in risk assessment and pricing optimization. Explore how predictive analytics transforms insurance underwriting and pricing strategies for a competitive advantage.

Source and External Links

Understanding Risk Pools: Why They Matter in Insurance Pricing - Risk pool segmentation involves grouping policyholders into pools where the diversity and size of the group affect pricing, availability, and financial stability by balancing high-risk with low-risk individuals to keep premiums manageable.

Pooling Prosperity: The Benefits of Risk Pooling in Captive Insurance - Risk pool segmentation depends on the number of members, diversity of insured exposures, and claims volume, where greater diversification leads to more stable pooled losses and pricing.

High-Risk Pools in the Individual Health Insurance Market - Segmentation into high-risk pools targets individuals with poorer health or higher likelihood of claims who may be charged higher premiums or face limited coverage, often supported by state subsidies to maintain insurance availability.

dowidth.com

dowidth.com