Micro-mobility insurance specifically covers electric scooters, e-bikes, and other small urban vehicles, offering protection tailored to the unique risks of shared and personal use in city environments. Traditional bicycle insurance focuses on standard bicycles, providing coverage mainly for theft, damage, and liability during recreational or commuting use. Explore the differences in coverage options, pricing, and claims processes to determine which insurance best fits your micro-mobility needs.

Why it is important

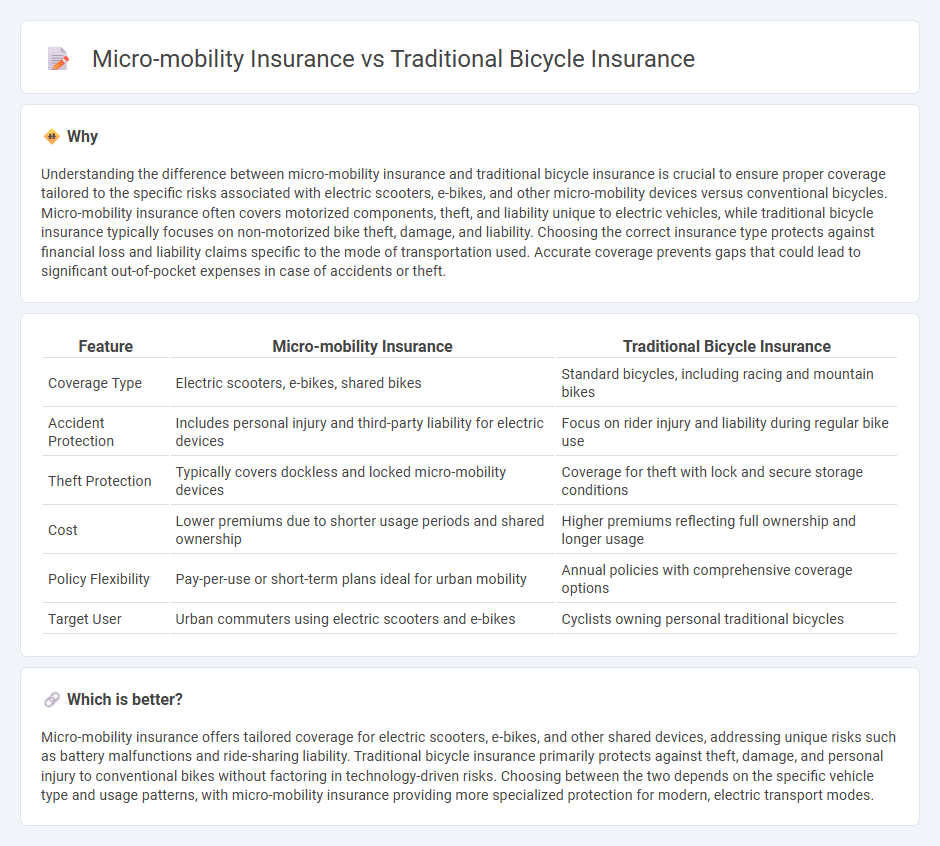

Understanding the difference between micro-mobility insurance and traditional bicycle insurance is crucial to ensure proper coverage tailored to the specific risks associated with electric scooters, e-bikes, and other micro-mobility devices versus conventional bicycles. Micro-mobility insurance often covers motorized components, theft, and liability unique to electric vehicles, while traditional bicycle insurance typically focuses on non-motorized bike theft, damage, and liability. Choosing the correct insurance type protects against financial loss and liability claims specific to the mode of transportation used. Accurate coverage prevents gaps that could lead to significant out-of-pocket expenses in case of accidents or theft.

Comparison Table

| Feature | Micro-mobility Insurance | Traditional Bicycle Insurance |

|---|---|---|

| Coverage Type | Electric scooters, e-bikes, shared bikes | Standard bicycles, including racing and mountain bikes |

| Accident Protection | Includes personal injury and third-party liability for electric devices | Focus on rider injury and liability during regular bike use |

| Theft Protection | Typically covers dockless and locked micro-mobility devices | Coverage for theft with lock and secure storage conditions |

| Cost | Lower premiums due to shorter usage periods and shared ownership | Higher premiums reflecting full ownership and longer usage |

| Policy Flexibility | Pay-per-use or short-term plans ideal for urban mobility | Annual policies with comprehensive coverage options |

| Target User | Urban commuters using electric scooters and e-bikes | Cyclists owning personal traditional bicycles |

Which is better?

Micro-mobility insurance offers tailored coverage for electric scooters, e-bikes, and other shared devices, addressing unique risks such as battery malfunctions and ride-sharing liability. Traditional bicycle insurance primarily protects against theft, damage, and personal injury to conventional bikes without factoring in technology-driven risks. Choosing between the two depends on the specific vehicle type and usage patterns, with micro-mobility insurance providing more specialized protection for modern, electric transport modes.

Connection

Micro-mobility insurance and traditional bicycle insurance both cover risks associated with two-wheeled transportation, providing liability, theft, and damage protection for riders. As micro-mobility options like e-scooters and e-bikes gain popularity, insurers are adapting traditional bicycle coverage frameworks to include electric and shared devices. This convergence addresses overlapping safety concerns while tailoring policies to the unique features and regulatory requirements of micro-mobility vehicles.

Key Terms

Coverage Scope

Traditional bicycle insurance primarily covers theft, accidental damage, and third-party liability, often limited to standard bicycles used for commuting or recreational purposes. Micro-mobility insurance extends coverage to electric scooters, e-bikes, and other personal transport devices, addressing risks unique to their usage such as battery malfunctions and e-vehicle-specific accidents. Discover how choosing the right insurance plan can protect your investment and ensure rider safety in evolving urban mobility landscapes.

Premium Structure

Traditional bicycle insurance premiums are typically calculated based on factors such as the bike's value, theft risk in the location, and the rider's claim history, resulting in fixed monthly or annual payments. Micro-mobility insurance, designed for e-scooters and shared bikes, often employs dynamic pricing models that adjust premiums according to usage patterns, ride frequency, and real-time risk assessments. Explore detailed comparisons to understand which premium structure best suits your micro-mobility needs.

Eligible Vehicle Types

Traditional bicycle insurance typically covers standard bicycles, including road, mountain, and hybrid bikes, focusing on theft, damage, and liability for these specific models. Micro-mobility insurance extends coverage to electric scooters, e-bikes, e-skateboards, and other emerging urban mobility devices, reflecting the evolving transportation landscape. Explore the differences in vehicle eligibility to choose the right insurance for your micro-mobility needs.

Source and External Links

The definitive guide to the best bike insurance in 2025 - Traditional bicycle insurance typically excludes e-bikes, classifying them as motorized vehicles, but specialty bike insurance covers theft, crash damage, and replacement at full value without depreciation, providing tailored protection for cyclists' unique risks.

A 2023 Buyer's Guide to America's Best Bicycle Insurance - Standardized bike insurance offers comprehensive coverage including theft protection with policies starting around $16.99/month and coverage limits typically at $10,000 with low deductibles, aiming to make insurance fast and affordable for traditional bicycles.

Bicycle Insurance - Traditional bicycle insurance can cover various bike types against physical damage, theft, and transit damage with replacement cost coverage, optional worldwide protection, and policy deductibles that range between $200 and $500.

dowidth.com

dowidth.com