Parametric insurance offers payouts based on predefined event triggers such as hurricane wind speeds or earthquake magnitudes, providing swift compensation without the need for lengthy claims assessments. Reciprocal insurance functions as a risk-sharing arrangement among members who pool resources to cover losses collectively, often managed by an attorney-in-fact. Explore the differences between these innovative insurance models to determine which best suits your risk management needs.

Why it is important

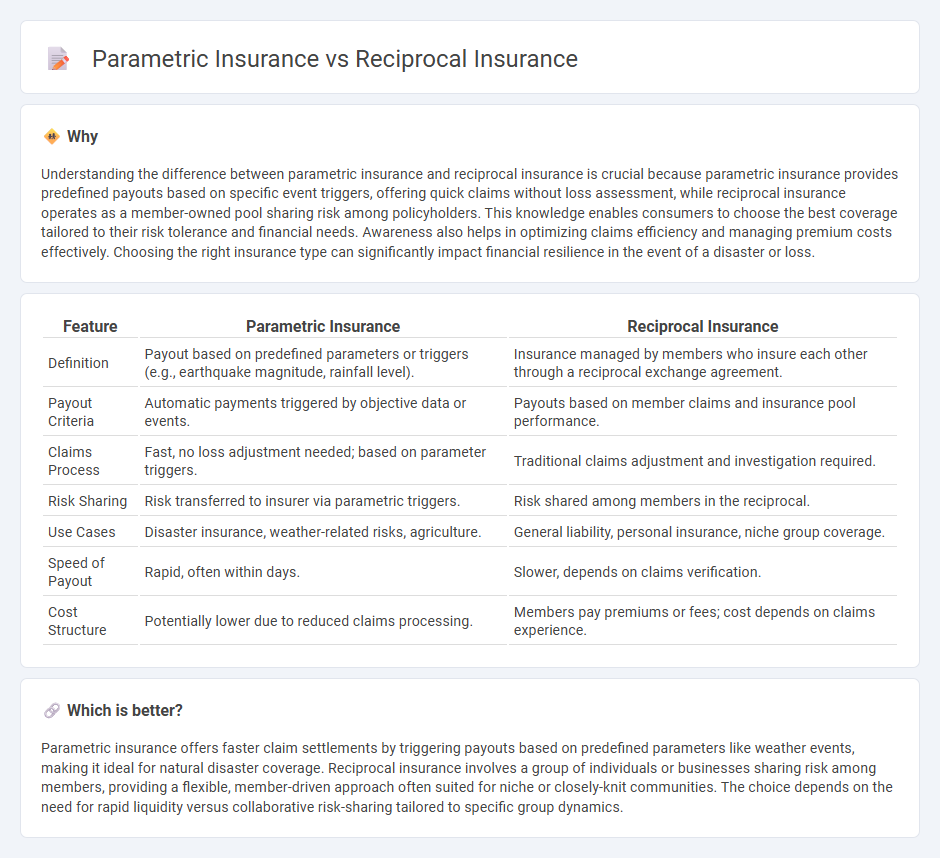

Understanding the difference between parametric insurance and reciprocal insurance is crucial because parametric insurance provides predefined payouts based on specific event triggers, offering quick claims without loss assessment, while reciprocal insurance operates as a member-owned pool sharing risk among policyholders. This knowledge enables consumers to choose the best coverage tailored to their risk tolerance and financial needs. Awareness also helps in optimizing claims efficiency and managing premium costs effectively. Choosing the right insurance type can significantly impact financial resilience in the event of a disaster or loss.

Comparison Table

| Feature | Parametric Insurance | Reciprocal Insurance |

|---|---|---|

| Definition | Payout based on predefined parameters or triggers (e.g., earthquake magnitude, rainfall level). | Insurance managed by members who insure each other through a reciprocal exchange agreement. |

| Payout Criteria | Automatic payments triggered by objective data or events. | Payouts based on member claims and insurance pool performance. |

| Claims Process | Fast, no loss adjustment needed; based on parameter triggers. | Traditional claims adjustment and investigation required. |

| Risk Sharing | Risk transferred to insurer via parametric triggers. | Risk shared among members in the reciprocal. |

| Use Cases | Disaster insurance, weather-related risks, agriculture. | General liability, personal insurance, niche group coverage. |

| Speed of Payout | Rapid, often within days. | Slower, depends on claims verification. |

| Cost Structure | Potentially lower due to reduced claims processing. | Members pay premiums or fees; cost depends on claims experience. |

Which is better?

Parametric insurance offers faster claim settlements by triggering payouts based on predefined parameters like weather events, making it ideal for natural disaster coverage. Reciprocal insurance involves a group of individuals or businesses sharing risk among members, providing a flexible, member-driven approach often suited for niche or closely-knit communities. The choice depends on the need for rapid liquidity versus collaborative risk-sharing tailored to specific group dynamics.

Connection

Parametric insurance and reciprocal insurance both focus on risk-sharing mechanisms but differ in execution; parametric insurance pays predetermined amounts based on specific triggers like weather events, while reciprocal insurance operates as a mutual exchange where members pool resources to cover losses. Both models prioritize efficiency and transparency by reducing claim processing time and promoting collective responsibility among policyholders. Their connection lies in leveraging predefined conditions or cooperative structures to manage risk innovatively within the insurance industry.

Key Terms

Policyholder Exchange

Policyholder Exchange in reciprocal insurance involves members exchanging risk by serving as both insurer and insured, creating a mutual risk-sharing pool that reduces reliance on traditional insurers. Parametric insurance, by contrast, utilizes predefined triggers based on measurable events, such as weather data, enabling faster payouts without traditional claims assessments. Explore further to understand how these distinct models impact policyholder engagement and risk management strategies.

Risk Pooling

Reciprocal insurance relies on risk pooling where members share losses collectively, spreading individual risk across the group to reduce financial impact. Parametric insurance bypasses traditional pooling by paying pre-agreed amounts based on specific event triggers, such as weather data, rather than actual losses. Explore deeper insights into how risk pooling shapes these insurance models for optimized risk management.

Source and External Links

Understanding Reciprocal Insurance Exchanges - This document explains how reciprocal insurance exchanges work, including their ownership structure and management, highlighting that they are similar to mutual companies but with a third-party manager.

Reciprocal Inter-Insurance Exchange - A reciprocal inter-insurance exchange is an unincorporated association where subscribers exchange insurance contracts through an attorney-in-fact, sharing risks and responsibilities.

Reciprocal Exchange: 5 Reasons SageSure Trusts the Model - This article discusses the benefits of reciprocal exchanges, including cost efficiency, flexibility, and customer focus, highlighting why some companies prefer this insurance model.

dowidth.com

dowidth.com