Digital claim automation streamlines the insurance process by enabling faster, more accurate claim evaluations through AI and machine learning technologies. In-person claim assessments rely on physical inspections and human judgment, which can lead to delays and subjective evaluations. Explore how digital claim automation revolutionizes efficiency and customer satisfaction in insurance claims.

Why it is important

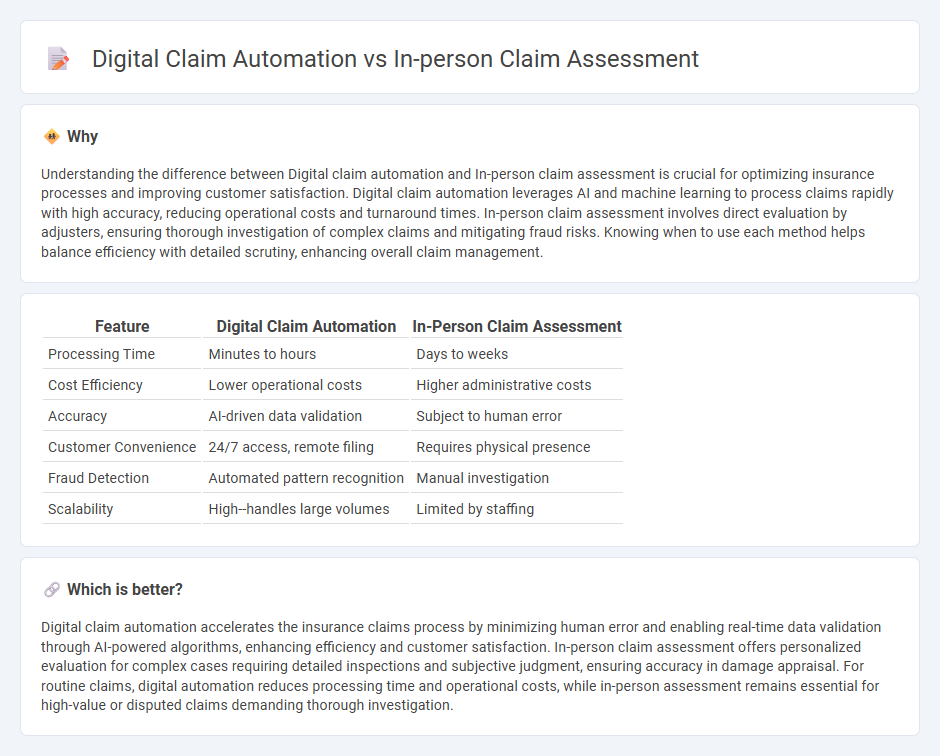

Understanding the difference between Digital claim automation and In-person claim assessment is crucial for optimizing insurance processes and improving customer satisfaction. Digital claim automation leverages AI and machine learning to process claims rapidly with high accuracy, reducing operational costs and turnaround times. In-person claim assessment involves direct evaluation by adjusters, ensuring thorough investigation of complex claims and mitigating fraud risks. Knowing when to use each method helps balance efficiency with detailed scrutiny, enhancing overall claim management.

Comparison Table

| Feature | Digital Claim Automation | In-Person Claim Assessment |

|---|---|---|

| Processing Time | Minutes to hours | Days to weeks |

| Cost Efficiency | Lower operational costs | Higher administrative costs |

| Accuracy | AI-driven data validation | Subject to human error |

| Customer Convenience | 24/7 access, remote filing | Requires physical presence |

| Fraud Detection | Automated pattern recognition | Manual investigation |

| Scalability | High--handles large volumes | Limited by staffing |

Which is better?

Digital claim automation accelerates the insurance claims process by minimizing human error and enabling real-time data validation through AI-powered algorithms, enhancing efficiency and customer satisfaction. In-person claim assessment offers personalized evaluation for complex cases requiring detailed inspections and subjective judgment, ensuring accuracy in damage appraisal. For routine claims, digital automation reduces processing time and operational costs, while in-person assessment remains essential for high-value or disputed claims demanding thorough investigation.

Connection

Digital claim automation enhances efficiency by streamlining the initial processing of insurance claims through AI-driven data extraction and validation, reducing manual errors and accelerating settlements. In-person claim assessment complements this by providing physical inspections and detailed evaluations that technology cannot replicate, ensuring accurate damage appraisal and fraud detection. Integrating both methods creates a hybrid approach that maximizes accuracy, speeds up claim resolution, and improves customer satisfaction in the insurance industry.

Key Terms

Adjuster

In-person claim assessment by an adjuster offers direct evaluation with the ability to investigate complex damages and interact personally with claimants, ensuring nuanced decision-making. Digital claim automation accelerates the process using AI and machine learning to analyze claims data, detect fraud, and provide instant adjustments, reducing human error and operational costs. Explore how integrating in-person expertise with digital solutions can optimize claim adjustments and enhance overall efficiency.

AI-driven Processing

AI-driven claim automation leverages machine learning algorithms to analyze and process insurance claims rapidly and with reduced errors compared to traditional in-person assessments, which rely heavily on manual inspections and human judgment. Digital platforms enable real-time data integration, predictive analytics, and automated fraud detection, significantly enhancing efficiency and customer satisfaction. Explore how AI-powered solutions transform claim processing and deliver measurable business value.

Fraud Detection

In-person claim assessment relies on physical verification and human judgment to detect fraud, often resulting in slower processing times and higher operational costs. Digital claim automation integrates artificial intelligence and machine learning algorithms to analyze data patterns, flag suspicious activities, and streamline fraud detection with greater accuracy and efficiency. Explore how cutting-edge digital solutions can transform fraud prevention in claims management.

Source and External Links

The Independent In-Person Assessment Process - This process involves licensed healthcare practitioners conducting assessments to gather information for insurance claims, focusing on various health domains.

Handling the Nurse Assessment for a Claim - This involves a nurse evaluating a claimant's ability to perform daily living activities and cognitive functions, which can impact claim decisions.

Everything You Need To Know About Claims Assessors - Claims assessors inspect and evaluate property damage to determine the extent of loss and estimate repair costs for insurance claims.

dowidth.com

dowidth.com