Behavioral policy pricing evaluates insurance premiums based on individual habits, such as driving behavior and lifestyle choices, incorporating data from telematics and wearable devices. Usage-based insurance (UBI) offers dynamic rates determined by actual usage metrics like mileage, trip frequency, and driving patterns collected through onboard diagnostics or mobile apps. Explore how these innovative approaches transform risk assessment and personalize coverage options.

Why it is important

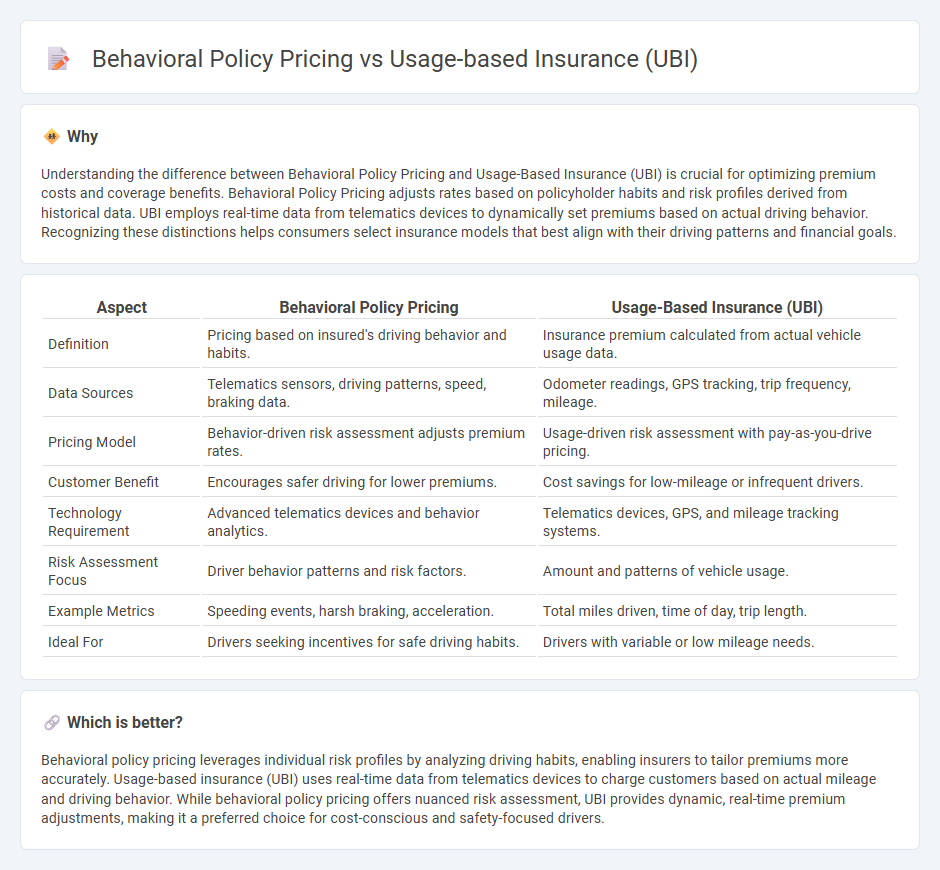

Understanding the difference between Behavioral Policy Pricing and Usage-Based Insurance (UBI) is crucial for optimizing premium costs and coverage benefits. Behavioral Policy Pricing adjusts rates based on policyholder habits and risk profiles derived from historical data. UBI employs real-time data from telematics devices to dynamically set premiums based on actual driving behavior. Recognizing these distinctions helps consumers select insurance models that best align with their driving patterns and financial goals.

Comparison Table

| Aspect | Behavioral Policy Pricing | Usage-Based Insurance (UBI) |

|---|---|---|

| Definition | Pricing based on insured's driving behavior and habits. | Insurance premium calculated from actual vehicle usage data. |

| Data Sources | Telematics sensors, driving patterns, speed, braking data. | Odometer readings, GPS tracking, trip frequency, mileage. |

| Pricing Model | Behavior-driven risk assessment adjusts premium rates. | Usage-driven risk assessment with pay-as-you-drive pricing. |

| Customer Benefit | Encourages safer driving for lower premiums. | Cost savings for low-mileage or infrequent drivers. |

| Technology Requirement | Advanced telematics devices and behavior analytics. | Telematics devices, GPS, and mileage tracking systems. |

| Risk Assessment Focus | Driver behavior patterns and risk factors. | Amount and patterns of vehicle usage. |

| Example Metrics | Speeding events, harsh braking, acceleration. | Total miles driven, time of day, trip length. |

| Ideal For | Drivers seeking incentives for safe driving habits. | Drivers with variable or low mileage needs. |

Which is better?

Behavioral policy pricing leverages individual risk profiles by analyzing driving habits, enabling insurers to tailor premiums more accurately. Usage-based insurance (UBI) uses real-time data from telematics devices to charge customers based on actual mileage and driving behavior. While behavioral policy pricing offers nuanced risk assessment, UBI provides dynamic, real-time premium adjustments, making it a preferred choice for cost-conscious and safety-focused drivers.

Connection

Behavioral policy pricing leverages data from Usage-Based Insurance (UBI) to tailor premiums based on individual driving patterns, such as speed, braking habits, and mileage. This connection enhances risk assessment accuracy by utilizing telematics data, allowing insurers to reward safe driving behavior with lower rates. Integration of behavioral insights through UBI thus drives personalized insurance products that promote safer roads and cost-effective coverage.

Key Terms

Telematics

Usage-based insurance (UBI) utilizes telematics to collect real-time data on driving behaviors such as speed, acceleration, and braking patterns, enabling insurers to tailor premiums based on actual usage. Behavioral policy pricing similarly relies on telematics but emphasizes broader patterns like trip frequency, time of day, and driver habits to dynamically adjust rates and incentivize safer driving. Explore how telematics-driven insights transform risk assessment and personalize insurance offerings.

Risk Assessment

Usage-based insurance (UBI) leverages real-time driving data collected from telematics devices to assess risk by monitoring factors such as speed, mileage, and braking patterns. Behavioral policy pricing incorporates a broader range of behavioral metrics, including driving habits, lifestyle choices, and individual risk profiles, to tailor insurance premiums more precisely. Explore the latest advancements to understand how these approaches transform risk assessment and pricing models.

Driving Behavior

Usage-based insurance (UBI) leverages real-time data from telematics devices to track actual driving behavior, such as speed, braking patterns, and mileage, enabling insurers to tailor premiums based on individual risk profiles. Behavioral policy pricing takes this concept further by integrating advanced analytics and machine learning to assess nuanced driving habits, promoting safer driving through dynamic premium adjustments. Explore how these innovative insurance models transform risk assessment and empower safer roads.

Source and External Links

What is Usage-Based Insurance (UBI)? - Insuranceopedia - Usage-based insurance (UBI) is a type of car insurance that enables insurers to track the policyholder's driving behavior using a monitoring device in the vehicle, partially determining premiums based on collected data rather than just risk class.

Usage-Based Car Insurance | Progressive - Usage-based insurance (UBI) aligns auto policy costs with individual driving habits, using telematics devices or mobile apps to measure factors like braking, acceleration, mileage, and time of day, which can lead to premium discounts or increases depending on driving behavior.

Usage-based insurance - Wikipedia - Usage-based insurance (UBI), also called pay-as-you-drive (PAYD) or pay-how-you-drive (PHYD), is vehicle insurance where costs depend on the type of vehicle, time, distance, behavior, and location driven, offering a more dynamic alternative to traditional insurance that relies on past trends.

dowidth.com

dowidth.com