Embedded insurance integrates coverage options directly into the purchase of products or services, offering seamless protection without requiring separate insurance transactions. Digital-only insurance operates exclusively online, providing convenience and quick access to policies through mobile apps or websites without physical branches. Explore how these innovative insurance models redefine customer experience and coverage efficiency.

Why it is important

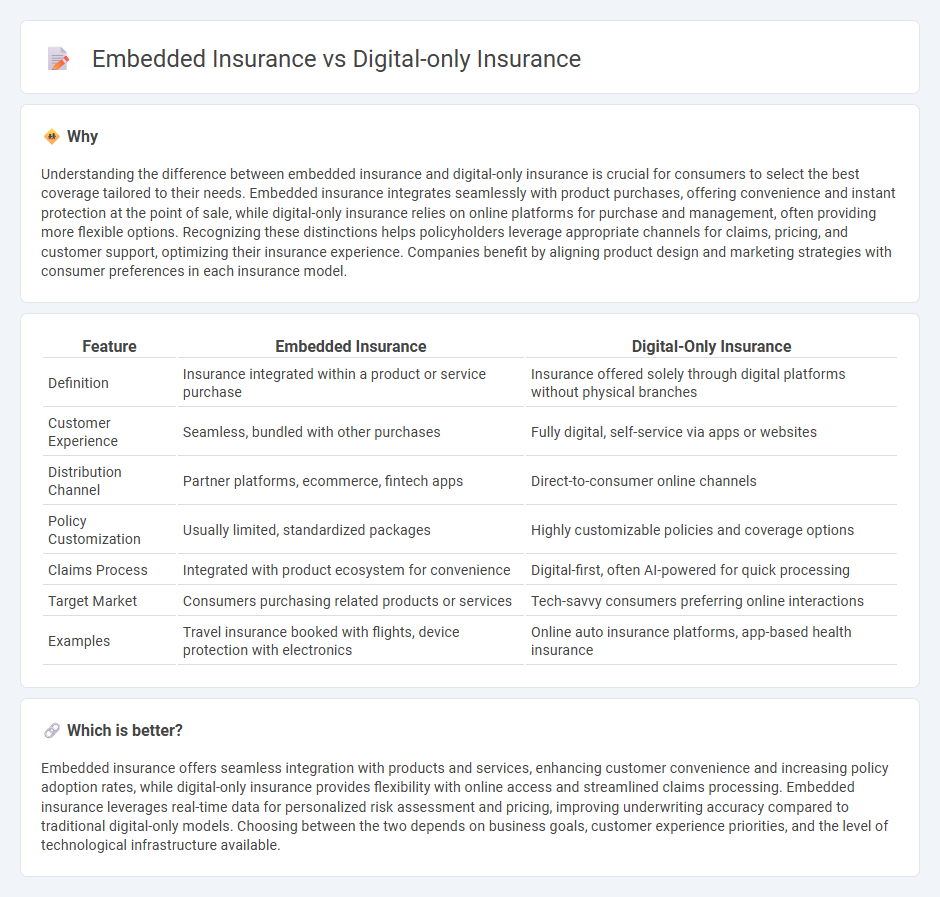

Understanding the difference between embedded insurance and digital-only insurance is crucial for consumers to select the best coverage tailored to their needs. Embedded insurance integrates seamlessly with product purchases, offering convenience and instant protection at the point of sale, while digital-only insurance relies on online platforms for purchase and management, often providing more flexible options. Recognizing these distinctions helps policyholders leverage appropriate channels for claims, pricing, and customer support, optimizing their insurance experience. Companies benefit by aligning product design and marketing strategies with consumer preferences in each insurance model.

Comparison Table

| Feature | Embedded Insurance | Digital-Only Insurance |

|---|---|---|

| Definition | Insurance integrated within a product or service purchase | Insurance offered solely through digital platforms without physical branches |

| Customer Experience | Seamless, bundled with other purchases | Fully digital, self-service via apps or websites |

| Distribution Channel | Partner platforms, ecommerce, fintech apps | Direct-to-consumer online channels |

| Policy Customization | Usually limited, standardized packages | Highly customizable policies and coverage options |

| Claims Process | Integrated with product ecosystem for convenience | Digital-first, often AI-powered for quick processing |

| Target Market | Consumers purchasing related products or services | Tech-savvy consumers preferring online interactions |

| Examples | Travel insurance booked with flights, device protection with electronics | Online auto insurance platforms, app-based health insurance |

Which is better?

Embedded insurance offers seamless integration with products and services, enhancing customer convenience and increasing policy adoption rates, while digital-only insurance provides flexibility with online access and streamlined claims processing. Embedded insurance leverages real-time data for personalized risk assessment and pricing, improving underwriting accuracy compared to traditional digital-only models. Choosing between the two depends on business goals, customer experience priorities, and the level of technological infrastructure available.

Connection

Embedded insurance integrates coverage seamlessly into the purchase of products or services through digital platforms, enhancing customer convenience by offering real-time protection. Digital-only insurance operates entirely online, leveraging digital tools and data analytics to streamline policy management and claims processing. Both models capitalize on technology to deliver personalized, accessible insurance solutions that reduce friction and improve user experience.

Key Terms

Distribution Channel

Digital-only insurance operates exclusively through online platforms, leveraging direct-to-consumer distribution channels such as mobile apps and web portals to simplify policy purchase and claims processing. Embedded insurance integrates coverage offerings directly within non-insurance digital products or services, such as e-commerce checkouts or automotive sales, enabling seamless access to insurance without a separate purchase process. Explore how distribution channels shape customer experience and market reach in these innovative insurance models.

Customer Experience

Digital-only insurance offers streamlined, user-friendly platforms that enable customers to purchase and manage policies entirely online, ensuring convenience and speed. Embedded insurance integrates coverage seamlessly within non-insurance products or services, providing personalized, context-aware protection that enhances user engagement and satisfaction. Explore how these innovative models redefine customer experience by visiting our detailed analysis.

Integration

Digital-only insurance operates through standalone platforms offering streamlined policies via mobile apps or websites, emphasizing direct customer interaction and simplified claims processing. Embedded insurance integrates coverage seamlessly within third-party services or products, such as travel bookings or e-commerce, enhancing convenience by offering protection at the point of purchase without requiring separate insurance transactions. Explore how integration strategies in digital and embedded insurance are reshaping customer experience and operational efficiency.

Source and External Links

The rise of digital-only insurance companies: Pros and cons - Digital-only insurance companies offer quick, convenient online services and lower costs by reducing overhead, but may lack the personalized support and flexibility that some customers expect.

What is digital insurance? - Digital insurance leverages technology like telematics and apps to provide personalized, usage-based policies and streamlined, transparent customer experiences, driving industry innovation and customer satisfaction.

Insurity Survey Finds Only 15% of Consumers Prefer a Fully Digital Insurance Experience - Most insurance customers prefer hybrid models that combine digital convenience with access to human support, highlighting the ongoing importance of choice and flexibility in service delivery.

dowidth.com

dowidth.com