Pay-as-you-drive insurance calculates premiums based on actual miles driven, offering personalized cost savings for low-mileage drivers, unlike traditional car insurance that charges fixed rates regardless of usage. Traditional policies often include standardized coverage options and predictable payments, but may not reflect individual driving behavior or vehicle usage. Explore the benefits and differences between these insurance models to determine which option best suits your driving habits and financial needs.

Why it is important

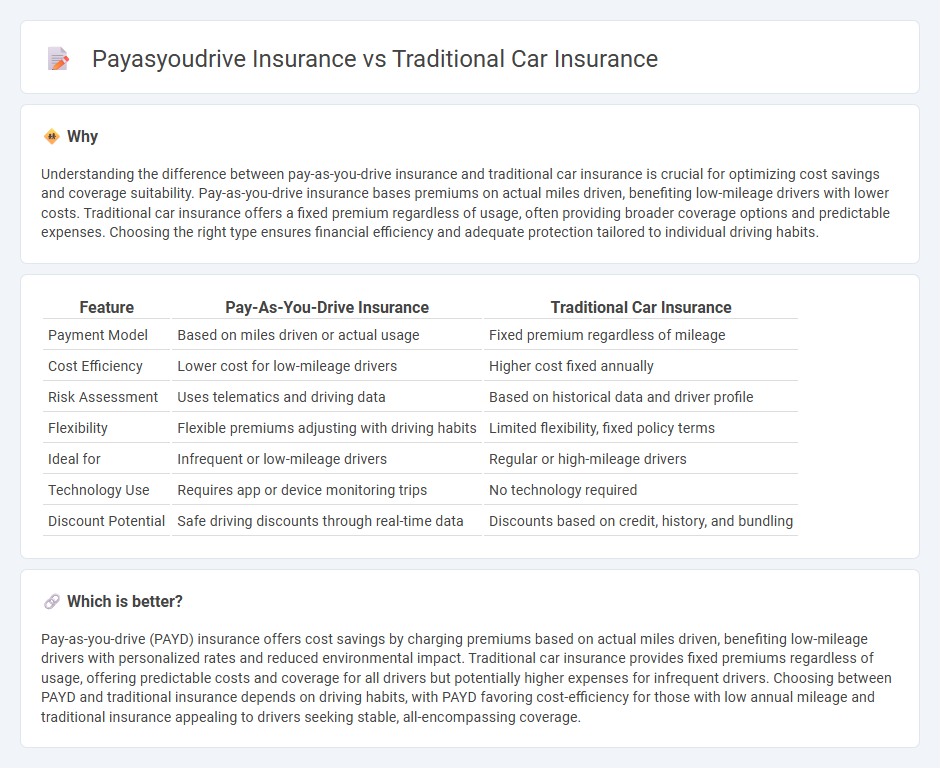

Understanding the difference between pay-as-you-drive insurance and traditional car insurance is crucial for optimizing cost savings and coverage suitability. Pay-as-you-drive insurance bases premiums on actual miles driven, benefiting low-mileage drivers with lower costs. Traditional car insurance offers a fixed premium regardless of usage, often providing broader coverage options and predictable expenses. Choosing the right type ensures financial efficiency and adequate protection tailored to individual driving habits.

Comparison Table

| Feature | Pay-As-You-Drive Insurance | Traditional Car Insurance |

|---|---|---|

| Payment Model | Based on miles driven or actual usage | Fixed premium regardless of mileage |

| Cost Efficiency | Lower cost for low-mileage drivers | Higher cost fixed annually |

| Risk Assessment | Uses telematics and driving data | Based on historical data and driver profile |

| Flexibility | Flexible premiums adjusting with driving habits | Limited flexibility, fixed policy terms |

| Ideal for | Infrequent or low-mileage drivers | Regular or high-mileage drivers |

| Technology Use | Requires app or device monitoring trips | No technology required |

| Discount Potential | Safe driving discounts through real-time data | Discounts based on credit, history, and bundling |

Which is better?

Pay-as-you-drive (PAYD) insurance offers cost savings by charging premiums based on actual miles driven, benefiting low-mileage drivers with personalized rates and reduced environmental impact. Traditional car insurance provides fixed premiums regardless of usage, offering predictable costs and coverage for all drivers but potentially higher expenses for infrequent drivers. Choosing between PAYD and traditional insurance depends on driving habits, with PAYD favoring cost-efficiency for those with low annual mileage and traditional insurance appealing to drivers seeking stable, all-encompassing coverage.

Connection

Pay-as-you-drive insurance links directly to traditional car insurance by offering a usage-based alternative where premiums reflect actual driving behavior and mileage, enhancing cost efficiency for low-mileage drivers. Traditional car insurance assesses risk based on general factors such as driver history, vehicle type, and location, while pay-as-you-drive integrates telematics data to provide personalized pricing. Both insurance models rely on risk evaluation but differ in premium calculation methods, merging to create more flexible and fair coverage options.

Key Terms

Premium calculation

Traditional car insurance calculates premiums based on factors like driver age, driving history, vehicle type, and location, often resulting in fixed monthly payments. Pay-as-you-drive (PAYD) insurance determines premiums primarily by actual miles driven and driving behavior, using telematics data to offer more personalized and potentially lower costs. Explore the differences to understand which premium calculation method suits your driving habits and budget best.

Mileage tracking

Pay-as-you-drive (PAYD) insurance uses mileage tracking technology, often via GPS or telematics devices, to monitor the exact distance driven, making premiums closely aligned with actual vehicle use. Traditional car insurance calculates rates based on broader factors like age, driving history, and location, without real-time mileage data, often leading to less personalized pricing. Explore how mileage tracking in PAYD insurance can tailor your premiums and create more cost-efficient coverage options.

Risk assessment

Traditional car insurance relies on generalized risk assessment factors such as driver age, driving history, location, and vehicle type to determine premiums, potentially leading to less personalized pricing. Pay-as-you-drive insurance uses telematics devices to monitor actual driving behavior, including mileage, speed, and braking patterns, allowing for more accurate and equitable risk evaluation. Discover how risk assessment transforms insurance pricing models by exploring the benefits of usage-based policies.

Source and External Links

What Is Classic Car Insurance & How Does It Work? - Progressive - Traditional car insurance covers everyday vehicles for standard risks but typically does not provide agreed value coverage for collectible or classic cars, and may not reflect their actual market value or cost of repair.

Classic car insurance: Get a quote - Allstate - Traditional policies generally use actual cash value, which bases payouts on standard depreciation and used car markets, not the unique value of collector or classic vehicles.

Classic Car Insurance Quotes - Progressive - Standard auto insurance is suitable for daily drivers, but for vehicles not used as everyday transportation and eligible for special coverage, classic car insurance may offer lower premiums and more appropriate protection.

dowidth.com

dowidth.com