Weather index insurance provides payouts based on predefined weather parameters such as rainfall or temperature, reducing the need for individual loss assessments. Revenue insurance covers losses related to a drop in a producer's income caused by factors like price fluctuations and yield declines, offering broader financial protection. Explore detailed comparisons to determine which insurance best suits your agricultural risk management needs.

Why it is important

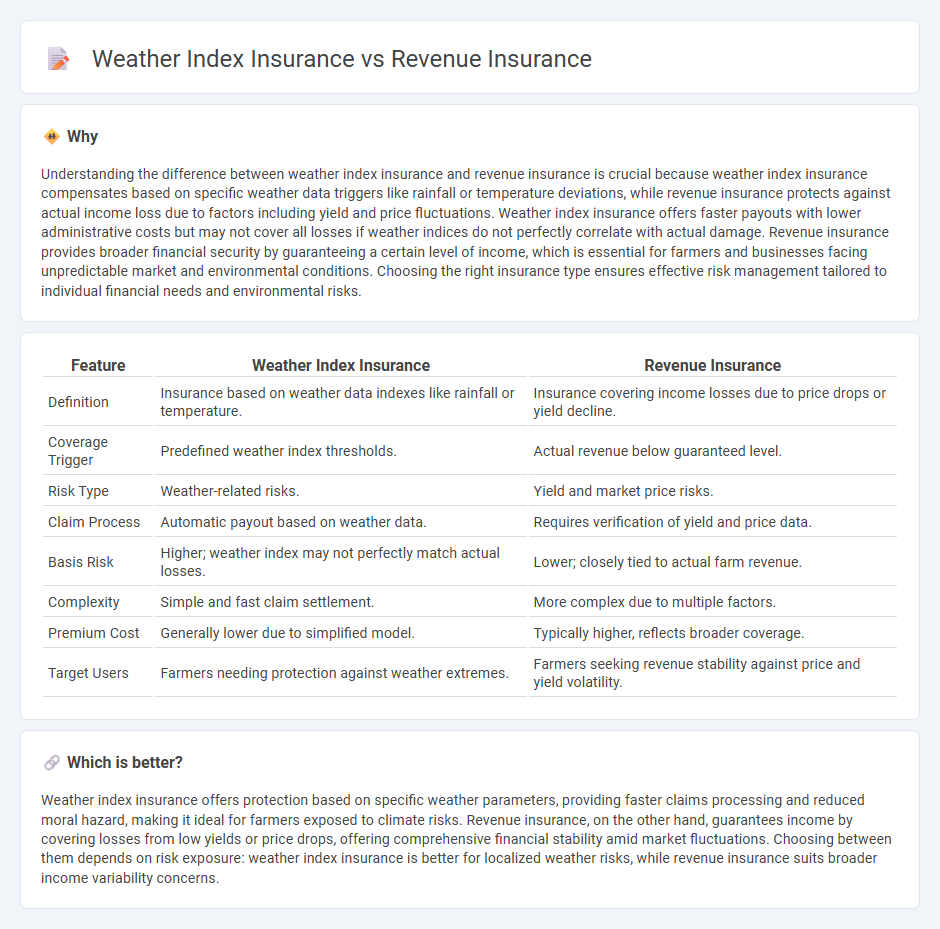

Understanding the difference between weather index insurance and revenue insurance is crucial because weather index insurance compensates based on specific weather data triggers like rainfall or temperature deviations, while revenue insurance protects against actual income loss due to factors including yield and price fluctuations. Weather index insurance offers faster payouts with lower administrative costs but may not cover all losses if weather indices do not perfectly correlate with actual damage. Revenue insurance provides broader financial security by guaranteeing a certain level of income, which is essential for farmers and businesses facing unpredictable market and environmental conditions. Choosing the right insurance type ensures effective risk management tailored to individual financial needs and environmental risks.

Comparison Table

| Feature | Weather Index Insurance | Revenue Insurance |

|---|---|---|

| Definition | Insurance based on weather data indexes like rainfall or temperature. | Insurance covering income losses due to price drops or yield decline. |

| Coverage Trigger | Predefined weather index thresholds. | Actual revenue below guaranteed level. |

| Risk Type | Weather-related risks. | Yield and market price risks. |

| Claim Process | Automatic payout based on weather data. | Requires verification of yield and price data. |

| Basis Risk | Higher; weather index may not perfectly match actual losses. | Lower; closely tied to actual farm revenue. |

| Complexity | Simple and fast claim settlement. | More complex due to multiple factors. |

| Premium Cost | Generally lower due to simplified model. | Typically higher, reflects broader coverage. |

| Target Users | Farmers needing protection against weather extremes. | Farmers seeking revenue stability against price and yield volatility. |

Which is better?

Weather index insurance offers protection based on specific weather parameters, providing faster claims processing and reduced moral hazard, making it ideal for farmers exposed to climate risks. Revenue insurance, on the other hand, guarantees income by covering losses from low yields or price drops, offering comprehensive financial stability amid market fluctuations. Choosing between them depends on risk exposure: weather index insurance is better for localized weather risks, while revenue insurance suits broader income variability concerns.

Connection

Weather index insurance and revenue insurance are connected through their reliance on external data to determine payouts, providing financial protection against agricultural risks. Weather index insurance uses specific weather parameters like rainfall or temperature indices to trigger compensation, while revenue insurance combines yield data and market prices to safeguard farmers' income. Both insurance types mitigate the economic impact of unpredictable environmental and market factors on agricultural production.

Key Terms

Indemnity

Revenue insurance compensates farmers based on actual income losses by comparing guaranteed revenue with realized revenue, accounting for yield and price fluctuations. Weather index insurance uses predefined weather indices, such as rainfall or temperature thresholds, to trigger payouts without assessing individual losses, reducing moral hazard and administrative costs. Explore how these indemnity mechanisms impact risk management strategies in agriculture.

Trigger event

Revenue insurance protects farmers by compensating for losses when actual revenue falls below a guaranteed level, triggered by yield reductions or price drops. Weather index insurance pays out based on predefined weather events, such as insufficient rainfall or extreme temperatures, without requiring yield loss assessment. Explore detailed comparisons to understand which insurance type aligns best with specific agricultural risks.

Premium

Revenue insurance typically involves higher premiums due to comprehensive coverage that protects against yield loss and price fluctuations, reflecting individual farm-level data for tailored risk management. Weather index insurance offers lower premiums by using objective weather data, such as rainfall or temperature indices, which trigger payouts only when predetermined weather conditions are met, minimizing administrative costs. Explore detailed comparisons of premium structures and cost-benefit analyses to better understand which insurance suits your agricultural risk profile.

Source and External Links

Revenue Protection | Ag360 Insurance - Revenue Protection (RP) is a federal crop insurance option that guarantees a minimum revenue per acre, protecting against losses from low yields, price drops, or a combination of both, and allows farmers to choose coverage with or without harvest price adjustments.

Benefits of Whole Farm Revenue Protection - American AgCredit - Whole-Farm Revenue Protection (WFRP) insures a farm's total revenue--covering all crops and livestock under one policy--up to $8.5 million, offering a safety net against revenue loss from natural causes and providing carryover coverage if insured the following year.

Understanding the Price Side of Revenue Crop Insurance - Producers select a percentage of their average yield to insure (typically 50-75%), and can opt for policies that adjust the revenue guarantee based on harvest prices or lock in the initial price, with premiums influenced by futures market volatility.

dowidth.com

dowidth.com