Insurtech platforms leverage advanced technologies like AI, big data analytics, and cloud computing to streamline underwriting, claims processing, and customer service, offering personalized and faster solutions compared to legacy insurance systems. Traditional insurance systems often rely on outdated software and manual processes that lead to inefficiencies and delayed customer experiences. Discover how leading insurtech platforms are revolutionizing the insurance industry by enhancing agility and customer satisfaction.

Why it is important

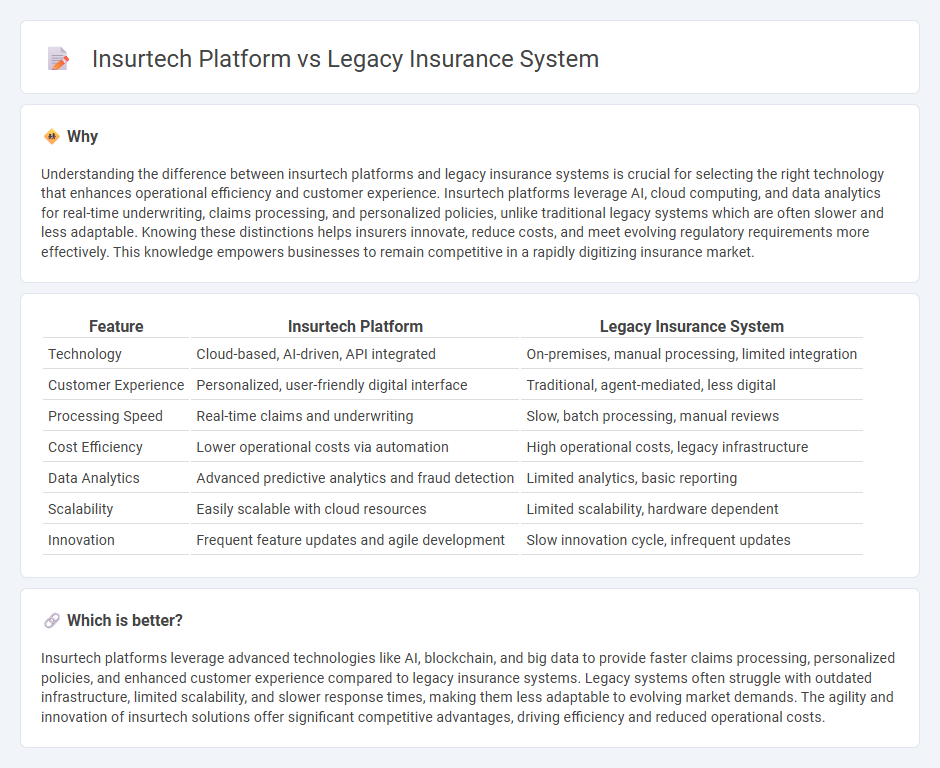

Understanding the difference between insurtech platforms and legacy insurance systems is crucial for selecting the right technology that enhances operational efficiency and customer experience. Insurtech platforms leverage AI, cloud computing, and data analytics for real-time underwriting, claims processing, and personalized policies, unlike traditional legacy systems which are often slower and less adaptable. Knowing these distinctions helps insurers innovate, reduce costs, and meet evolving regulatory requirements more effectively. This knowledge empowers businesses to remain competitive in a rapidly digitizing insurance market.

Comparison Table

| Feature | Insurtech Platform | Legacy Insurance System |

|---|---|---|

| Technology | Cloud-based, AI-driven, API integrated | On-premises, manual processing, limited integration |

| Customer Experience | Personalized, user-friendly digital interface | Traditional, agent-mediated, less digital |

| Processing Speed | Real-time claims and underwriting | Slow, batch processing, manual reviews |

| Cost Efficiency | Lower operational costs via automation | High operational costs, legacy infrastructure |

| Data Analytics | Advanced predictive analytics and fraud detection | Limited analytics, basic reporting |

| Scalability | Easily scalable with cloud resources | Limited scalability, hardware dependent |

| Innovation | Frequent feature updates and agile development | Slow innovation cycle, infrequent updates |

Which is better?

Insurtech platforms leverage advanced technologies like AI, blockchain, and big data to provide faster claims processing, personalized policies, and enhanced customer experience compared to legacy insurance systems. Legacy systems often struggle with outdated infrastructure, limited scalability, and slower response times, making them less adaptable to evolving market demands. The agility and innovation of insurtech solutions offer significant competitive advantages, driving efficiency and reduced operational costs.

Connection

Insurtech platforms integrate with legacy insurance systems through API-driven architectures that enable seamless data exchange and process automation. This connection allows insurers to leverage advanced analytics, cloud computing, and AI capabilities while maintaining compliance and operational continuity. Enhanced interoperability between insurtech solutions and traditional platforms accelerates claims processing, underwriting, and customer experience improvements.

Key Terms

**Legacy Insurance System:**

Legacy insurance systems rely on outdated IT infrastructure and manual processes, resulting in slower claims processing and limited customer personalization. These systems often lack real-time data analytics and integration capabilities, hindering agility and innovation in underwriting and risk assessment. Explore how modern insurtech platforms overcome these challenges to revolutionize the insurance industry.

Mainframe

Legacy insurance systems rely heavily on mainframe technology known for its robustness and ability to handle large-scale transaction processing essential for traditional insurance operations. In contrast, insurtech platforms emphasize cloud-based infrastructures, offering enhanced flexibility, scalability, and integration capabilities that modernize underwriting, claims processing, and customer engagement. Explore how integrating modern solutions with mainframe systems can transform insurance businesses and improve operational efficiency.

Manual Processing

Legacy insurance systems rely heavily on manual processing, leading to slower claim handling, increased errors, and higher operational costs. Insurtech platforms automate data entry, underwriting, and claims management, significantly enhancing efficiency and accuracy with real-time analytics and AI integration. Explore how transitioning to insurtech can revolutionize your insurance operations and reduce manual workload.

Source and External Links

Insurance Legacy System Transformation: Challenges & Trends - This article discusses how transforming legacy systems can improve operations and competitiveness in the insurance industry.

Insurance Legacy Systems Modernization: Winning Strategy - This guide highlights the need for modernizing legacy insurance systems to enhance customer service and operational efficiency.

Transforming Insurance Legacy Systems - This article emphasizes the importance of digital transformation in the insurance sector to overcome the limitations of outdated systems.

dowidth.com

dowidth.com