Insurtech sandboxes provide a controlled regulatory environment enabling innovators to test new insurance technologies and business models with reduced compliance risk. Embedded insurance integrates coverage seamlessly within non-insurance platforms, offering customers convenient access to insurance products at the point of sale or service. Explore the differences and benefits of insurtech sandboxes versus embedded insurance to understand their impact on the future of insurance.

Why it is important

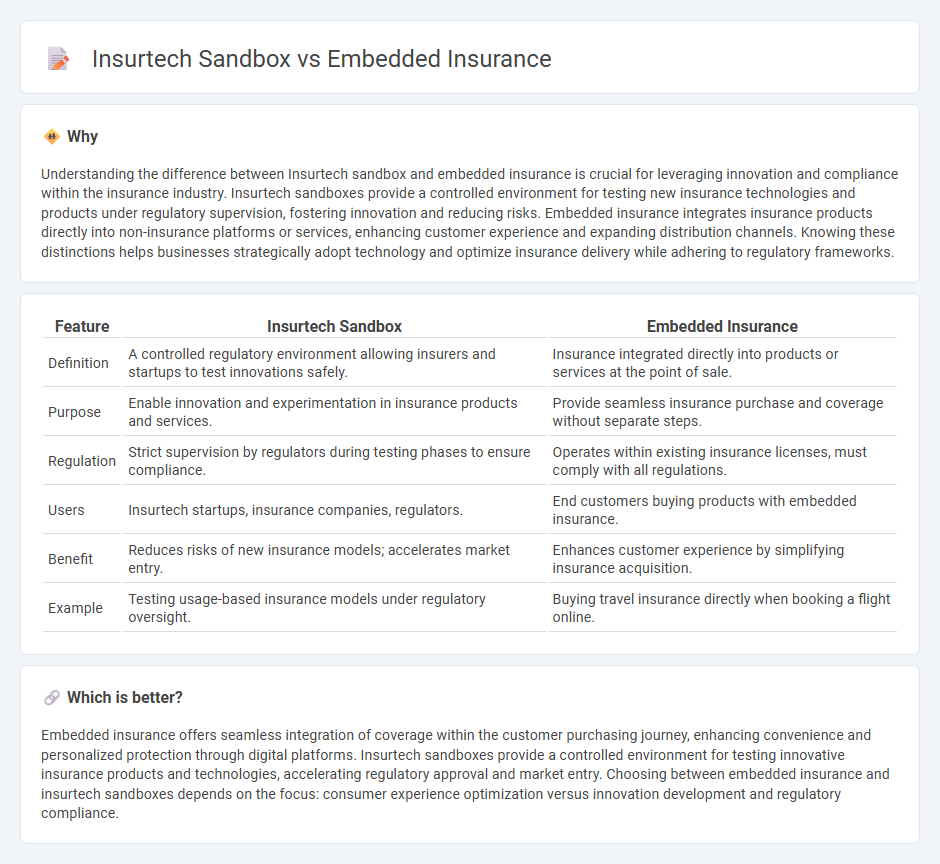

Understanding the difference between Insurtech sandbox and embedded insurance is crucial for leveraging innovation and compliance within the insurance industry. Insurtech sandboxes provide a controlled environment for testing new insurance technologies and products under regulatory supervision, fostering innovation and reducing risks. Embedded insurance integrates insurance products directly into non-insurance platforms or services, enhancing customer experience and expanding distribution channels. Knowing these distinctions helps businesses strategically adopt technology and optimize insurance delivery while adhering to regulatory frameworks.

Comparison Table

| Feature | Insurtech Sandbox | Embedded Insurance |

|---|---|---|

| Definition | A controlled regulatory environment allowing insurers and startups to test innovations safely. | Insurance integrated directly into products or services at the point of sale. |

| Purpose | Enable innovation and experimentation in insurance products and services. | Provide seamless insurance purchase and coverage without separate steps. |

| Regulation | Strict supervision by regulators during testing phases to ensure compliance. | Operates within existing insurance licenses, must comply with all regulations. |

| Users | Insurtech startups, insurance companies, regulators. | End customers buying products with embedded insurance. |

| Benefit | Reduces risks of new insurance models; accelerates market entry. | Enhances customer experience by simplifying insurance acquisition. |

| Example | Testing usage-based insurance models under regulatory oversight. | Buying travel insurance directly when booking a flight online. |

Which is better?

Embedded insurance offers seamless integration of coverage within the customer purchasing journey, enhancing convenience and personalized protection through digital platforms. Insurtech sandboxes provide a controlled environment for testing innovative insurance products and technologies, accelerating regulatory approval and market entry. Choosing between embedded insurance and insurtech sandboxes depends on the focus: consumer experience optimization versus innovation development and regulatory compliance.

Connection

Insurtech sandboxes provide a controlled environment for testing innovative insurance products, including embedded insurance solutions, by allowing startups and established firms to validate new models without full regulatory compliance risks. Embedded insurance integrates coverage seamlessly within non-insurance platforms like e-commerce or ride-sharing apps, accelerating customer adoption and enhancing user experience. The synergy between insurtech sandboxes and embedded insurance drives market innovation, regulatory cooperation, and faster deployment of tailored insurance offerings.

Key Terms

**Embedded insurance:**

Embedded insurance integrates insurance products directly into purchasing processes, enhancing customer experience by offering seamless coverage options at the point of sale. This approach leverages APIs and digital platforms to provide tailored insurance solutions across sectors like automotive, travel, and e-commerce, driving higher conversion rates and customer retention. Explore the benefits and implementation strategies of embedded insurance to optimize risk management and revenue streams.

API integration

Embedded insurance leverages API integration to seamlessly incorporate insurance products within non-insurance platforms, enhancing customer experience and streamlining policy purchases. Insurtech sandbox environments provide a controlled API testing space for startups and insurers to innovate, validate, and refine new insurance technologies under regulatory oversight. Explore how these API-driven concepts transform insurance delivery and compliance by learning more about their technical and business impacts.

Point-of-sale

Embedded insurance integrates coverage options directly at the point-of-sale, enabling seamless policy purchase during product transactions and enhancing customer experience through instant protection. Insurtech sandboxes provide a controlled environment for testing innovative insurance products and technologies, including point-of-sale solutions, allowing startups to experiment with minimal regulatory constraints. Explore how these advancements reshape insurance by visiting our in-depth analysis on embedded insurance and insurtech sandboxes.

Source and External Links

What is Embedded Insurance | Chubb - Embedded insurance integrates risk protection into customers' purchase journeys, offering coverage seamlessly at the point of sale.

Embedded Insurance: Definition, Types, Benefits | Endava - Embedded insurance is integrated into the purchase process of a product or service, providing immediate coverage at the point of sale.

The Rise of Embedded Insurance: Opportunities & Challenges | One Inc. - Embedded insurance transforms how insurance is bought and sold by integrating products directly into the purchase journey, offering a seamless customer experience.

dowidth.com

dowidth.com