Pet insurance provides financial protection for veterinary expenses, covering accidents, illnesses, and routine care for pets. Business insurance safeguards companies against risks such as property damage, liability claims, and employee-related issues, ensuring operational continuity. Explore detailed comparisons to determine the best insurance suited for your specific needs.

Why it is important

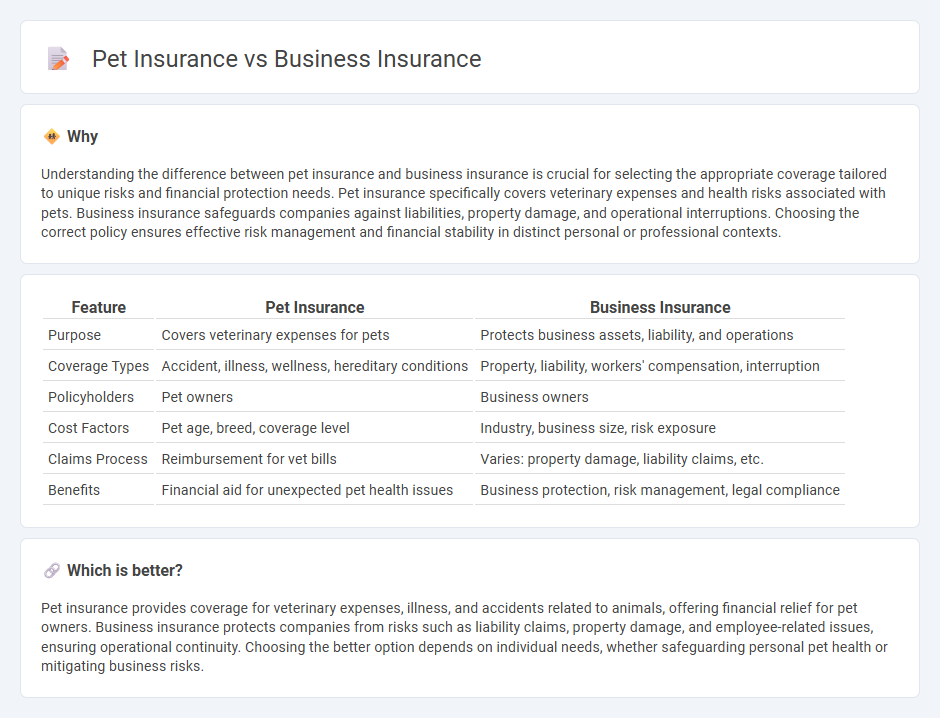

Understanding the difference between pet insurance and business insurance is crucial for selecting the appropriate coverage tailored to unique risks and financial protection needs. Pet insurance specifically covers veterinary expenses and health risks associated with pets. Business insurance safeguards companies against liabilities, property damage, and operational interruptions. Choosing the correct policy ensures effective risk management and financial stability in distinct personal or professional contexts.

Comparison Table

| Feature | Pet Insurance | Business Insurance |

|---|---|---|

| Purpose | Covers veterinary expenses for pets | Protects business assets, liability, and operations |

| Coverage Types | Accident, illness, wellness, hereditary conditions | Property, liability, workers' compensation, interruption |

| Policyholders | Pet owners | Business owners |

| Cost Factors | Pet age, breed, coverage level | Industry, business size, risk exposure |

| Claims Process | Reimbursement for vet bills | Varies: property damage, liability claims, etc. |

| Benefits | Financial aid for unexpected pet health issues | Business protection, risk management, legal compliance |

Which is better?

Pet insurance provides coverage for veterinary expenses, illness, and accidents related to animals, offering financial relief for pet owners. Business insurance protects companies from risks such as liability claims, property damage, and employee-related issues, ensuring operational continuity. Choosing the better option depends on individual needs, whether safeguarding personal pet health or mitigating business risks.

Connection

Pet insurance and business insurance share a foundation in risk management by providing financial protection against unforeseen events, helping both pet owners and business operators mitigate potential losses. They often involve assessing liabilities, whether related to veterinary care costs or commercial property damages, emphasizing the importance of tailored coverage to meet specific needs. Understanding the principles of coverage limits, deductibles, and policy exclusions enhances effective insurance planning across these different sectors.

Key Terms

**Business insurance:**

Business insurance protects companies from financial losses due to property damage, liability claims, and employee-related risks, ensuring operational continuity and legal compliance. Coverage options include general liability, property insurance, workers' compensation, and professional liability to safeguard assets and minimize exposure to lawsuits. Explore the various types of business insurance to find the best protection tailored to your company's unique needs.

Liability coverage

Business insurance liability coverage protects companies from claims related to bodily injury, property damage, and legal defense costs arising from business operations, offering financial security against lawsuits. Pet insurance liability coverage primarily safeguards pet owners against expenses from damages or injuries caused by their pets, such as dog bites or property damage, including legal fees. Explore deeper insights into liability coverage differences to choose the most suitable insurance for your needs.

Property insurance

Business insurance property coverage protects commercial assets such as buildings, inventory, and equipment from risks like fire, theft, or natural disasters, ensuring financial stability. Pet insurance does not extend to property protection but focuses instead on veterinary expenses for pets, covering accidents, illnesses, and routine care. Explore the detailed differences between business property insurance and pet insurance policies to choose the best coverage for your needs.

Source and External Links

Business Insurance - Provides news and information for insurance professionals responsible for corporate insurance/self-insurance programs.

Progressive Commercial Business Insurance - Offers a range of business insurance options to protect small businesses from financial losses due to accidents or property damage.

NEXT Business Insurance - Provides protection for small businesses, self-employed workers, and various types of companies against liabilities, property damage, and other risks.

dowidth.com

dowidth.com