Cyber risk insurance covers financial losses from data breaches, hacking incidents, and cyberattacks targeting digital assets, while crime insurance protects businesses against theft, fraud, and employee dishonesty involving physical or monetary assets. Both policies address different threat vectors, making it essential for organizations to assess their unique risk profiles to determine the appropriate coverage. Explore the distinctions and benefits of cyber risk insurance versus crime insurance to safeguard your business effectively.

Why it is important

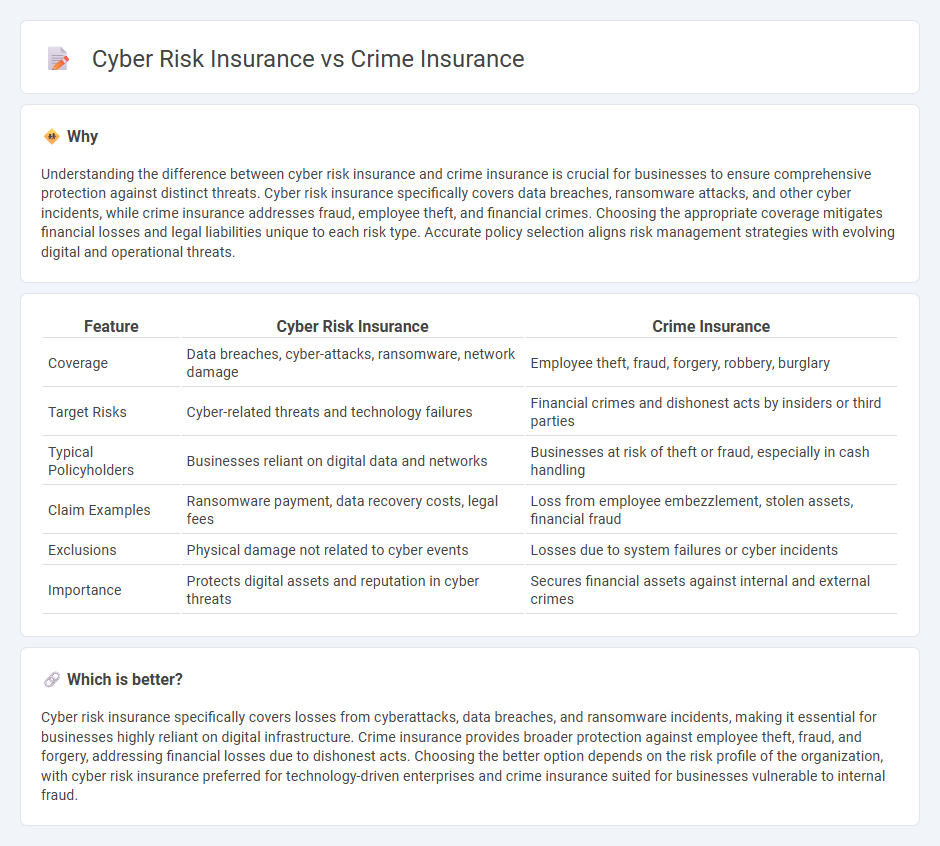

Understanding the difference between cyber risk insurance and crime insurance is crucial for businesses to ensure comprehensive protection against distinct threats. Cyber risk insurance specifically covers data breaches, ransomware attacks, and other cyber incidents, while crime insurance addresses fraud, employee theft, and financial crimes. Choosing the appropriate coverage mitigates financial losses and legal liabilities unique to each risk type. Accurate policy selection aligns risk management strategies with evolving digital and operational threats.

Comparison Table

| Feature | Cyber Risk Insurance | Crime Insurance |

|---|---|---|

| Coverage | Data breaches, cyber-attacks, ransomware, network damage | Employee theft, fraud, forgery, robbery, burglary |

| Target Risks | Cyber-related threats and technology failures | Financial crimes and dishonest acts by insiders or third parties |

| Typical Policyholders | Businesses reliant on digital data and networks | Businesses at risk of theft or fraud, especially in cash handling |

| Claim Examples | Ransomware payment, data recovery costs, legal fees | Loss from employee embezzlement, stolen assets, financial fraud |

| Exclusions | Physical damage not related to cyber events | Losses due to system failures or cyber incidents |

| Importance | Protects digital assets and reputation in cyber threats | Secures financial assets against internal and external crimes |

Which is better?

Cyber risk insurance specifically covers losses from cyberattacks, data breaches, and ransomware incidents, making it essential for businesses highly reliant on digital infrastructure. Crime insurance provides broader protection against employee theft, fraud, and forgery, addressing financial losses due to dishonest acts. Choosing the better option depends on the risk profile of the organization, with cyber risk insurance preferred for technology-driven enterprises and crime insurance suited for businesses vulnerable to internal fraud.

Connection

Cyber risk insurance and crime insurance are interconnected through their focus on protecting businesses from financial losses due to digital threats and fraudulent activities. Cyber risk insurance covers damages from data breaches, ransomware attacks, and cyber extortion, while crime insurance addresses fraud, theft, and employee dishonesty. Both policies help organizations mitigate the impact of increasingly sophisticated cybercrimes and malicious conduct.

Key Terms

**Crime Insurance:**

Crime insurance protects businesses from financial losses due to employee dishonesty, theft, forgery, or fraud, covering events like burglary, robbery, and computer fraud. This type of insurance is essential for safeguarding company assets, including cash, securities, and physical property, against internal and external criminal acts. Explore how crime insurance can provide comprehensive protection for your organization's financial security.

Employee Dishonesty

Employee dishonesty coverage under crime insurance protects businesses against financial losses caused by fraudulent acts like theft, embezzlement, or forgery committed by employees. Cyber risk insurance primarily addresses losses related to cyber incidents such as data breaches, ransomware, and network damage, often excluding internal fraud by employees unless it leads to a cyber event. Explore detailed comparisons to understand how each policy can safeguard your business from internal and external threats.

Forgery or Alteration

Forgery or alteration coverage within crime insurance predominantly guards against losses from fraudulent manipulation of financial instruments like checks, promissory notes, or securities. Cyber risk insurance, while addressing digital fraud, typically focuses on cyberattacks such as data breaches or ransomware rather than traditional forgery of physical documents. Explore our detailed comparison to understand the nuanced protection each policy offers against forgery or alteration risks.

Source and External Links

The Basics of Commercial Crime Insurance - This document provides an overview of commercial crime insurance, which protects businesses from financial losses due to various types of crime, including employee theft and cyber fraud.

Crime Insurance for Businesses - Cincinnati's crime insurance offers customizable coverage against employee theft, burglary, robbery, fraud, and other financial crimes affecting businesses.

Commercial Crime Insurance - Zurich's commercial crime insurance provides broad coverage against criminal activities, including fraud and theft, with global insurance solutions and expert claim handling.

dowidth.com

dowidth.com