Insurtech sandboxes provide a controlled environment for testing innovative insurance technologies and business models, facilitating regulatory compliance and accelerating product development. Parametric insurance offers coverage based on predefined triggers and measurable events, enabling faster claims processing and increased transparency compared to traditional indemnity insurance. Explore further to understand how these innovations are transforming risk management and the insurance industry.

Why it is important

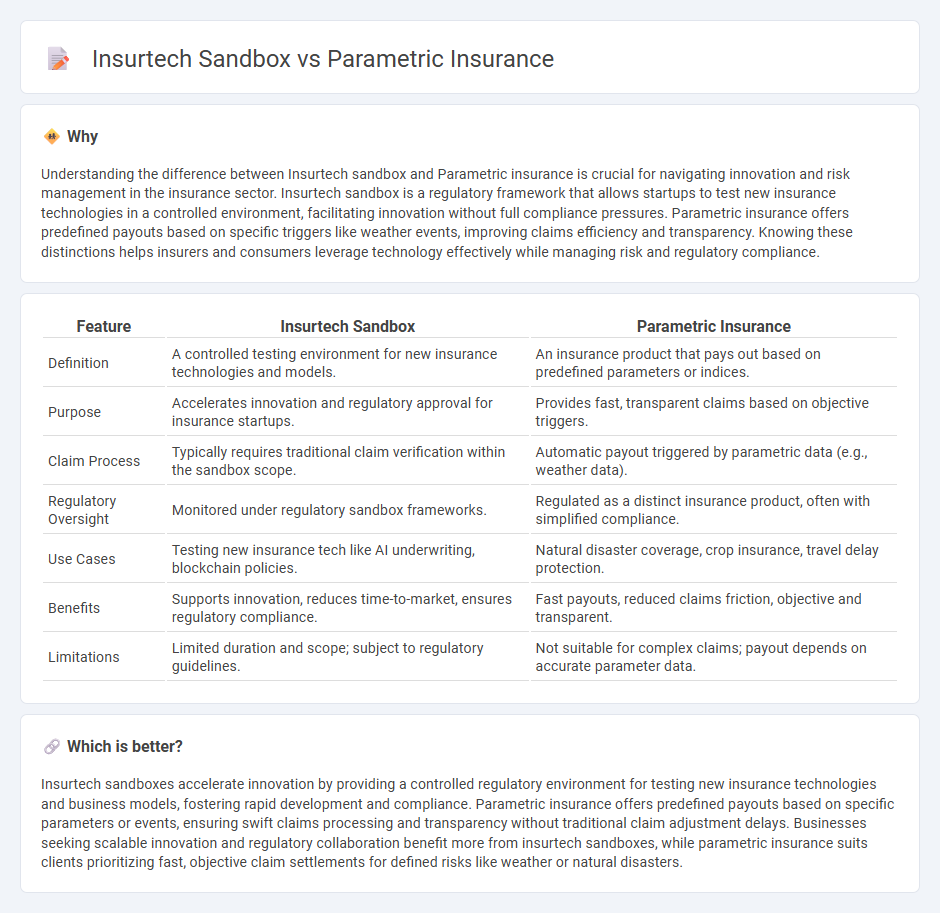

Understanding the difference between Insurtech sandbox and Parametric insurance is crucial for navigating innovation and risk management in the insurance sector. Insurtech sandbox is a regulatory framework that allows startups to test new insurance technologies in a controlled environment, facilitating innovation without full compliance pressures. Parametric insurance offers predefined payouts based on specific triggers like weather events, improving claims efficiency and transparency. Knowing these distinctions helps insurers and consumers leverage technology effectively while managing risk and regulatory compliance.

Comparison Table

| Feature | Insurtech Sandbox | Parametric Insurance |

|---|---|---|

| Definition | A controlled testing environment for new insurance technologies and models. | An insurance product that pays out based on predefined parameters or indices. |

| Purpose | Accelerates innovation and regulatory approval for insurance startups. | Provides fast, transparent claims based on objective triggers. |

| Claim Process | Typically requires traditional claim verification within the sandbox scope. | Automatic payout triggered by parametric data (e.g., weather data). |

| Regulatory Oversight | Monitored under regulatory sandbox frameworks. | Regulated as a distinct insurance product, often with simplified compliance. |

| Use Cases | Testing new insurance tech like AI underwriting, blockchain policies. | Natural disaster coverage, crop insurance, travel delay protection. |

| Benefits | Supports innovation, reduces time-to-market, ensures regulatory compliance. | Fast payouts, reduced claims friction, objective and transparent. |

| Limitations | Limited duration and scope; subject to regulatory guidelines. | Not suitable for complex claims; payout depends on accurate parameter data. |

Which is better?

Insurtech sandboxes accelerate innovation by providing a controlled regulatory environment for testing new insurance technologies and business models, fostering rapid development and compliance. Parametric insurance offers predefined payouts based on specific parameters or events, ensuring swift claims processing and transparency without traditional claim adjustment delays. Businesses seeking scalable innovation and regulatory collaboration benefit more from insurtech sandboxes, while parametric insurance suits clients prioritizing fast, objective claim settlements for defined risks like weather or natural disasters.

Connection

Insurtech sandboxes foster innovation by providing a regulatory framework for testing parametric insurance products, which use predefined triggers like weather data to automate claims. This environment accelerates development and deployment of parametric solutions by allowing real-world experimentation without full regulatory compliance. Collaborative insights from sandbox trials enhance risk modeling and pricing accuracy in parametric insurance offerings.

Key Terms

Parametric insurance:

Parametric insurance offers rapid claims payouts based on predefined event parameters such as weather data, streamlining risk management for natural disasters. This insurance model leverages precise triggers like rainfall thresholds or hurricane wind speeds to minimize underwriting complexity and reduce claim processing time. Explore more to understand how parametric insurance can transform your risk mitigation strategy.

Trigger event

Parametric insurance relies on predefined trigger events such as natural disasters measured by specific parameters like rainfall amount or wind speed, enabling rapid and transparent claim settlements without traditional loss assessments. Insurtech sandboxes provide a controlled regulatory environment to test innovative insurance products, including parametric solutions, by simulating trigger events and assessing real-time data integration and policy automation. Discover how the interplay between trigger events and insurtech frameworks is revolutionizing risk management and insurance innovation.

Predefined payout

Parametric insurance offers predefined payouts triggered by specific, measurable events such as weather conditions or natural disasters, enabling rapid claim settlements without traditional loss assessments. Insurtech sandboxes provide a controlled environment for testing innovative insurance products, including parametric models, allowing startups to refine predefined payout mechanisms under regulatory supervision. Explore how these frameworks revolutionize insurance accuracy and efficiency by learning more about their applications and benefits.

Source and External Links

What is parametric insurance? - Swiss Re Corporate Solutions - Parametric insurance is a type of insurance that pays out based on the occurrence of an event meeting or exceeding a pre-defined threshold (parameter) such as earthquake magnitude or wind speed, rather than indemnifying actual loss.

Parametric Insurance Solutions - Amwins - Parametric insurance policies pay out quickly based on objective event triggers like wind speed or seismic magnitude, allowing insured parties to use proceeds flexibly to cover any financial loss, with clear predefined terms and minimal claims processing.

Parametric insurance - Wikipedia - Unlike traditional indemnity insurance, parametric insurance offers faster payouts based on verifying that a trigger event exceeded its threshold, making it suitable for catastrophic perils and liquidity needs after disasters, though it may not fully cover all losses due to basis risk.

dowidth.com

dowidth.com